Republicans on Capitol Hill took steps Wednesday to overturn an emergency D.C. measure that divorced the city from certain federal tax cuts, potentially creating an estimated $600 million hole in the District’s budget.

The House approved by voice vote a disapproval resolution to kill the D.C. measure, which would decouple the District from several tax-saving provisions included in last year’s One Big Beautiful Bill. House Democrats said the resolution was being pushed through against the will of D.C. residents and leaders.

“The D.C. Council would rather punish their own residents, their own people, than recognize the achievements of President Trump’s legislation,” said Rep. Brandon Gill, the Texas Republican who sponsored the resolution. “This is anti-working class, it’s anti-senior citizens, and of course, it’s anti-business.”

Earlier Wednesday, the Senate Government Affairs Committee advanced in a 7-3 party-line vote a disapproval resolution that D.C. leaders say will upend their tax-filing schedule and erase a child tax credit that was being funded by opting out of the tax cuts.

City leaders last fall enacted legislation to opt the District out of some of the One Big Beautiful Bill’s provisions, including tax exemptions on overtime, tips and seniors on Social Security; no taxes on personal interest on car loans; specific tax breaks for business manufacturing and research; and an increase to the standard deduction.

Twelve states took similar action to pull out of the tax cuts that don’t align with their revenue projections.

The District, which city leaders say is in for some belt-tightening due to the Trump administration’s downsizing of the federal government, withdrew from the tax cuts to bank an additional $600 million through 2029.

But Sen. Rick Scott, the Florida Republican who introduced the disapproval resolution, argued the tax cuts empower D.C. residents to spend their money how they want.

“These tax cuts support hard working American families and businesses,” Mr. Scott said during the Senate committee hearing. “It allows Americans, especially those in the service industry here in D.C., to keep more of their own money. It also allows deductions for seniors who live on fixed incomes and struggle when costs go up again.”

Sen. Maggie Hassan countered by saying the District should be in control of its own financial destiny.

“The people of D.C., through their elected representatives in the D.C. Council, have a right to decide their own local tax policy, just like the people of New Hampshire get to decide how much state taxes we have in New Hampshire,” the New Hampshire Democrat said. “That’s one of the reasons why Congress has never overturned a tax measure like this, a measure that was approved by the District of Columbia.”

On the House floor, Rep. Maxwell Frost said the One Big Beautiful Bill is a boon for corporations and billionaires while cutting funds to public goods that many Americans rely on.

“It has caused a revenue shortfall that has thrown state budgets into chaos, threatening services like health care, child care, schools, elder care and emergency response,” the Florida Democrat said.

’It will sow chaos’

D.C. leaders have sounded the alarm about the congressional momentum behind undoing their tax framework.

D.C. Mayor Muriel Bowser and D.C. Council Chairman Phil Mendelson, both Democrats, wrote in a joint letter that the resolution infringes on the District’s Home Rule authority.

The two further said Capitol Hill’s proposal would force a midyear change to tax policy that will cause delays in collection and increase costs on the city.

The Center on Budget and Policy Proposals, a nonpartisan research group, backed the District’s opposition to the measure because they said it helps patch a budget hole created by federal initiatives.

D.C. Delegate Eleanor Holmes Norton, a Democrat and the District’s nonvoting representative in Congress, was more pointed in her criticism of the resolution.

“It will sow chaos in the middle of tax filing season, likely forcing the District to hold tax filings altogether while it scrambles to rewrite forms, systems and guidance,” Ms. Norton said Tuesday during a press conference. “That is not oversight. That is not governance. It is sabotage, and the damage would be severe and intentional.”

The resolution, if passed, would be another instance of Republicans exerting their will on D.C. policy.

Congressional lawmakers enforced a $1 billion budget cut on the District last year by removing language in a temporary spending package. By using some emergency maneuvers, the District was able to mitigate the cut to about $350 million.

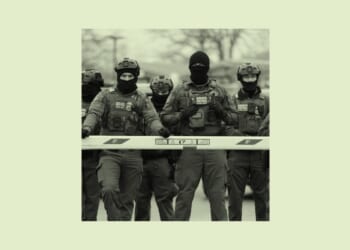

Outside of taxation, Mr. Trump launched a sweeping crime and immigration crackdown in the District last summer that involved deploying the National Guard and sending federal agents to patrol city streets.

Last month, military officials ordered National Guard troops to stay in the District through the end of this year.

Republicans in Congress also threatened to withhold federal funding from the District if it didn’t tear up a Black Lives Matter street mural that sat a block away from the White House.

Ms. Bowser did remove the mural, but said it was already scheduled to be replaced by new artwork for the nation’s 250th celebration.