First, welcome to new subscribers who signed up for a Paradigm Press subscription over the holiday season. Thank you for being part of what we do, and absolutely we do it for you.

Today we’ll look at recent, eye-popping moves in precious metals. Then we’ll segue into how President Trump is shaking up the entire structure of both the internal U.S. and external global order (aka the “old” order)… which has much to do with the moves in metals.

Then along those same Trumpian lines, we’ll look at one particular case, namely what’s going on with Greenland, which looked like this last September – that is, at the tail end of summer! – as I passed by on my way back from Iceland (see below).

Not very green; Southern Greenland last September. BWK photo.

Surfing The Precious Metal Waves

Around Paradigm Press, it’s hard to miss our collective focus on and respect for the price of gold. Yellow metal is a time-tested and true barometer of many things that range from raw industry and classical economics to the social and political health of the nation, if not the world.

5-Ounce gold nugget. BWK photo; courtesy Alaska Mint, Anchorage.

Right now, the price of gold is in the range of $4,600 per ounce; up over $100 between Friday night and Sunday night. And as you can discern by watching a few charts, gold mining shares are doing well. So, gold is telling us something, right?

Also surfing upon the wave is silver, currently priced over $87 per ounce. It was a mere $73 as recently as (… check notes …) one week ago, a 19% move in seven days. Of course, silver miners are soaring, and silver too is telling us something. Indeed, no less then the U.S. Mint just notified its customers – including me – of production delays and price increases for silver coins and other products.

All this, while platinum’s price hovers in the range of $2,400 per ounce; up from about $1,550 way back long ago, just before (… again, check notes …) this past Thanksgiving. That’s a 54% move in what… seven weeks? Makes you wish you bought shares in Sibanye Stillwater Ltd (SBSW) last year, before they tripled.

Are you getting the sense that there’s a message here, in these price moves for precious metals? Well of course, and it has several angles.

Singing the Supply-Side Blues

Begin with the supply-side, which reflects my bias as a real live geologist who tracks industrial output of metals, and precious metals in particular. The short version is that prices are rising because “not enough” metal is coming out of the ground, the mills and the refineries.

For well over 15 years, many people who follow investment patterns in mining have lamented the long-term paucity of exploration and investment in new developments. In essence, for two decades capital markets have starved the mining sector of investment funds. To be both cynical and honest about it, Big Money favored “flavor of the month,” vaporware tech plays, or other shiny things like fanciful, cure-all biotech that never came through.

I hate to break the news, but there’s only so much investment capital floating around out there, and not enough of it washed up on the beach of the mining sector. And now – to change my metaphors – the proverbial wolf is at the door. He demands paybacks for all that underinvestment and lack of sustainment capital. And price discovery proceeds apace, to find the true value of elemental metals, clearly upwards in recent times and likely even higher as we look ahead.

The bottom line is that mines and mills that can produce ore and metal are doing so and making great money, while there’s a profound shortage of new projects in the pipelines. Limited supply now confronts growing demand. And yes, industrial demand for metals is soaring, whether it’s for basics like copper and aluminum, or precious metals. Up-up-up.

With silver, much of the demand is industrial, for things like ubiquitous electronics, along with solar panels that gobble up silver in ways that didn’t exist 20 years ago. But there’s also growing demand for monetary silver. It’s not geeky silver-stackers anymore; we have governments and central banks buying tonnes of the stuff.

Platinum is resurfacing because the electric vehicle revolution has plateaued. Basically, people have figured out that internal combustion engines will be around for another generation or two. And those engines typically require catalytic converters that use platinum (and palladium too, which depends on the engine and fuel).

All this while gold has more than a few industrial uses, although it holds its ancient and historical title as the monetary go-to. And of course, gold leads the rush to hard asset security in a world that is rapidly de-dollarizing for a long list of reasons (which we’ll address some other time). Indeed, in its own way, gold is re-monetizing.

So… how much is an ounce of gold worth? Hey… It’s worth an ounce of gold! And this is why many people and governments would rather hold gold than accounts full of dollars.

Trump’s Global Reboot, from Fed to Greenland

We could discuss metals all day, but let’s refocus on what triggered the weekend melt-up in gold-silver-platinum prices; namely, news that Federal Reserve Chairman Jerome Powell is under investigation, supposedly for making misleading statements in testimony before Congress. (Yes, it’s shocking to think that people may not tell the truth when they speak to Members of Congress!)

Perjury, schmerjury… What’s really going on here is the Trump administration giving Powell the “bum’s rush” to get him out the front (or back) door of the Fed building.

