Gold has broken out to new highs. It’s currently trading around $3,640.

Silver moved past $40 with gusto and is currently trading at $41.42/oz.

Miners are churning out cash flow and starting to attract attention from the generalist investors.

A few weeks ago we wondered where the generalists were in Tale of the Gold Miner Tape.

The largest gold miner ETF (GDX) is up an impressive 63% so far in 2025.

Yet strangely, investors in the fund have been selling aggressively. So far this year they’ve sold $3.5 billion worth of GDX shares on net.

…ETF investors are not buying the gold miner story yet. They seem to think the move in gold is just a fad. Despite soaring profitability and excellent performance by the underlying stocks.

We puzzled over the fact that despite excellent performance (now +90% this year), investors on net were selling GDX.

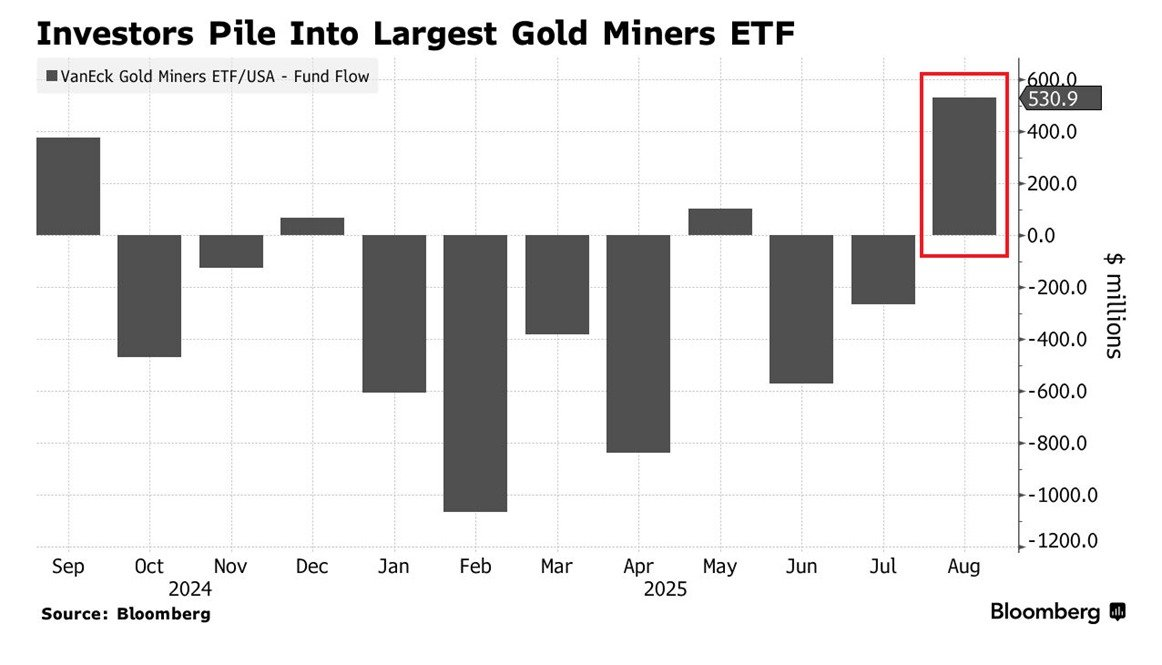

Now, we might have seen a reversal in this trend. According to Bloomberg, GDX saw a major inflow period in August:

Source: via Kobeissi Letter

So August brought +$530 million on the inflow side of this ETF’s net asset value equation. But on the year, investors have still sold $3 billion worth of shares.

So if this is a signpost indicating the imminent arrival of generalist investors, it’s still in the very early stages.

The important thing is that investors in the individual gold and silver names, like Newmont (NEM) and Pan American Silver (PAAS), are holding strong. And new buyers are coming in based on price action.

So if this GDX and broader gold miner ETF inflows continue, it should provide a nice constant buying pressure to the sector, especially in the bigger names.

The sector has seen remarkably strong returns even without ETF inflows, so if that trend has changed, price action should continue to be positive going forward.

The Catalyst

The initial spark that lit this precious metal bull market was the return of inflation.

What sent it into overdrive was the West’s reaction to Russia’s invasion of Ukraine. Specifically, when Russia’s central bank assets were frozen.

Our friend Jim Rickards laid all of this out in the Daily Reckoning of April 19 2022, in The Stars are Aligning for Gold:

The second reason to own gold is the unprecedented economic war between the U.S. and Russia that’s raging side by side with the shooting war in Ukraine. Economic results always receive some consideration in times of war, but there has never been a war where the economic costs of sanctions are greater and more long lasting than the destruction caused by the actual fighting.

One of these costs is a loss of confidence in the U.S. dollar.

