My goodness…

Gold and silver just keep going.

Silver just hit $101/oz, while gold rose above $5,000/oz.

Two huge milestones in a single day.

For silver, we described this move pretty well as it developed. Industrial demand is soaring from electronics and solar panels. And now that investors are jumping on board, this explosive move is the result.

But gold is arguably sending an even more urgent message.

Both metals are on the rise due to a building global debt crisis. But gold is the “pure play” on this narrative.

And it’s a flashing warning light screaming, “something’s wrong”.

Soaring global debt and deficit are the most obvious explanations, but that’s been the trend for more than a decade now.

What changed? Well, the debt crisis appears to be reaching a tipping point.

Trouble in Tokyo

Japan has the highest debt-to-GDP in the world at around 260%.

Despite gobs of debt, for years the yields on their debt stayed very low.

This was because Japan’s central bank instituted yield curve control. In other words, they bought tons of their own bonds to keep yields low.

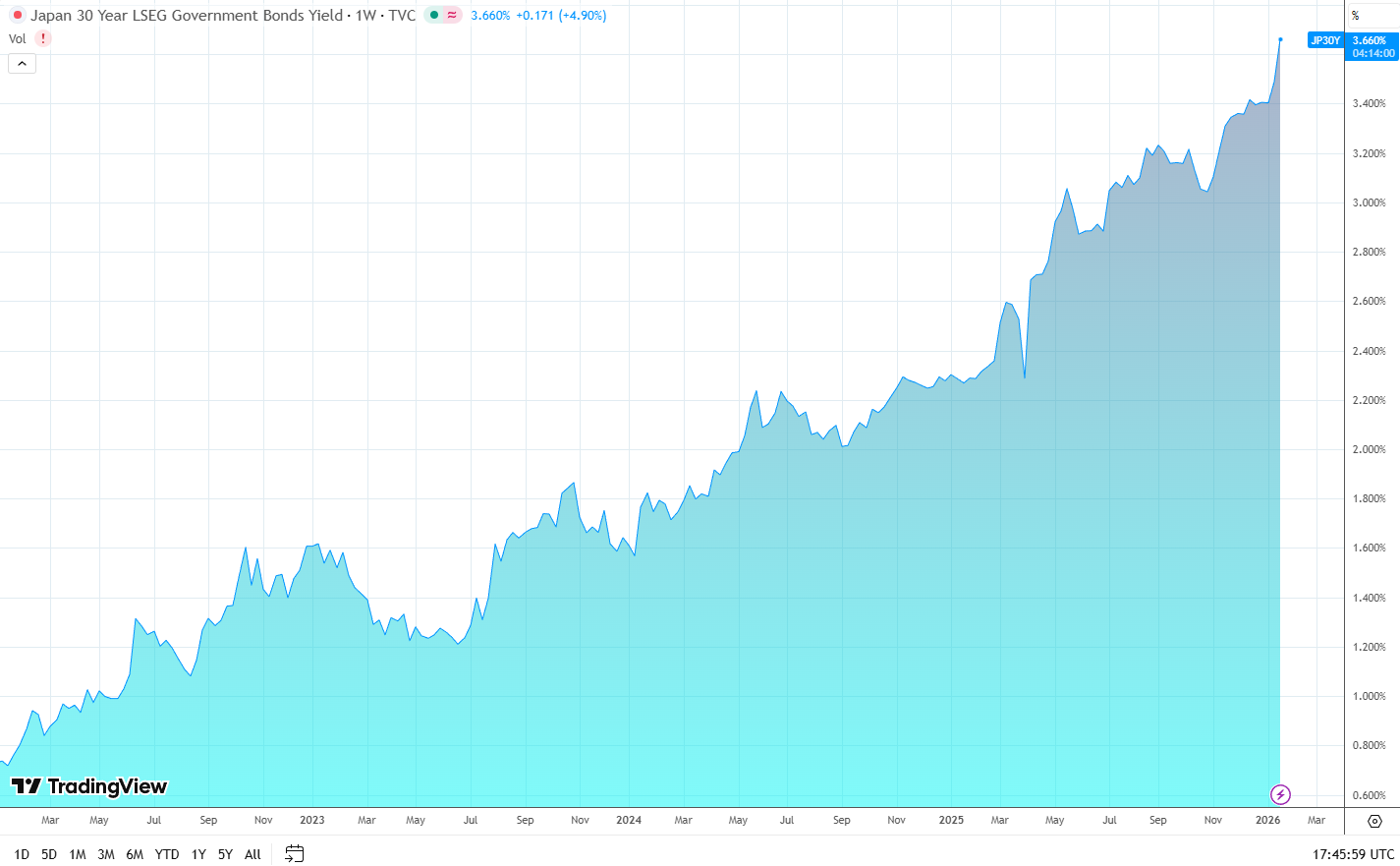

But now, Japan’s bonds are soaring. I just pulled the chart below, which shows Japanese 30-year bond yields over the past 5 years.

Yields have soared from 0.7% to 3.6% since 2022.

When a country has as much debt as Japan, that’s a VERY big problem. Costs to service that debt are going to snowball.

After years of painstaking control, Japan’s central bank is losing its handle on the country’s debt market.

And look at the chart below, which our friend Sean Ring recently shared. It shows Japanese bond yields (blue) vs. the price of gold.

The two seemingly unrelated assets are marching in step together…

Now, why would bond yields in Japan be moving in lock-step with the price of gold?

It may surprise some of you to learn that Japan’s yen is the third-largest reserve currency in the world.

For decades, investors and traders have borrowed Japanese yen because it’s so cheap, switched to dollars, and invested in whatever they want. Stocks and bonds mostly.

This is known as the yen carry trade. And it’s now blowing up.

Additionally, Japan was long cited as a reason that U.S. debt could continue growing indefinitely. Since our debt-to-GDP is “only” 128%, and theirs is 260%, many analysts would point to Japan and say, “See, it’s not a big deal”.

Throughout history, countries have almost always run into a currency/debt crisis when they surpass 120% debt-to-GDP. But Japan was the one example Keynesians could point to as a counter-example.

