“Are you looking for the Holland America check-in? Or Princess? Or Viking?”

The polite, smiling greeter was addressing me, and I was surprised. My mind was elsewhere.

“No, thank you,” I replied. “No cruise ships. I’m here for work. But can you point me to the taxi stand, to get into town?”

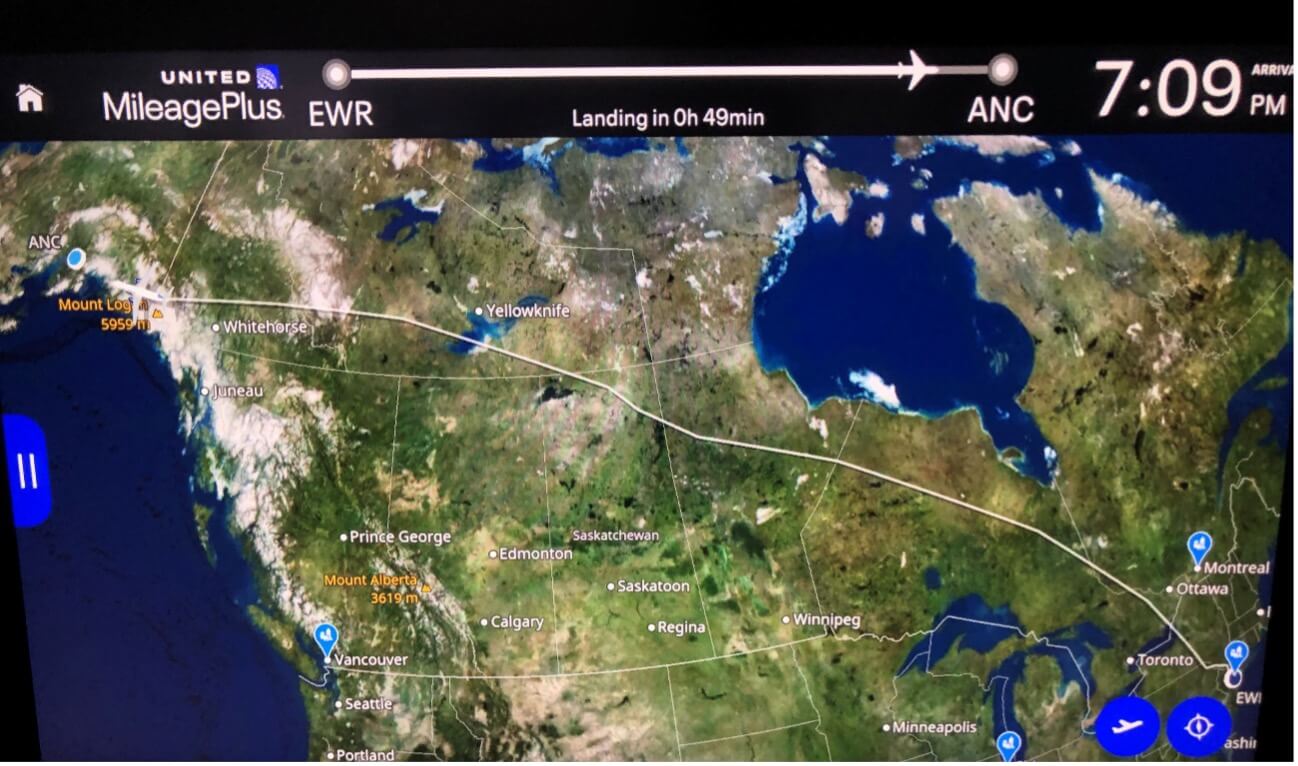

And so it began on Sunday evening, as I disembarked at the Ted Stevens International Airport in Anchorage, after a long, transcontinental, mostly trans-Canada flight from Newark.

Inflight track of route from Newark to Anchorage. BWK photo.

No cruise-ship-Alaska for me. No Glacier Bay, scenic coastlines, stops in Skagway and Ketchikan, Inner Passage, etc. Okay, yes… I’ve done that in the past and it’s a lot of fun. I recommend an Alaska cruise if you have the opportunity.

But for this visit to the 49th state, my attire includes hard-toed boots (carbon fiber, not steel) and a reflective vest. I’m in the field this week, up in America’s “last frontier,” as it has been called, to visit a group of exploration/early development sites.

And by the time you read this, I’ll be far inland, kicking rocks and looking at minerals.

