Watching sports these days feels completely different than it did a decade ago.

These days, half the ads are about gambling. During pre-game shows, analysts seem to spend more time on betting strategies than actual analysis.

Major sports leagues like the NFL now openly partner with sports books and gambling platforms. That was once a red line which respectable leagues wouldn’t cross.

Influencers promote “parlay” strategies which involve 5-10 legs and offer the chance to earn 50x. But in truth, parlays are where the sports books make the most money.

Another hard truth is that only about 5% of sports bettors withdraw more than they put in. It’s very difficult to overcome the house’s edge. The average sports bet has a commission rate of around 9%, which only a very lucky minority can overcome.

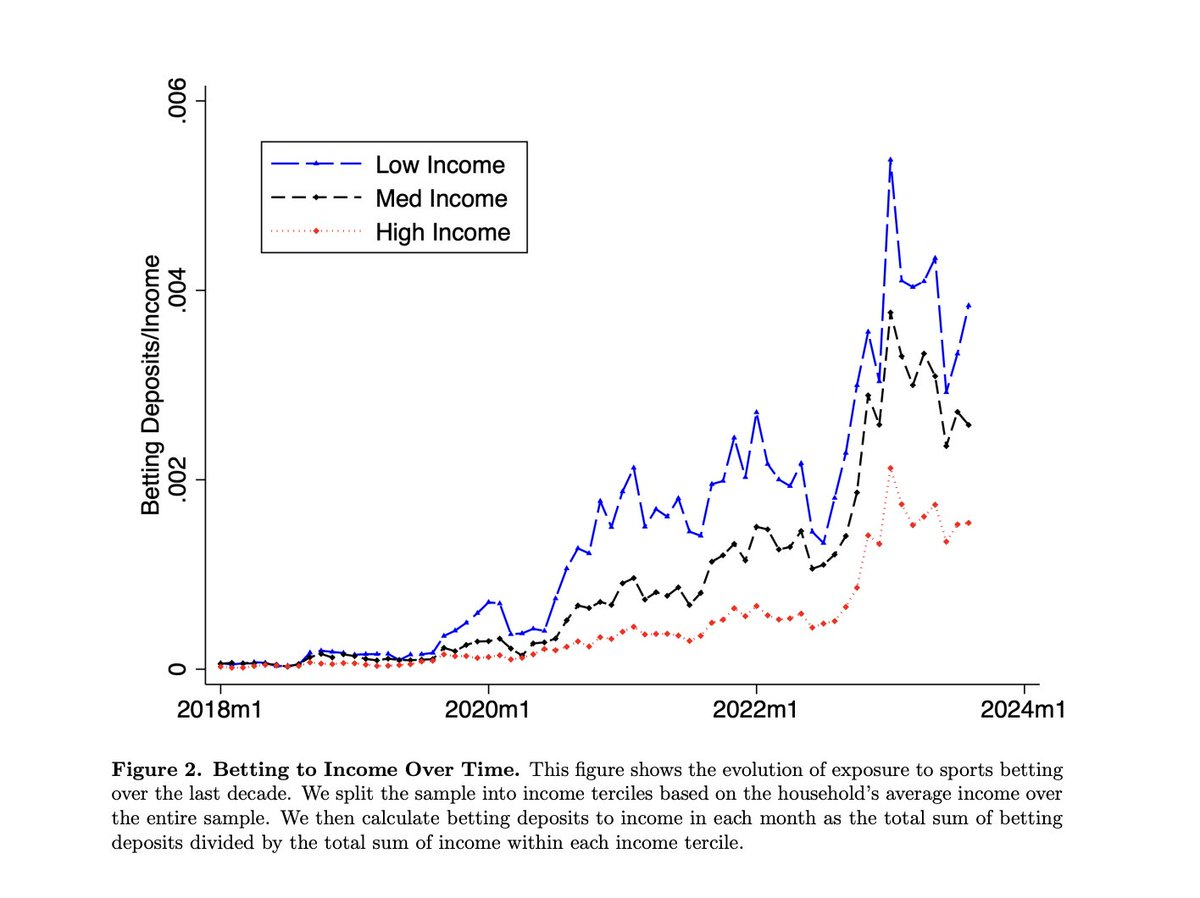

Lower income households are disproportionately affected by sports gambling. This group spends a much larger percentage of income on sports betting, as shown in the chart below.

