“If you don’t become a multi-millionaire in the next couple of years, you’re doing something wrong,” quipped Rick Rule in a sidebar to his investment conference last week in Boca Raton, Forida.

Rick wasn’t kidding. He means it. Although, of course, to do well you must begin with seed money; and no, I don’t mean plopping down a few bucks at the local 7-Eleven store for lottery tickets. It takes money to make money, and you must have investable, risk-tolerant (!) cash to put into the hard asset ideas on display at Rick’s get-together.

Rick hosted forty or so companies in the exhibit hall. And all of them had something to offer, each in their own way: coins and ingots; early-stage exploration; advanced exploration; various phases of project development; pre-production plays; mouth-of-the mine production; royalties; and even a bank that understands gold and silver.

Speaking of silver, on the first day of the conference I bought a few 5-ounce ingots from the guys at the First Majestic Silver (AG) table for $1.50 over spot, a special deal at the conference; $38 per ounce at the time. And by the end of the week, silver’s price was over that number. So, I’m ahead already!

5-Ounce silver ingots from First Mint, a subsidiary of First Majestic Silver. BWK photo.

Then again, this kind of quick gain is a fluke of timing. Metal spot prices go up and down. And I don’t chase short-term trades, definitely not in real metal. When I buy physical, I take delivery and it’s for the long haul. My focus is to preserve wealth while the current dollar system falls apart at its own rate, another topic deeply discussed last week in Boca.

Your Dollars are Dying

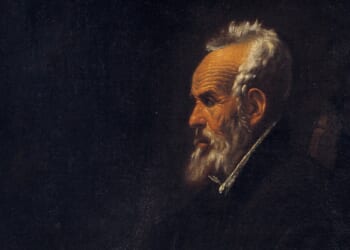

Along the lines of our failing dollar system and an inevitable, looming monetary reset, David Stockman gave a talk, complete with all the usual charts. And oh man, are we ever hosed…

Long ago, David served as a key economic adviser to President Reagan, and 40 years later he certainly knows a few things; like, where the bodies are buried, so to speak. He laid out the litany and history of the dollar’s decline, disaster and impending downfall: federal deficit spending, inflation, national debt, interest on the debt, accelerating loss of purchasing power. Ugh… totally depressing.

But you know the drill, right? There’s no sense reproducing David’s charts. Just be assured that the numbers are terrible and the chart trends are toxic. Your dollars are dying, so look for ways to preserve wealth.

All this and, on a side note per David, the U.S. faces severe labor shortages just to keep the economy buzzing. Partly, it’s due to long-term declining fertility, currently about 1.73 children per couple which is below population replacement rate. Boomers are aging out of the workforce and economy, and there aren’t enough people with the right skillsets to replace them.

Indeed, David offered a memorable quip along those demographic lines: “I’ll tell you why I can be so certain of labor shortages. Because over the past 30 years, those future workers were never born!”

And from another angle, future labor shortages are baked into the cake due to America’s abysmal, nationwide collection of poorly-run, widely ineffective government schools. The fact is that America is home to tens of millions of ill-educated people who are unprepared for high-productivity jobs in a globally competitive environment.

But don’t bother looking at government statistics for truth. One long-time friend of Paradigm Press, Danielle DiMartino Booth, offered her take on the numbers and charts out of the Federal Reserve and Bureau of Labor Statistics (BLS): “Everybody at the Fed and BLS hates Trump. They’ll shade the real numbers until right before the 2026 elections and then do a dump that explains how bad the economy really is out there.”

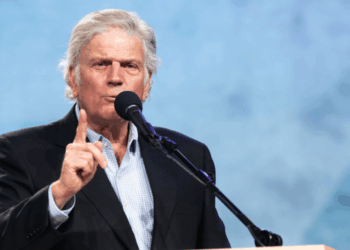

Our own Jim Rickards attended the Rick Rule event as well. Memorably, during a discussion panel he shook his head in despair and noted that “the Fed has become irrelevant in the overall picture. It’s all about Congressional spending and how the Treasury juggles the books anymore.”

Several points of agreement were that Fed chairman Jay Powell will not leave office any time soon (i.e., not voluntarily), and thus hand President Trump the opportunity to nominate a successor. Nor will Powell lower interest rates anytime soon. Hence, we now see the typical, dirty-trick, Washington-style political efforts to boot Powell from office by hook or crook, namely by tarring and feathering him over cost overruns to renovate the 90-year-old Federal Reserve building.

Will construction overruns doom Fed Chair Powell? AP photo.

At the same time, though, Jim noted that “Trump ought to keep Powell right there at the Fed, because if something bad happens with the economy the Fed chair is the perfect foil. Trump can blame Powell.”

What’s Going on With Gold?

The Rule Conference also hosted several well-known, long-time gold and precious metal dealers. These gents and their firms have their collective fingers on the actual pulse of gold and silver, in that they buy and sell physical metal every day, 24/7.

At the conference, the dealers had tables where attendees could buy gold or silver coins and small ingots right on the spot (see my small silver-buy, above), or else submit orders for larger purchases. Plus, all of the sellers had time slots for talks and presentations.

The dealers agreed on one general point, that the rising price for gold and silver over the past two years is not due to retail coin buyers in America.

