It’s been a wild ride over the past few trading days…

On Friday, President Trump started a mini-crash by threatening China with new 100% tariffs.

Stocks slid, crypto crashed, and miners dipped.

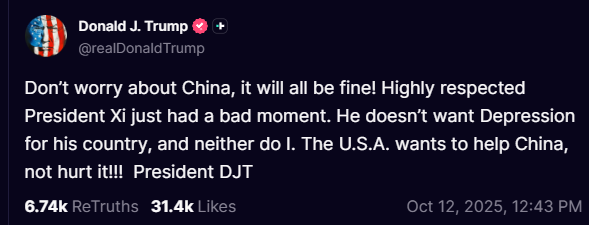

But yesterday, President Trump strapped on his Superman cape and saved the day. He struck a more conciliatory tone after China replied to his tariff threat with a hard-nosed retort.

As a result, markets opened up nicely this morning. The Nasdaq rose 2%, with the S&P 500 up 1.5%.

Clearly, Trump’s “Don’t worry about China” post reassured American markets that all was well. I’m not so sure China feels the same way, as there remain many unresolved aspects to the trade war.

But for now, we’ll simply soak in the euphoria and focus on our favorite area of the market: precious metals, and silver in particular.

After all, silver and gold are poised to do well regardless of what happens in the trade battle. In fact, they’re one of the few assets that may do better if things get worse.

Today gold galloped to a fresh record at $4,131 as of mid-day, while silver spiked to a new high of $52.19. Precious metal miners jumped higher. The GDX gold miner ETF rose 4.6%, while the SILJ junior silver miner ETF rose 6.12%.

The Silver Squeeze is ON

Boom! The move above $50/oz silver happened quicker than we expected.

And for good reason. Silver is getting very scarce. There are shortages reported in London, NY, and at multiple precious metals dealers.

Perhaps most interesting of all, silver lease rates rocketed to the moon. From Bloomberg:

Silver lease rates — which represent the annualized cost of borrowing metal in the London market — surged to more than 30% on a one-month basis on Friday, creating eye-watering costs for those looking to roll over short positions.

Silver lease rates are typically very low, often 1-2%. This is the cost to borrow silver in order to short it (attempt to make a profit from the price going down). But it’s not just speculators who borrow silver, of course. It’s also industrial users, miners, and others who require silver for a brief period.

Silver shorts and other borrowers have two options. They can close their position by buying to cover (at much higher prices), or roll over the short at eye-watering 30% annualized lease rates.

This is a silver squeeze in action. Shorts are being pressed in a vise.

Most shorts will likely choose to cover, and that requires buying silver at current prices. Considering these types of trades often involve leverage, that could be a rather expensive proposition.

The gist of a squeeze is that it essentially forces shorts to flip long and cover their position. It can be a vicious cycle if there are enough traders on the wrong side of the trade.

But skyrocketing lease rates are also having some weird effects on the entire chain of silver miners, refiners, dealers, and buyers. We can’t entirely predict what the short-term effects will be due to the market’s complexity, but over the mid-long run, silver is headed much higher.

The Path to $100/oz Silver (and Beyond)

For the last year, we’ve been writing about how the bulk of silver demand has been industrial. Solar panels, electric vehicles, electronics, and even weapons systems.

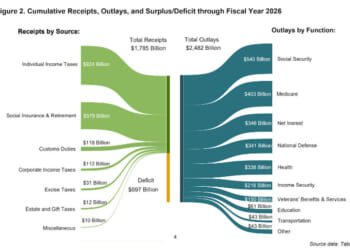

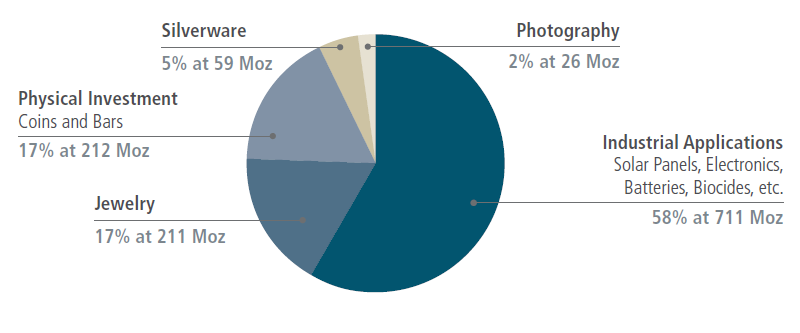

Today, investment demand (bars and coins) only makes up about 17% of silver demand, while industrial makes up 58%.

Silver Market Demand

Source: Sprott

But the point we’ve been hammering home is that if investment demand increases, we could see an incredible move in silver prices.

And I think that’s what we’re starting to observe. Now that silver is making headlines worldwide, investors are rushing into this tiny market.

Combined with the short squeeze, things could get exciting.

China is not going to stop building solar panels if the price of silver triples. It’s still a relatively small part of their input costs. And there is no viable alternative to silver for the vast majority of these use industrial cases.

So if investment demand jumps, and silver bugs continue to hold strong, we could see an epic ramp up in silver over the next few years.

I haven’t sold any of my silver or silver miners yet, and plan to continue to hold. If I decide to sell any of my silver positions, I’ll let readers know before that happens. Currently, the plan is to hold at least 3-5 more years.

For those of you looking for ways to play silver miners, I continue to like the SILJ junior silver miner ETF. It gives broad exposure to the smaller silver miners, of which there are only a few dozen worth owning.