Officially, Powell’s term as Chair ends in May, but President Trump and his policymakers don’t want to wait. There’s no question, but that the Fed and its roomfuls of PhD economists can cause quite a bit of economic damage in just the next few months, and that’s not what Trump et al. want to see as the 2026 election cycle ramps up.

Bottom line… Trump wants Powell out, period. Trump then wants the Fed to ease monetary policy, namely, to lower interest rates. The idea is that this will help grow the economy, but Powell is not onboard. So, per Trump, Powell must hit the exit door. And fearful of increased inflation from this approach, investors have quickly bid up prices for gold, silver, platinum and more.

Meanwhile, for comparison, recall how (… check notes …) just over one week ago, Trump pushed the magic button to dispatch the nettlesome Nicolas Maduro out of Venezuela. That is, the U.S. President sent in the Navy, Air Force, Marines, Army, Coast Guard, and even federal law enforcement – guys with guns – to body-snatch the man. Or stated another way, are you paying attention, Mr. Powell?

Whether it’s intimidating the Fed at home or sending in Delta Force door-kickers abroad, it’s crystal clear that President Trump is rebooting how things are done. Which opens up a quick pivot to discuss Greenland, as I mentioned at the beginning…

“Why Greenland,” many ask?

“Cuz the minerals!”, say others… And even President Trump says, “Cuz the minerals.”

To which I, as an old geologist, say “Not quite.”

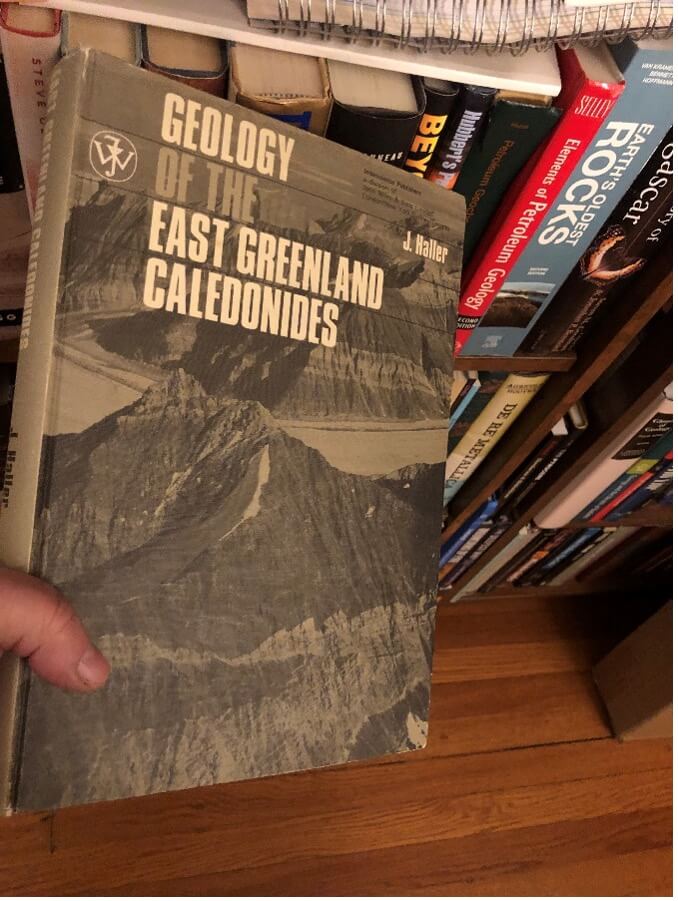

That is, one of my first geology professors at Harvard was the late John Haller, who cut his teeth with the Danish Geologic Survey, working in Greenland in the late 1940s and 50s. And then, over the years, Haller literally wrote the – now quite rare – book on the place, Geology of the East Greenland Caledonides (John Wiley & Sons, 1971).

Your editor’s copy of Haller’s book on Greenland. BWK photo.

Okay, Pilgrims… Yes, the geology of Greenland is extensive and fascinating. And yes, there are many “minerals” (that’s me making a geological sort of joke). But!…

It’s next to impossible to get most of those Greenland minerals out; in the best cases it won’t be fast, cheap, or in any way easy. Indeed, per Haller’s first words in his book (pg. xi):

“Greenland bears to this day the burden of the Pleistocene. So far only a tenth of its area has been freed from the grip of glaciers; the rest lies buried under inland ice. Most of the coastline is barricaded by pack ice, and only the southwestern coast is ice-free and can be reached by ordinary ships in summer.”