They said that more and more Americans are selling coins and other precious metals just to raise cash and pay bills. In this sense, metal flows through U.S. dealers offer powerful evidence of growing financial problems across the nation’s middle and upper middle class, even among households that were buying gold and silver just a few years ago.

“Inflation has robbed perhaps 30% and more of household purchasing power in the past five years,” noted one dealer. “Even people and households that you think would be well-off are struggling. When people sell coins we ask why, and they tell us.”

Of course, the coins go somewhere: “Typically, we buy small lots from sellers who need the cash,” said one dealer. “And then I’ll contact a long-time client who might come in and buy 300 or 400 ounces at a time.” In other words, retail-level gold is moving into the hands of large accumulators.

Fundamentally, though, and according to the dealers, rising gold prices are due to central bank buying outside the U.S. and other Western nations like Canada and the U.K., where government anti-gold sentiment remains strong. Plus, we have significant demand from the “Asian market,” by which the experts mean mostly China.

“China is buying gold at the state level, and I mean by the tonne,” said Andy Schechtman of Miles Franklin Metals.

Andy gave an impassioned talk to about 750 conference attendees (with over 1,200 watching online), in which he discussed the ongoing efforts of the so-called “BRICS” nations – Brazil-Russia-India-China-South Africa – to construct an alternative trading and credit system to what now dominates. “Instead of world trade being financed by dollars through New York and London, it’ll be Shanghai and Singapore, using some sort of BRICS-unit” he said. “And one way or another,’ he emphasized, “there will be a gold component!”

Meanwhile, according to Andy, China has envoys and purchasing agents across the far corners of the world, where they buy or encumber ore and mineral deposits, especially for gold, silver and copper but also for much else. “Chinese buyers constantly visit small operations across South America and Africa,” he explained, “and offer cash deals right on the spot for concentrates and metal straight from the mines and mills.”

Indeed, China has constructed a brand-new, multi-billion-dollar port facility just north of Lima, Peru, to handle ores and mineral concentrates straight from Andean mines; and this new port dovetails nicely with China’s growing operations in Panama, certainly with China’s ultimate designs on the Panama Canal.

Rick Checkan of Asset Strategies International spoke knowledgably about U.S. demand for gold and silver, especially pertinent to high net-worth players. He offered solid advice on how to balance the desire for physical possession with the need for safety and security, certainly for anyone with significant physical holdings. This includes domestic storage in various U.S. jurisdictions, or storage in Canada or other secure locales overseas.

Dana Samuelson, of American Gold Exchange in Austin, also offered his unique insight into the numismatic side of precious metal coins; he’s been in this business for 45 years or so.

“For most people,” said Dana, “the investment and wealth preservation idea should be to acquire the most bullion for their dollars as possible, with low markups over spot.” Still, per Dana, we’re in a market where demand for older coins has dried up to the point that markups are very small, and in many cases just over melt-value. In other words, if you’re a coin collector and want to add to your stash of older coins, now is the time.

Classic 1926 U.S. $10 gold “Indian Head” at low markup over melt. BWK photo.

For example, a pre-1933 U.S. $10 gold piece has just over .48 ounces of gold in it. And depending on the so-called “mint-state” (ie., “MS,” or the quality of the coin), it sells for about the price of half an ounce of gold. As you might expect, though, something like the MS-64 pictured above sells for higher markup than, say, MS-62. And it depends on the date as well. But the takeaway point here is that old gold coins are a bargain just now if you are inclined to collect them.

If you’re not a collector, stick with bullion items like U.S. Eagles, Canadian Maple, Australian Kangaroos, etc. Accumulate bullion now and avoid the rush later when prices go moon-shot.

Pounds in the Ground

Meanwhile, the Rule Conference hosted numerous other companies in the mining space: gold, silver, copper, uranium, rare earths, and various other metals that are currently hot. All of the companies boast strong management teams, or Rick would not have invited them. Plus, they control great assets and a strong resource base in terms of ounces or pounds in the ground; in essence, these companies display good, growing numbers where it matters.

All this, while last week President Trump, placed a 50% tariff on imported copper, which instantly goosed the share price of several U.S.-focused companies exhibiting and presenting at the Boca event. And then on Friday, the U.S. government announced a deal to support rare earth producer MP Materials (MP), which skyrocketed the share price of that company.

Time and space don’t allow for a long discussion here of the many companies I saw in Boca, and with which I met last week. But over the next few months I’ll follow-up with details and lay out my commentary in the Jim Rickards franchise for Strategic Intelligence, and with Zach Scheidt in Lifetime Income Report. So be sure that your subscriptions are up to date.

Looking ahead, I have a sweet list of under-appreciated royalty plays, a sector that’s heating up just now with takeovers and upside. I also have several great names in mind for early- and mid-stage explorers that work in what I consider to be safe jurisdictions. Plus, I have a list of developers that are moving along crisply to the point where markets will soon recognize the value. And I have some producers that are just getting started and are destined to be re-rated in a way that will benefit the share price.

Of course, I also have up-and-running production names, currently making money and likely to make seriously more money in a strong and rising market for hard assets like precious metals, basic industrial items, and an important energy-metal like uranium.

Which gets us back to Rick Rule’s comment at the top of this article, about how investors can make life-changing gains in the years to come. That, and preserve wealth while the monetary system transforms from its current state into whatever is coming down the rails.

That’s all for now. Thank you for subscribing and reading.