This post Silver’s 27% Drop, in Context appeared first on Daily Reckoning.

Well, it’s finally here.

A major correction in gold and silver. It’s pretty gnarly out there.

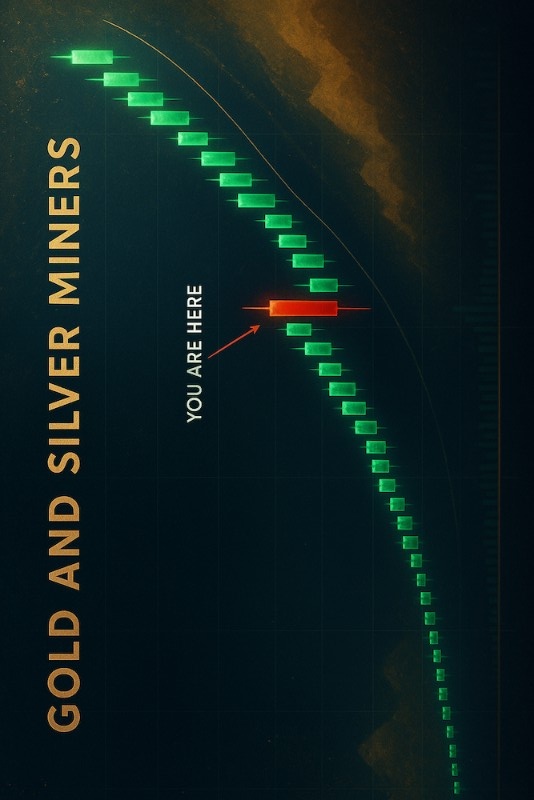

A big dip was inevitable, as we’ve mentioned a few times lately. Metals have come a very long way in a very short time.

But the sharpness of this move has surprised me. As I write, silver is down about 27% on the day to $83. Oof.

Thankfully, gold is “only” down 11% and miners are down around 14%.

At times like this, it’s important to remember how far we’ve come over the past 18 months. Both miners and bullion are still up hugely, and the miners would still look attractive even if we go down to $3,500 gold and $60 silver.

Perspective is everything. If you had told me a year ago that silver would be trading at $83 and miners would be up 2x to 4x, I’d have been beyond thrilled. But now it seems like a disaster.

That’s just how our brains work. When we set a new high water mark in our portfolios, that becomes the norm. So let’s keep that in mind.

This correction is a tough one, but my belief is there’s still much more upside ahead on the other side of it.

If we continue to move lower on Monday, I’ll add to big, high quality silver and gold miners like First Majestic Silver (AG), Newmont (NEM), and Pan American Silver (PAAS). They look very cheap here.

If you’ve been waiting for a dip, it’s here. Now is a fine time to start adding/buying. If you told yourself you’d buy on the next big dip, and have the cash, go for it. Yes, it’s scary, but that’s the nature of this thing.

We may go a bit lower, but I suspect we’ll recover and creep towards new highs throughout the year.

And once China and South Korea re-open for trading early Monday, I suspect this dip will be bought.

Root Causes

The financial media is pinning this correction on President Trump’s new Fed Chair pick, Kevin Warsh.

Many analysts were expecting the more “dovish” (print-happy) Rick Rieder.

But the Fed doesn’t matter as much as people think, as we have learned from Jim Rickards.

And no matter who runs the Fed, during the next crisis, money will be printed. Unprecedented amounts of it. The government will send out stimulus checks, run huge deficits, build infrastructure, and it’ll all be financed by the Fed’s debt monetization (printing money to pay the bills).

Besides, we can’t blame this correction on a Fed appointee. It’s really just a reaction after such an incredibly bullish move.

Ultimately, the fundamental story has only strengthened.

JPMorgan Slaps an $8,000 Target on Gold

This week, analysts at financial titan JPMorgan released a research note calling for $8,000 gold by the end of the 2020s. Via Mining.com:

In a research note issued Thursday, strategists led by Nikolaos Panigirtzoglou said prices could push even higher to $8,000 an ounce by the end of this decade, if private sector investors continue to pile into the metal.

This scenario, which represents an upside of over 40%, could happen if investors increase their allocations into gold from 3% to 4.6% of portfolios, the analysts said.

