This post The Fed Brews Up a Nasty Potion appeared first on Daily Reckoning.

Stocks are priced at valuations near the 2000 dot-com extremes.

Hot tech IPOs like Circle are doubling and tripling on day 1.

Home prices have soared to unaffordable levels.

Meme coins and meme stocks are back in vogue.

Sports-betting is red hot, with the latest trend being 10-leg parlays with a (tiny) chance to pay off 100x+.

Trading on margin (leverage) has reached new records.

Speculation is the new national pastime.

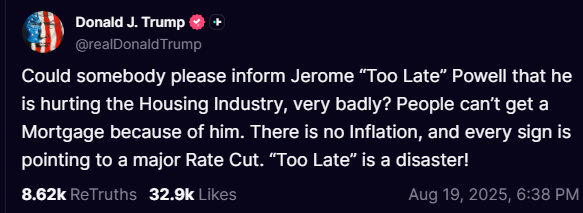

So why is President Trump pushing the Fed to cut rates? At first glance, it seems a bit reckless.

But the truth is, when it comes to monetary policy, there are no good options left.

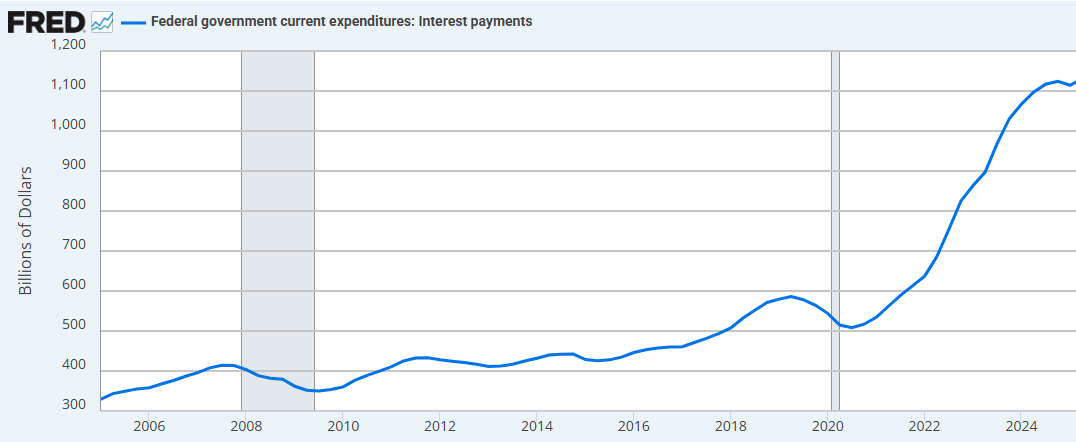

If we keep rates at current levels, the U.S. government’s interest expenses will continue to soar. That’s the cost to service federal debt. As you can see by the chart below, annual interest payments have exploded to over $1 trillion in recent years as debt soared and rates rose.

We now famously spend more on paying the interest on our debt than we do on military and defense spending.

It is utterly unsustainable.

And it’s a big reason why rates need to eventually be brought down. But there are other reasons, as well…

The Dollar and the Wealth Effect

“Well, you know, I’m a person that likes a strong dollar, but a weak dollar makes you a hell of a lot more money”.

–Donald Trump, July 2025

When the Fed raises U.S. interest rates, the dollar rises against other fiat currencies. When they cut, the dollar weakens and falls.

Right now, Donald Trump and Scott Bessent want a weaker dollar. They’re trying to rebuild and strengthen American industry, and that’s going to be very difficult with a strong dollar.

A weaker dollar would make American products more competitive in the global market. Trump has repeatedly pointed to Japan and China, and how they constantly weaken their own currencies to boost exports.

Trump also wants lower interest rates to lower mortgage payments, which have more than doubled in recent years, compounding the housing affordability crisis.

Lower interest rates could also help prop up the stock market bubble. If that bubble pops, it would absolutely crush consumer spending and the economy. Trump does not want that to happen.

However, we should note that the relationship between interest rates and stock market performance is far from clear. Our friend Jim Rickards says that lower rates are often associated with falling markets.

Nevertheless, the prevailing “wisdom” is that lower rates = higher stock prices, and that seems to be what President Trump believes.

So despite the market being bubbly and overheated, there is indeed a strong case for cutting rates. And that is exactly what is likely to happen over the next year.

The End Game: Yield Curve Control

Once interest rates approach zero again, we should fully expect more QE (money printing).