You saw that aerial photo up at the top of this article, right? Mountains and glaciers, right? As a matter of fact, and better to understand the geology of the entire North Atlantic/Greenland region, I took a geologic-oriented field trip to Iceland last fall.

Your editor’s flight track to Iceland. BWK photo.

In fact, this is me in southwest Iceland, at the Reykjanes Ridge, standing directly atop the Mid-Atlantic suture that divides the North American tectonic plate from the Eurasian plate.

Your editor stands atop the Mid-Atlantic tectonic divide. BWK photo.

I’ll tell you more about the Iceland-Greenland geologic relationship in another article. But my point is…

NO! Do NOT count on Greenland for “minerals” any time soon. Because any large-scale exploitation of Greenland is at least a 100-year program.

Meanwhile… Here’s how REALLY to think of Greenland and the Trump approach: Not in terms of minerals. Think in terms of geostrategy.

Strategic Greenland

Again, why does Trump want Greenland? Easy… It’s a necessary – some say indispensable – site for U.S. strategic defense. That is, Greenland is directly along and beneath the flight path of missiles fired from the Kola Peninsula of Russia, and/or fired from China towards North America. Here’s the map:

Russian missile flight paths from Kola Peninsula towards North America. Courtesy Arctic Institute.

And if – actually “when” – the U.S. puts a large-scale strategic missile defense system into operation (call it “Golden Dome” if you wish), the most appropriate sites are Alaska for western defense, and Greenland for defense of the Eastern U.S.; here’s that map:

Missile defense coverage circles. Courtesy John Konrad.

In other words, “Greenland” is at root a geography scenario that involves strategic defense to protect the U.S. from Russian and Chinese missiles. Alaska and Greenland are the only practical locales to place systems that can close the flight corridors to major American cities and the U.S. heartland.

But talking about missiles, nuclear war, strategic defense, etc. gets emotional, and a whole lot of people just don’t want to hear it. So instead, Trump says that the U.S. wants Greenland “for the minerals.” Yeah, right, Mr. Prez… Minerals!

That’s what is going on. That is what drives the Greenland fixation. It’s why something will happen with Greenland, sooner or later. And obviously, there’s much more to say about Trump, Greenland, the Fed, gold, silver, platinum and many other metals… But we have to save some content for future articles.

Meanwhile… here are a few final points. Read on!

More Info for New Subscribers

As part of your subscription to Paradigm Press, you will routinely receive emails like this one… Morning Reckoning(Tuesday and Thursday), plus Daily Reckoning, the Rude Awakening, and the 5-Bullets summary. Keep an eye out…

Your specific Paradigm newsletter subscription will provide what you signed up for, namely investment ideas and approaches to preserve and build wealth. Our frontline letter writers are deeply knowledgeable, as you’ll see as time goes by. Meanwhile, the prudent but party-pooper lawyers insist that we include a caution that “we do not give personal financial advice.”

Many times, your supplemental emails – your Reckonings,Rudes and Bullets – will squarely address investment ideas. We might mention company names, although no, we don’t track a portfolio.

In my case, if I mention a company name, it’s probably because I know something about it and maybe even like it. And always – with anything I say or from anyone else! – if you buy shares, watch the charts and price, look for down days in the market, always use limit orders, and never chase momentum.

But the editorial fairway in these supplemental letters also includes discussions of broad social, economic and political themes… Like Trump and Greenland, although it’s also not difficult to come up with investment themes and ideas grounded in these topics.

Wrap Up: Three More Opportunities

And to bring it all to closure, over the next week we have three other, no-cost informational items for you:

This coming Wednesday, January 14th, at 1:00 pm Eastern Time, I’ll host a live talk with Rick Van Nieuwenhuyse, CEO of Contango Ore (CTGO), a successful and profitable Alaska gold miner that just announced a merger with British Columbia silver explorer Dolly Varden Silver (DVS). We’ll discuss mining in general, Alaska and the Arctic, precious metals, and of course what’s happening with Contango and Dolly. It’s no cost, and you’re welcome to sign up here.

Then on Thursday, January 15th, also at 1:00pm Eastern Time, Paradigm Press and my colleague Jim Rickards will host a special event to introduce a new member of our editorial team. This gent is a highly regarded geologist with a long track record of successful efforts and investment ideas. Indeed, he’s even a CEO of a real mining company, with the scars to prove it. I’ve known this fellow for 15 years and long held him in true esteem. Jim and “the CEO” will discuss gold and silver, plus rare earths, energy and more.

That’s all for now. Thank you for subscribing and reading, and best wishes for 2026.