For once, mainstream analysts are onto something. All it takes is a small shift from traditional assets into gold, and the price will continue rising.

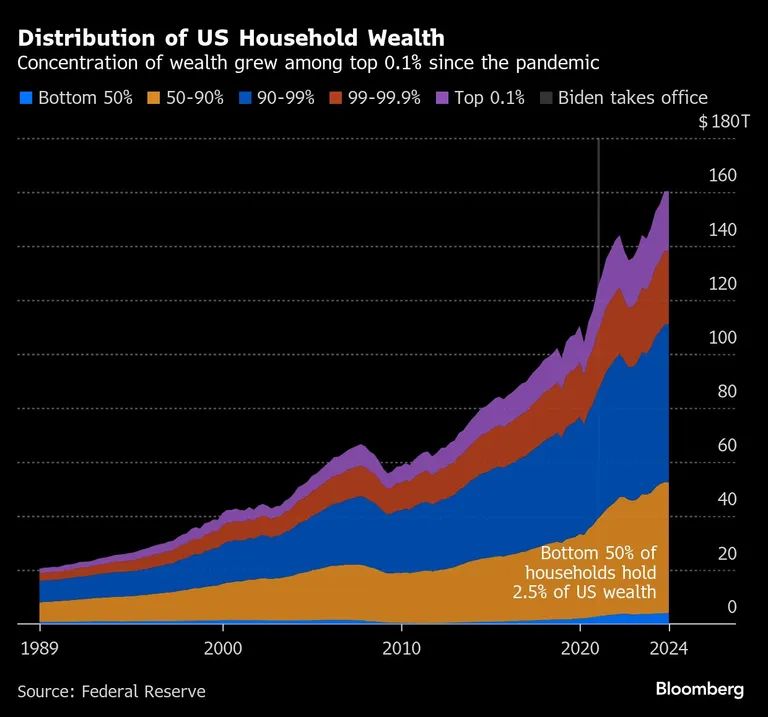

After all, the world has far more wealth than it ever has before. The chart below, via Bloomberg, is meant to show the rising inequality in U.S. wealth.

And it shows that well. But let’s also realize how much wealth has been created over the past 15 years. It’s been an incredible run for stocks and home prices.

U.S. household wealth has grown by more than 2.5x since 2010. And that chart is more than a year old, so it’s grown even more than that since.

And despite its significant issues, the story is similar in China. Chinese households have a 40% savings rate, meaning they save on average 40% of their disposable income. And they love gold and silver. So unlike previous precious metal bull markets, China has become a very important factor.

Around the world, there’s far more cash and wealth sloshing around than ever before.

And as we continue to approach a global debt crisis, a growing percentage of that money will find its way into gold, silver, and miners.

Hard assets for hard times.

It’s difficult to say exactly when precious metals will begin ascending again. But I still believe they will find new highs this year. And if not this year, then next. And as I mentioned earlier this month, miners continue to look more attractive than bullion.

Back in October of last year, we had a selloff from $55/oz silver to $47. During a day when silver miners fell about 8%, I wrote a piece titled Keep Calm and Hold Gold and Silver Miners.

Here’s the image I made for that piece:

I’m glad I didn’t sell then, and sometime in the near future, I suspect I’ll be glad for not selling now either.

The situation today is more extreme, of course. We’ve come so much further this time around, and this crash is in-line with that bump.

Buy the dip, in miners, or physical bullion if you prefer (if you have the means to). Physical bullion is always a nice option too. An insurance policy in case everything gets extra chaotic.

But consider saving a little cash in case we go lower. Our friends on Jim Rickards’ and Matt Badiali’s teams will undoubtedly have buy-low recommendations coming your way.

If you’re in this precious metals journey with us, it’s been mentally taxing. The highs and lows are extreme. Try to take a step back, and get out and do something. I’ll be playing pickleball tonight to blow off some steam for a few hours.

In the long run, the precious metals bull market isn’t close to done yet. We had an incredible bullish move, and now we have to deal with the inevitable drawdown.

Have a good weekend everyone.

The post Silver’s 27% Drop, in Context appeared first on Daily Reckoning.