It was fully expected that the U.S. would impose sanctions on certain Russian industries, exports and its oligarchs. It was not expected that the U.S. would seize and freeze the reserve assets held by the Central Bank of Russia.

Now that that has happened, every central bank in the world is reevaluating its dollar-denominated reserves and asking itself if the U.S. will freeze those holdings in some future dispute.

Jim nailed it more than 3 years ago. Over that period gold has risen from around $1,950/oz to $3,634/oz.

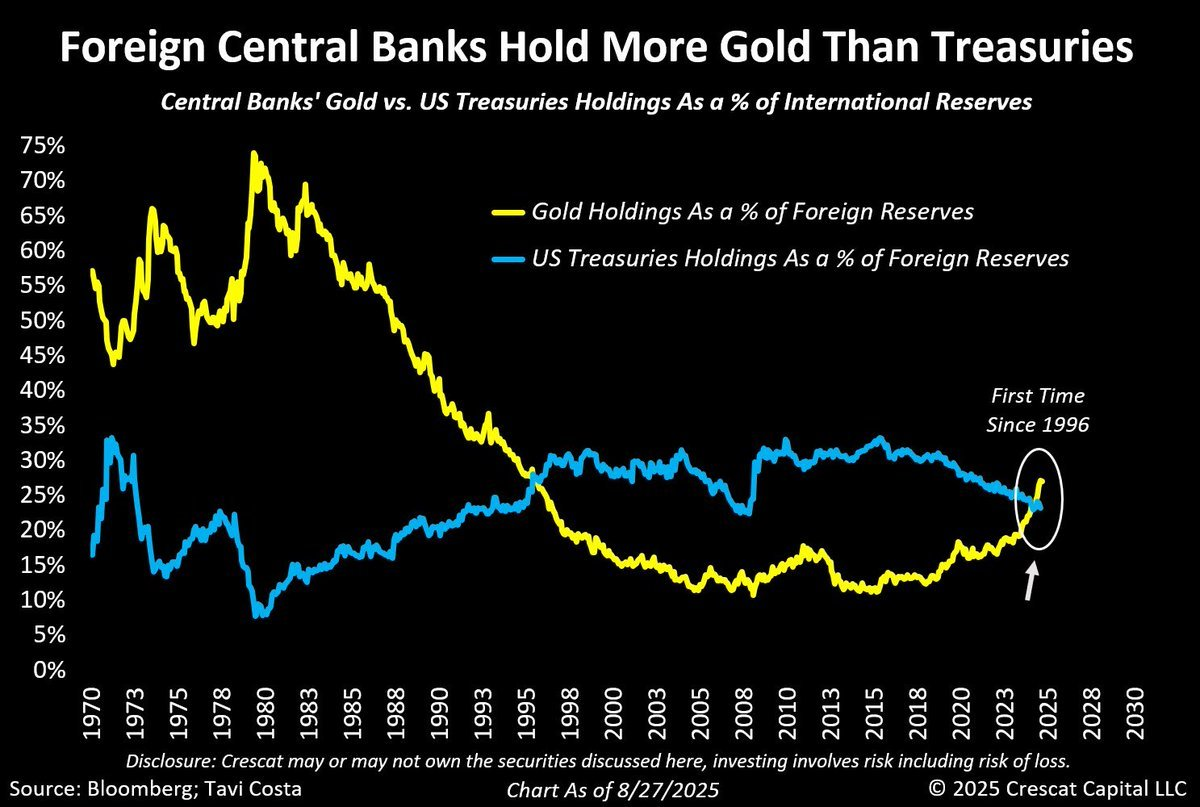

And as predicted, ever since Russia’s assets were frozen by Biden and NATO leaders, central banks have begun to shift out of dollar assets like US bonds, and into gold.

We can see this clearly in the chart below.

Source: Tavi Costa, Crescat Capital

It sure is nice to have constant central bank buying pressuring prices upwards.

The Next Phase

The early part of this precious metal bull market was largely driven by central bank gold buying. This demand will continue to be strong, and should help put a “floor” under the price of gold.

Higher gold prices have driven huge gains in miner profitability, and we’re starting to see significant buying of miner equities finally.

Silver has extremely robust demand from industrial uses such as solar panels, and now that retail investors are getting involved a bit more, I still see a hugely attractive risk/reward in “poor man’s gold”.

It looks like the generalist investors are finally starting to notice the precious metal space. That’s a good thing, as they will bring significant buying pressure as they come into the market.

The generalist investors will come into the gold and silver spaces in cohorts. The ones dipping their toes in now are early adopters.

Despite the capital beginning to flow into the space, miner valuations still look cheap and fundamentals should continue to improve as bullion prices run further.

The rush into hard assets has just begun. I’m not even thinking about selling yet. We’ll let you know if, and when, that time comes.