Source: Gambling Away Stability: Sports Betting’s Impact on Vulnerable Households

As you can see from the chart, this problem is only getting worse. In 2024 Americans legally wagered around $148 billion on sports, up a massive 23% from 2023.

Look, it’s a free country and some people are capable of gambling responsibly. I myself play in a few fantasy football leagues with friends and co-workers, and it’s great fun. But I won’t allow myself to download a sports book app. It’d be too tempting to gamble on 8-leg parlays in the hopes of hitting a 50x. Much better to stick to what I know: contrarian and long-term investing.

The fact that Americans increasingly see sports gambling as a path to riches is downright scary…

Seeking a Way Out

Our nation’s obsession with gambling extends beyond sports. We see it in crypto markets, margin trading, meme stocks, options mania, and crazy stock valuations.

America is in the midst of a decade-long speculation bender.

This trend is being driven by fundamental factors which cannot be ignored. The core problem is that the cost of living is rising far faster than wages.

Younger generations face completely unaffordable home prices, expensive stocks, a brutal job market, and stagnant pay.

Many see speculation and gambling as the only way out.

The average person knows little about the stock market, but they do know something about sports. So the sports gambling path seems to offer an exit from the rat race. But it’s the worst possible route to riches. Overcoming the house advantage may as well be impossible.

If you find yourself in a situation where you “need” to speculate, do it smartly. Don’t bet on 9-leg sports parlays which are never going to hit.

Invest In Yourself

For people with limited savings, speculation shouldn’t even be on the menu. It’s much better to invest in yourself. Try building a business on the side. This is how the vast majority of self-made individuals become wealthy.

In contrast, the number of people who got rich through pure speculation is miniscule. Especially from a low starting point.

If you have $500 to invest, it’s much better to buy a pressure washer and hit the streets rather than speculate on dubious investments.

The pressure washer has a high probability of paying for itself many times over, assuming the owner is willing to apply the necessary elbow grease. Meanwhile, $500 on sports parlays may as well be flushed down the toilet.

Get an AI MBA for $20 a Month

Building a business today is more accessible than ever. A motivated and curious person can use cheap AI tools to build a website, write a business plan, get legal advice, and brainstorm marketing ideas. Just a few years ago these setup costs could have easily totaled $10,000+.

If you’re unemployed or struggling, one of the best investments you can make is in your own AI skills. Just go to ChatGPT.com and start experimenting. You can do a lot even with a free account. A premium subscription costs $20 per month and used correctly can provide an incredible ROI.

One could argue that a $20/month ChatGPT membership is far more valuable than a $150k MBA in today’s world.

The future belongs to entrepreneurs and those who learn to harness AI to its full potential.

Smart Speculation

For those who do have funds to invest, only a portion should be used for high-risk bets. The majority should be put into tax-protected retirement accounts like a 401k or IRA, and invested in index or target-date retirement funds.

Of course, a portion of your portfolio can be invested in speculative assets. There’s absolutely nothing wrong with smart and disciplined speculation.

For example, well-researched and executed options bets can improve long-term returns. But we need to recognize the increased risk in this area, and treat it with respect. Keep options betting to a small portion (5% or less) of your overall portfolio. And no, that doesn’t mean invest 5% on a single options trade. It means that only 5% of your total portfolio should be dedicated to options, and that’s it. If you lose that 5%, don’t dip into the core.

Personally, I feel safe putting a larger percentage of my assets in long-term contrarian investments. For me, that often means buying out of favor assets like emerging markets (Brazil is a personal favorite currently – see more here).

Silver miners are another of my favorite speculative investments today. They are a classic asymmetric trade, meaning they have far more upside potential than downside. Read more about the silver miner thesis in Something to Behold.

These examples are speculative, but in a smart way. They couldn’t be more different from sports gambling.

This method takes patience, but it has an infinitely higher chance of producing wealth than gambling and other dubious methods.

Look for more contrarian investment ideas in the near future.