And eventually, the Fed will be forced to institute “yield curve control”. Let’s break down this intimidating-sounding concept. It’s really not difficult to grasp once we show how it worked in the 1940s.

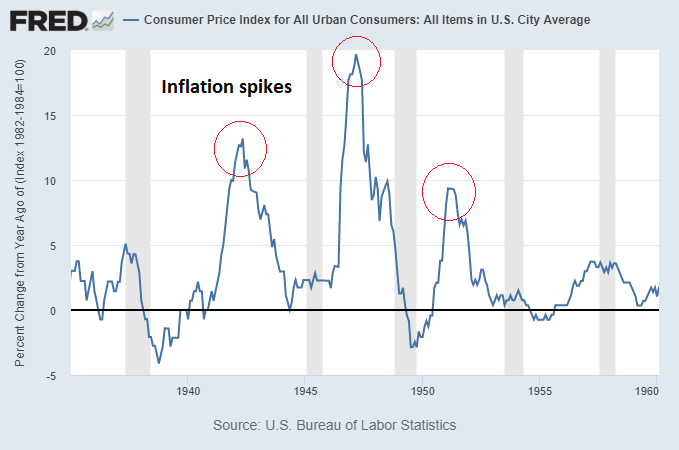

Yield curve control (YCC) was instituted between 1942 to 1951 because the U.S. had to issue massive amounts of bonds and notes to pay for WW2. Normally this supply dump would have caused interest rates to soar higher.

But 15% interest rates on the 10-year bond would have been disastrous to federal finances. So the Fed and Treasury capped long-term bonds at 2.5%. Short-term notes were capped at 0.375%.

Even as inflation reached nearly 20% annualized, government bond yields were suppressed at near-zero levels.

1940s Inflation During Yield Curve Control

Source: Lyn Alden

Anyone who had savings, bonds, or CDs had their purchasing power crushed.

During the YCC period from 1942-1951, inflation soared around 75% in total. Owning bonds and holding cash was an absolute disaster.

Compounding the problem, owning gold was illegal for U.S. citizens. Besides, the price of gold was “capped” by the gold standard at $35/oz.

Hard Assets Win Again

During the 1940s yield curve control period, investors who thrived did so by owning hard assets. Oil companies, base metal miners, manufacturers, railroads, smelters. Even food companies did pretty well.

Financial stocks like banks, meanwhile, performed poorly. As did utilities and other “yield-sensitive” sectors.

It’s important to remember that history doesn’t repeat, but it does rhyme. Within the next 5 years, I fully expect yield curve control to come into play. Possibly quite a bit sooner. There are no good options left on the table. YCC will once again become the path of least resistance.

But this go-round, gold and silver miners should be the stars of the show. During the 1940s they were essentially capped by their monetary ties. There is no such harness today. Sky’s the limit.

But it’s also good to hedge our bets with other hard assets. We’re bullish on base metal miners like Vale, oil and gas, and even commodity-heavy emerging markets like Brazil. We’ll continue to explore this trend and find other ways to protect ourselves from what’s coming.

Fortunately there’s still plenty of time to prepare. The market is just beginning to wake up to the possibility of rate cuts and QE. And we may not get the first rate cut for a few months still.

And yield curve control? Almost nobody’s talking about that yet. But they will be. Just give it time.

Hard Assets Win Again

During the 1940s yield curve control period, investors who thrived did so by owning hard assets. Oil companies, base metal miners, manufacturers, railroads, smelters. Even food companies did pretty well.

Financial stocks like banks, meanwhile, performed poorly. As did utilities and other “yield-sensitive” sectors.

It’s important to remember that history doesn’t repeat, but it does rhyme. Within the next 5 years, I fully expect yield curve control to come into play. Possibly quite a bit sooner. There are no good options left on the table. YCC will once again become the path of least resistance.

But this go-round, gold and silver miners should be the stars of the show. During the 1940s they were essentially capped by their monetary ties. There is no such harness today. Sky’s the limit.

But it’s also good to hedge our bets with other hard assets. We’re bullish on base metal miners like Vale, oil and gas, and even commodity-heavy emerging markets like Brazil. We’ll continue to explore this trend and find other ways to protect ourselves from what’s coming.

Fortunately there’s still plenty of time to prepare. The market is just beginning to wake up to the possibility of rate cuts and QE. And we may not get the first rate cut for a few months still.

And yield curve control? Almost nobody’s talking about that yet. But they will be. Just give it time.

The post The Fed Brews Up a Nasty Potion appeared first on Daily Reckoning.