Gold, silver, and miners are finally dipping after an insane run.

Red days are no fun, but this is healthy for long-term bulls. We needed to slow down and consolidate gains. The move was too far, too fast.

If you’re looking to buy, free up some cash and be patient. This drop could be substantial. Although lately, every dip in gold and silver has been bought with a vengeance. We’ll have to see if this one is different.

Today, let’s shift gears and talk about an opportunity that may just be getting started.

After all, we believe the world is in the beginning stages of a major commodity boom. It will extend far beyond precious metals, into nearly every nook and cranny of the natural resource space.

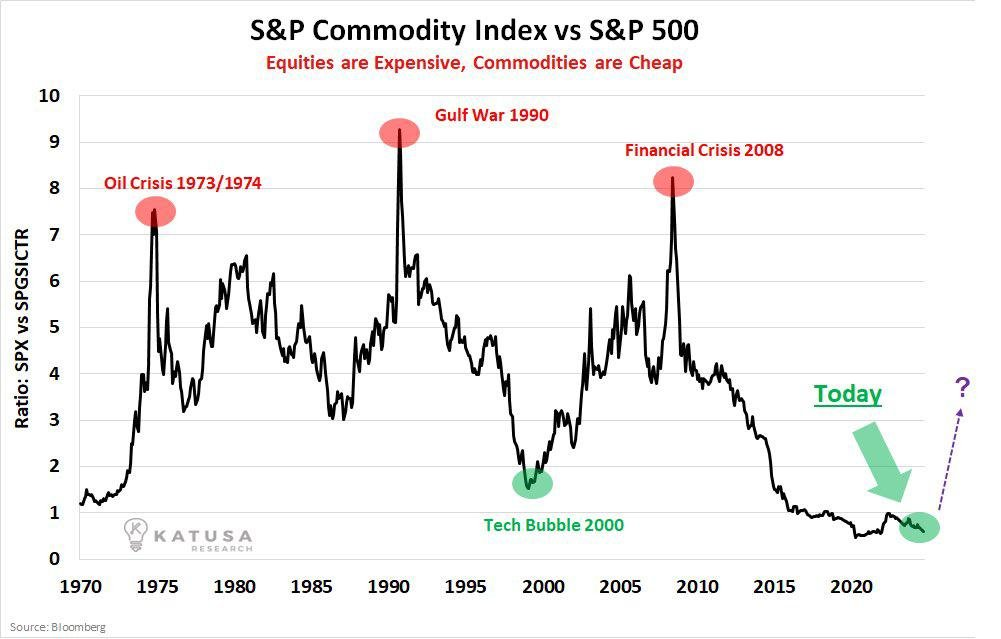

The chart below compares the S&P Commodity Index (oil and gas, metals, agricultural products) to the S&P 500.

As this chart falls, stocks outperform. When it rises, commodities are winning. And as you can see, stocks have been beating commodities hugely since the 2008 financial crisis.

Sources: Katusa, Bloomberg

But as you can see in the chart, commodities always take their turn eventually.

I encourage everyone to take a minute and recognize how rare this opportunity is.

Commodity supercycles (if that’s what this is) only happen once every few decades. And they tend to last 10-15 years.

Gold often leads the way, followed by silver, then palladium and platinum. Eventually copper, oil, iron, and other commodities jump on board. That’s what we’re seeing today.

It looks like we’re in the early stages of a new cycle. And there’s still plenty of profits to be made.

Opportunities in Oil

The recent winter storm has frozen oil production and refining across much of the U.S.

Combined with the weakening dollar, oil is finally rising. We may be a little early on this one, but I’m willing to take that chance.

Because over the past few years, oil has been beaten into the ground.

Below is a 20-year inflation-adjusted chart of WTI oil.

Source: GuruFocus

Adjusting for inflation allows us to get a real sense of just how cheap oil is today.

And let’s remember that this chart uses official U.S. inflation numbers, which are way too low.

In reality, oil is even cheaper. The only time it’s been lower is when oil briefly went negative during the COVID crash. But that was a very unusual situation.

This oil bear market has caused producers to get lean and mean. Most companies have underinvested in the future.

And in many cases, drillers have struggled to raise capital in this green new scam world, to use Jim Rickards’ signature phrase. Big banks have mandates to fund “green energy” projects, not “dirty” oil projects.

And many big institutional investors are boycotting fossil fuels altogether. They think the era of oil and gas is ending. Nothing could be further from the truth.

These fuels still form the foundation of our energy economy, and they’re the only reason we can even make windmills and solar panels.

Their oversight is our opportunity.

Brazil Catches a Bid, Petrobras Jumps

Over the past year we’ve been extremely bullish on Brazilian stocks. And it’s starting to pay off.

Our favorite Brazilian ETF (EWZ) is up about 50% since we first mentioned it last February.

And my favorite oil stock, Brazil’s Petrobras (PBR, PBR.A) is now up 30% since we first covered it. With much more room to run over the long-term. The company just reported an 11% increase in oil production, which is huge for such a large company. They’re outperforming the market and still underpriced.

The entire Brazilian stock market has traded at severe discounts, largely due to the country’s socialist leadership. But the selloff was overdone. Stocks were trading at 8x earnings with 8% yields.

Brazilian companies are still cheap at an average P/E of around 12 and a 5% yield. I’m holding, hopefully for another 5+ years.

We also continue to like Vale (VALE), Brazil’s iron mining giant. That one’s up about 75% since we featured it in June of last year.

Brazil remains one of my favorite ways to play the commodity boom.

There are many ways to invest in this cycle, and we’ll continue to explore them. If you’re a member of Strategic Intelligence, or any of Jim Rickards’ other services, I recommend paying close attention to the research they’re putting out. Jim, Dan, Byron, Zach, and the rest of the team are absolutely hitting the ball out of the park right now. Remarkable stuff.

The Disclaimer

Commodity supercycles can generate incredible profits for investors.

But there is a risk that we enter a global recession in the near future. That could put a damper on the bull run, for a while anyway.

But as we have discussed previously, if we do see a big stock market crash, central banks will react predictably. Printing money and lowering interest rates. The government will send out stimulus checks and start spending big on infrastructure, boosting commodities.

So for long-term investors, I believe the future in natural resources remains bright. I’m only mentioning this risk because it’s important people are aware that it may be a bumpy road.

But hopefully a very profitable one, too.