Gold Is Where You Find It

The price of gold began this week up and over $3,400 per ounce, which reflects monetary issues at home and central bank gold-buying abroad. For innumerable reasons, yellow metal is valuable and becoming more so, at least in terms of the declining purchasing power of dollars.

Meanwhile, I’m looking for real gold on this trip, and its rising price makes the search even more important. But there’s also silver to be found. And copper and molybdenum. And many other odds and ends of the periodic table, without which modern society stops functioning.

Right now we’re at a point where hard asset prices are rising firmly, and showing their inherent value, certainly against troubled currencies. Which brings me to Alaska, a geological treasure house to be sure. For now, mostly, I’ll settle for gold. And of course, Alaska is famous for its gold, going back to the Gold Rush of the 1890s.

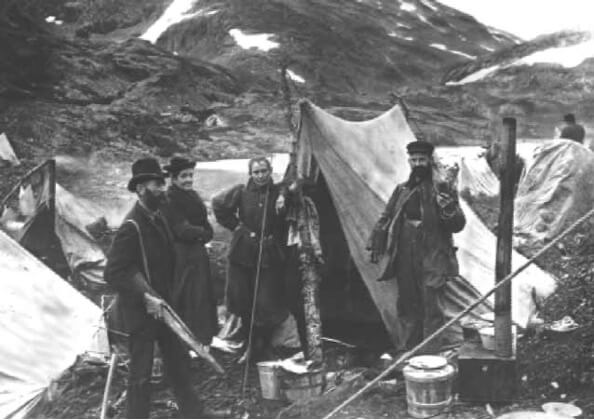

Fortune-seekers setting up camp in Alaska, 1895. Courtesy U.S. National Park Service.

Much of the early gold fever up North was about panning for metal in the vast basin of the mighty Yukon River. This effort extended upstream and far eastward across the then-territory of Alaska, well into Canada and its Yukon region where the Klondike Gold Rush also occurred in the same timeframe. I’ll refrain from delving into that fascinating history, although we could have many long articles just on this alone.

Suffice to say that, in terms of geology and what geologists call “deep time,” Alaska offers well over 200 million years of gold-rich opportunity, coupled with a mining legacy that dates back 130 years or so. The gold is there, and it’s exactly where you find it… if you look in the right places, and that’s the trick.

Most old prospectors chased what’s called “placer gold,” which means nuggets, grains and dust in the river sand. Gravity being what it is, and water doing what it does, gold washed down from mountain slopes and hillsides into stream channels and river basins. Then it settled out in the lowest nooks and crannies of the surface bedrock. Of course, Pleistocene glaciation and post-glacial erosion had much to do with it all.

In their day, fortune-seekers bent over and scooped up gravel, then washed it out in the chilly waters. Sometimes, Lady Luck smiled, and people measured their take in “ounces per pan,” which is a lot of gold. That, and they mucked their way upstream, looking for the source rocks.

Today, people still pan for gold, and I mean literally. You see it on those television shows about placer mining in Alaska and the Yukon, although much of that content is scripted nonsense. But yes, Alaska and Yukon still have placer miners, who still recover quite a bit of gold.

The real golden prize today, though, remains those upstream and uphill source rocks. And the goal of exploration-discovery-development-mining is to locate ore bodies with resources in the range of multi-millions of ounces. As in… seriously big, valuable, multi-billion-dollar plays.

We’re long past the era of grizzled guys eyeballing the ground in search of something shiny. Modern exploration is about cutting-edge science. Begin with over a century of ground mapping, and massive historical databases. Couple this with remote sensing and geophysics. Add surface geochemical sampling and ultra-detailed analyses. Then verify with complex drilling programs that target zones where geologists believe the gold “ought” to be.

In other words, modern exploration is about coming up with a geologic model of what’s down there in the rocks. It’s about figuring out how the past 200 million years or so of earth history – and that’s just here in Alaska; time frames vary in other regions – emplaced gold (or other minerals) in a particular zone of rocks and crustal structure.

The bottom line is that every part of a modern exploration program should have a valid, rational scientific basis. Every hole must go into the ground for a reason, with a solid idea of what’s down there. And every analysis of the rocks that come out of those holes must inform the geologists, management and shareholders whether the model is correct or not.

So yes, like I said… Gold is where you find it. But you still must look in the right place.

