Well, that sure was fast. It’s been six weeks since President Trump’s so-called “Liberation Day,” when he announced draconian levels of tariffs at a global-scale. And now, we have a thinly disguised retreat and kowtow to China’s Emperor Xi.

Despite hoopla, tough talk and bluster, Team Trump walked into a policy minefield. Tariffs on China highlighted how many of America’s problems are rooted in toxic domestic politics, and unforgiving industrial-scientific reality.

To be fair, Trump didn’t create the original issue of America’s massive trade imbalances. But to be realistic about everything, Trump will have his hands full if he truly moves to resolve it.

The fact is that China holds a not-so-secret trade weapon, which I’ll detail below. It gives China’s Premier Xi an asymmetrical ability to retaliate against Trump’s tariffs. Indeed, Beijing’s scheme is already playing out via widespread Chinese embargoes on critical materials that are no longer moving to the West. Over time, China’s actions will literally shut factories and turn out lightbulbs across the U.S. economy.

Trump surely knows all this which is why he’s now beating retreat and making the best of a bad situation. He “doesn’t hold the cards,” to use one of his famous phrases. Or label it whatever else you wish, but the U.S. has suffered a self-inflicted strategic defeat. America will require time and a strong political commitment to redirect resources and fix what’s wrong, if that’s even possible in the current culture and political climate.

For now, we’ve reached the end of a brief, sad chapter in Trump’s tariff gambit against China. After a whole month and a half, and with all the unsettling and costly gyrations to global trade and markets, the U.S is running up the white flag. It’s time to move on to Plan B, C, D or whatever else there is.

In a nutshell, that’s the bad news. The good news is that at least part of the solution here is investable. So, what’s going on? Keep reading…

Strategic Retreat

Let’s start last month, on Wednesday, April 2, 2025, when President Trump announced his “liberation” plan for the United States. With characteristic showmanship, he released a long list of stiff tariffs that the U.S. government would impose on countries across the globe, to include even a couple of remote islands inhabited mostly by seals, seagulls and penguins.

Trump’s grand design spared no foreign producers, not from Liberia or Laos, not from Latvia or even tiny Lesotho. In the future, all nations would face imposts, duties and border-entry fees to move their goods across the unloading docks and onto American store shelves.

The background to this is that the U.S. has become a country of consumers, defined by a culture of consumerism. We can thank the Federal Reserve for this, and its constantly-inflating, elastic currency. And the fact is that, anymore, much of America’s global power emanates at checkout counters across the land, in the nation’s shops, stores, malls, warehouses and online distribution systems.

In other words, and as Trump has noted, the U.S. is the world’s greatest mass market. And his message of national liberation was that the price of entry just rose to outsiders who want access. If you’re a non-U.S. producer that sells shower sandals, or high-thread-count bedsheets, or flat-screen television sets, it will cost you more to obtain that lucrative product placement.

This is all part of Trump’s Big, Beautiful Plan to reindustrialize the country. Politically, the oft-repeated goal is to return manufacturing to America’s deindustrialized economy, along with the myriad of jobs-jobs-jobs that have otherwise vanished from the dark fields of our Republic.

The prime target of Trump’s liberation-by-tariff was mainland China, economically (and also figuratively) carpet-bombed by the President and his economic team with triple-digit tariffs on pretty much everything. Although it’s worth noting that, a short time later, post-liberation, Trump pulled back tariff rates on certain items of Chinese electronics.

Then came yesterday, Monday, May 12, after a weekend of U.S. negotiations with Chinese counterparts. In essence, the Trump administration backed down from its sky-high tariffs on the Middle Kingdom. At least for now.

According to a headline in no less than the New York Times (which I read so that you don’t have to): “U.S. and China Agree to Temporarily Slash Tariffs in Bid to Defuse Trade War.”

It’s such a big story that the Times actually used a split infinitive in a headline! But that’s not all…

According to the Times:

“The move by the United States, after President Trump had repeatedly declared that he would not lower tariffs without concessions from China, represented an acknowledgment of the costs of an all-out trade war with China. Despite the White House’s bluster, the Trump administration ultimately backed off, for now, from the steepest tariffs, and agreed to hold more formal talks with Beijing after companies and consumers started showing signs of economic strain.”

President Trump channels his inner Roughrider. Courtesy NY Times.

“We’re not looking to hurt China,” said Mr. Trump in a briefing at the White House. And in a joint statement, the U.S. and China announced that the two nations would suspend their mutual tariffs for 90 days and continue with negotiations. It all sounds very businesslike.

Yet from first accounts, China has not budged in the face of Trump’s tariff pressure. For example, according to a Chinese economist named Zhiwei Zhang, president of Pinpoint Asset Management in Hong Kong, “From China’s perspective, the outcome of this meeting is a success, as China took a tough stance on the U.S. threat of high tariffs and eventually managed to get the tariffs down significantly without making concessions.”

Indeed, it’s no stretch to say that China was never going to allow itself to be intimidated; not by Trump or anybody else, no matter the hit to the country’s export-led economy. That’s because China is run by its hardline, iron-willed Chinese Communist Party (CCP), which from Day One took a wartime approach to resist the New York Yankee and his “imperialist bullying”.

For example, in early April, right after Trump released the new tariff schedules, a high-level spokesperson of China’s Foreign Ministry posted on X (formerly Twitter) a video of a speech that Mao Zedong made during the Korean War, known in China as (hint-hint!) the War to Resist U.S. Aggression and Aid Korea. Among other things, the founder of modern China declared, “No matter how long this war is going to last, we’ll never yield.”

