The past 10 years has been dominated by tech.

The Magnificent 7 is up 2,278% over that period. That’s Google, Microsoft, NVIDIA, Tesla, Meta, Amazon, and Apple.

It’s been an incredible run. But the tech bull will soon be put out to pasture. Valuations are stretched. Employees are already filthy rich off stock options, draining their motivation.

Spending on AI hardware and talent is completely out of control. Meta reportedly offered a single AI researcher $1.25 billion for a four-year contract! Talk about unsustainable…

Meanwhile, once great companies like Apple and Amazon have completely dropped the ball on AI and are losing their way. Real innovations are few and far between.

In other words, the Mag 7 bull run doesn’t have much gas left in the tank.

So what’s next?

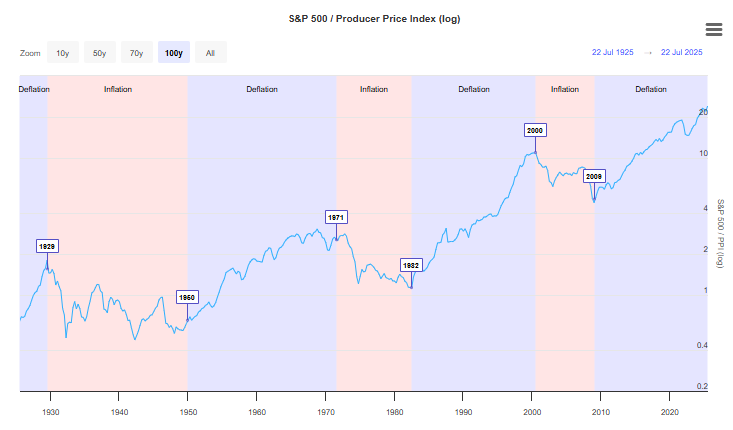

Below is a 100-year chart showing how commodities perform vs the S&P 500. When the blue line rises, it means stocks are outperforming commodities. When it falls, commodities outperform (for a full-size version of the chart, click here).

Source: Longtermtrends

As you can see, it’s a cycle that repeats. Stocks soar for a decade or two versus hard assets, then it reverses. Over the past ~15 years, stocks have dominated.

But commodities take their turn too. And when they outperform, natural resource stocks soar. These periods tend to be inflationary, as shown on the chart periods shaded in pink.

The classic example is the 1970s, when gold and silver miners rose around 2,200% and the S&P commodity index rose about 586%. From 2000 to 2008 was another lucrative period for hard asset investors.

I believe we are entering another commodity bull cycle now. The dollar is falling, stocks are ridiculously expensive, and President Trump is finally addressing our country’s red-tape nightmare. And of course, the Federal Reserve will inevitably be forced to restart money printing operations within a few years.

Since the beginning of this year, capital has begun rotating into the natural resource sector. Gold and silver have been the strongest performers, and we’ve been all over that.

With Trump’s ambitious natural resource reforms coming into effect, this trend is set to expand and accelerate.

Copper, uranium, lithium, nickel, palladium, platinum, oil, gas and more. The whole natural resource sector is about to open up, and we expect capital to flood in.

Trump’s Greatest Success

President Trump has had some recent political stumbles. With all the subterfuge and spycraft going on, it’s hard to figure out exactly where the truth lies.

But in one area in particular, POTUS has consistently hit the ball out of the park.

Trump has been laser-focused on fixing America’s broken natural resource sector. As we pointed out in The Dirt on Gold Miners, it has taken an average of 29 years for a new mining project to go from discovery to production! It’s absurd.

The President is using a combination of legislation, executive orders, and political appointments to dismantle the regulatory gulag which has crippled our natural resource sector.

I shudder to think how bad it would have gotten had Kamala won. America would have become ever-more dependent on China and foreign nations for resources, as our own mineral wealth wasted away in the ground. So we can be thankful for that.

Picks & Shovels for the Mining Boom

The big question is: which companies stand to benefit most from this mining renaissance? Over the long run, it could end up being early-stage exploration companies. Small aspiring miners with great teams, access to capital, and rich mineral deposits. For long-term investors, it makes sense to allocate some funds to these types of stocks (and majors, as well).

But even with Trump’s reforms, those projects will take years to get going. And picking the right companies can be difficult even for the sharpest analysts.

The companies which stand to benefit immensely and immediately are what Jim Rickards calls MDPs (Mineral Discovery Prospectors).

These MDPs sell the modern, high-tech equivalent of picks and shovels for mining. They offer exploration and drilling services, seismic surveys, resource management, and more. These companies use advanced equipment which is set to radically improve efficiency and hit-rates in the mining industry.

As the American mineral boom speeds up, select companies stand to benefit greatly. Their success doesn’t depend on hitting a mineral jackpot. They get paid for their services regardless of whether the exploration sites they work on are ultimately fruitful. Of course, they do the best they can. But ultimately the quality of the resource isn’t up to them. And their bottom line doesn’t depend on it.

It’s the closest thing to a true pick and shovel play that I’ve seen. And as demand for these services rises, so will the price these companies can charge. It’s a beautiful model for this current environment.