The Raw Politics of Hard Assets

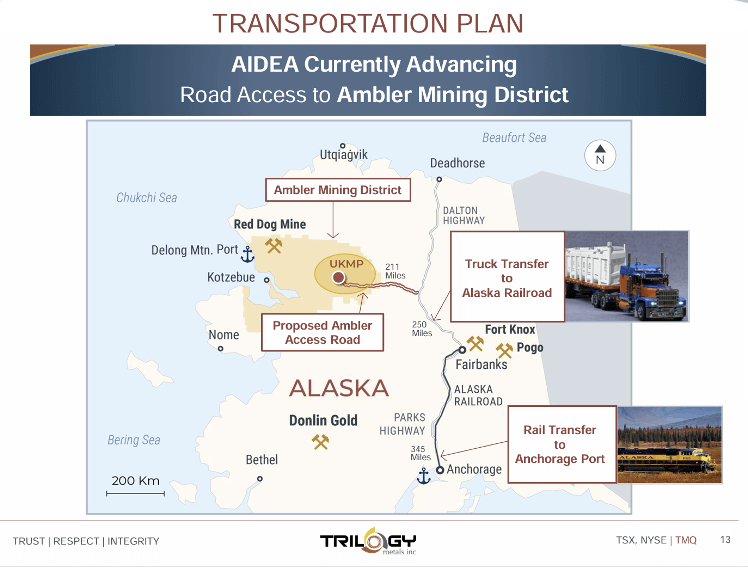

As the airplane landed in Anchorage the other night, it struck me that the last time I was on a site visit to this part of Alaska was pre-pandemic in 2019. I was up here to visit an impressive exploration-development project in northwest Alaska, within a district called Ambler, run by Trilogy Metals (TMQ). Here’s a general map:

Ambler Mining District within Alaska. Courtesy Trilogy Metals.

For this project, the geology is just plain great. The mineralogy is outstanding. The ore deposits within the complex are superb. There’s gold-silver-copper-lead-zinc-cobalt, and more. Overall, the resource could support mining for 75 years, and likely longer but there’s no telling at this early stage.

Meanwhile, as you can see from the map, the locale is remote. There’s not much up there but the great outdoors and a scattering of native villages. In fact, all modern amenities must come in via air, and costs for everything are through the roof.

With this in mind, any semblance of development in Ambler requires an industrial-grade access road from the mining camp eastward, to connect with the north-south highway that runs along the Alaska Pipeline. (See map; “Proposed Ambler Access Road.”)

And to make a long story short, for several years in the late 2010s, Trilogy management worked closely with local tribes, state government, and the federal government over where to site the road, how to construct the roadbed and bridges, etc., and how to protect the environment.

All went well, and Trilogy received a road permit in mid-2020. But then in 2021, the Biden administration showed up in the White House, and promptly, summarily rescinded the permit (are you surprised?).

Of course, this led to several years of litigation, with little additional development out in the field. Although now, under President Trump and his administration, the access road permitting process is back on track, but much delayed.

At this stage, things should go well with Trilogy and its efforts to develop Ambler. The minerals are there, the locals want to see it happen, and the state government is enthusiastic. Technically, there’s nothing wrong with the Ambler project and it ought to move ahead. While Trilogy itself is in good shape as development companies go.

Indeed, looking ahead Trilogy is a long-term, buy-and-hold development play. It will have its ups and downs over time, as markets react and do their up-down thing. But Trilogy’s underlying assets and development potential are more than apparent. So, watch the chart. Buy on down days. Use limit orders. And never chase momentum.

But this Trilogy story also illustrates the fickle nature of American politics, certainly as pertains to major projects like building and operating mines.

That is, and no matter the merits of any project, there’s a well-entrenched school of anti-development politics out there, backed by so-called “environmental” organizations and armies of lawyers. They oppose… everything! And they fund-raise off a well-designed approach of scare tactics and misplaced emotionalism.

Sad to say, this anti-everything opposition to mining is over and above America’s generally bureaucratized approach to most other important subjects as well, where just about anyone can say “no” and there’s hardly anyone who ever says “yes.”

Or consider a different kind of example: that there’s almost zero rebuilding going on in Los Angeles since the Altadena and Pacific Palisades fires last January. This is modern California, with its surly, grifting, “just say no”-approach by entire systems of government that don’t much like their own constituents.

Watch Your Subscriptions

If you’re wondering… No, I won’t mention in this note the projects I’m visiting this week in Alaska. Hey, I still must get out and about, and do the work!

But stay tuned. I’ll be out there in the field with my eyes and ears open, checking things out on behalf of subscribers. And I’ll write about developments in other pubs, especially Strategic Intelligence and Lifetime Income Report. So make sure that your subscriptions are up to date.

That’s all for now. And thank you for subscribing and reading.