Playing old Mao movie clips is one thing. But more practically, and in response to Trump’s tariffs, China tightened existing restrictions on critical material exports and enacted stringent new controls on their use. And that’s the hit that matters.

Rare Earth Leverage

This brings us to China’s global-scale dominance of entire supply chains of critical materials that span large tracts of the periodic table of elements. And how, without access to these materials, much of the Western industrial complex – definitely in the U.S. – simply ceases to function after stockpiles are exhausted. People write books on this very technical topic, and it helps to have studied some chemistry, if not quantum physics.

Briefly, the current situation is rooted in the early 1980s when China’s then-leaders made a series of truly strategic decisions. They devoted significant national funds and resources to building the country’s industrial capabilities. The goal was for China to become the world’s low-cost producer of a long list of elements and materials that are necessary to run a modern, technological civilization.

We’re way past quaint, old, classical economics, like with David Ricardo and “comparative advantage” of one country over another in, say, respective output of wheat and wine. No, we’re not in that antique world anymore; we now live on a planet of continent-spanning supply chains, many of which are dominated by China.

In fact, due to past U.S. restrictions on exports of various tech to China, the latter nation already has in place extensive counter-restrictions on the sale of critical materials to U.S. companies in the defense business like Lockheed, Northrop Grumman, General Dynamics, Boeing and many more.

Consider Chinese restrictions on exports of gallium and germanium, byproducts of smelting bauxite into aluminum and sphalerite into zinc. U.S. domestic production of these two elements is miniscule, yet they are critical to the modern semiconductor industry, for example.

Meanwhile, China dominates global output of graphite, much of which is used in all manner of batteries. And that takes us to Chinese dominance of supply chains for what are called “battery metals” like samarium, cobalt, lithium, nickel and much more. (All of this over and above China’s gigantic copper industry.)

Then there’s China’s dominance in the production of antimony, used as a fire suppressant and critical in production of ammunition primers, explosive detonators and rocket motor igniters. That is, absent China’s antimony, the world – certainly the U.S. – will have a tough time manufacturing ordnance, whether for military use or just for target practice down at the range.

Plus, China dominates global production of tungsten, a super-hard metal with a high melting point, used in all manner of machine tools as well as every sort of aerospace application.

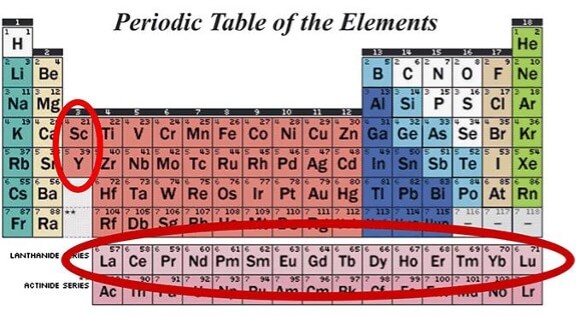

Periodic table, highlighting REEs. Courtesy MIT Department of Chemistry.

And of course, we have China’s long-term dominance of supply chains for rare earth elements (REEs), those 17 elements of the periodic table in the Lanthanide series; see the image above. Each in their own way, these elements have unique properties of magnetism, phosphorescence, electronic capacities, and other of what are called “field effects” in atomic bonding. Without them, the technology of your life would regress to about the 1940s.

Today, for example, your car contains significant amounts of REEs; and if you drive an electric vehicle, you truly rely on a large amount of REEs in your set of wheels. Plus, you have REEs in your smart phone, computer and screen, and most household appliances, if not grandma’s pacemaker and hearing aid. Even your light bulbs use REEs, and vast amount of those materials (well over 80%) originated in China.

I won’t overly detail the downstream military uses of REEs, except to say that an F-35 has not quite half a ton of REEs inside of it; a Virginia-class submarine holds about eight tons of REE inside the hull; and every piece of guided ordnance uses REEs; missiles, rockets, JDAM bombs, etc. Again, there are entire books on these points.

When you boil it down, this story of critical materials, and where they are produced, tells the real tale behind the 90-day pause in Trump’s tariffs after a weekend of negotiations with China.

That is, Trump’s tariffs hit the Chinese export economy right in the gut. And yes, many Chinese factories saw orders dry up overnight. But then, China kicked back at Trump and the U.S. with ultra-tight restrictions on materials that are essential to running the Western economy, particularly the defense complex. Finally, in the past month China began to shut the door, good and tight.

Of course, China’s restrictions on exports of critical materials would take time to play out. Most U.S. companies have stockpiles, or material in transit somewhere in the global logistics pipeline. But give it perhaps three or six months, or nine months or a year at most, and the reserve bins and supply lockers will be empty.

Trump’s negotiators had little choice. China trumped Trump, so to speak. And now we must ask… What can Trump do? What can the U.S. do?

Well, the U.S. will make “deals,” of course. That, and America must get strategically serious about what makes its modern society work; namely, critical metals and materials, plus ample amounts of energy.

To secure critical elements and materials, Trump and U.S. policymakers must enable the buildout of domestic supplies or obtain output from close allies. This will require tax incentives and investment credits, plus subsidies, regulatory relief and much else, all to the end of helping the U.S. and Western extraction industry get projects up and running.

If not? Well, plan for when the light bulbs burn out. Yes, it’s that serious.

All of this means that some companies will do quite well. And on my end, for twenty years and more I’ve covered these kinds of ideas for Paradigm Press. I write about these things with Jim Rickards in the Strategic Intelligence family of newsletters. We’ll keep an eye out for promising opportunities in this space.

I’ll leave it at that, for now. And we’ll keep watching the spectacle and logrolling of tariff negotiations. That’s all for today. Thank you for subscribing and reading.