Now Japan is losing control, taking away the one example Keynesians had on their side.

The Global Fiat Experiment is Failing

Throughout history, countries have often experimented with fiat currency.

The typical story is that a country gets into wars, overspends, and has to abandon hard money (gold/silver).

They create paper money, and eventually, it ends the same way. With that paper money becoming worthless.

This story has played out hundreds of times around the world.

It always fails.

What’s unique about this time around is that the entire world is on a “fiat standard”. Nobody today backs their currency with gold or silver.

Eventually, I expect much of the developed world to return to some form of a hard money standard.

It may not look like the gold or silver standards of the past, but eventually we must return to using money that restricts government spending.

When a country can print money at will, it always gets out of hand. Today we are witnessing this take place on a global scale.

The fiat disaster will take time to play out, but it’s clear that we’ve reached a point where the crisis is accelerating.

Miners Look Fantastic Here

By now, regular readers know my plan. Continue to hold onto precious metal investments for the next 3-5 years.

But some of you are surely just now considering building a position. Or adding to one.

For those of you who don’t own any yet, gold and silver miners look like a better bet here than bullion. Especially on the silver side.

Silver miners will be reporting Q4 2025 earnings soon, and the numbers are going to look great. In Q4 the price of silver averaged around $60, up from $40 in Q3. A nice 50% boost.

But if silver prices stay at current levels of around $100 for Q1, silver miners are going to report explosive earnings.

If you missed it, be sure to read my recent article Silver Miners are Printing Money. We go through the math in detail, and I truly don’t think most investors are aware of just how impressive upcoming earnings are going to be.

To be clear, it has seemed like we’re due for a correction for a while now. But nothing has materialized. At some point, one will come.

Those with patience can choose to wait for that correction, or to dollar-cost-average into positions (spread your buys out over at least a few weeks).

P.S. In a recent Q&A, our friend Jim Rickards made some comments on gold which are worth sharing.

Q: Do you see any bearish catalysts in the near future that would signal an end to the current gold bull market? – Ronny R.

Jim’s answer: No. The drivers of higher gold prices include net buying by central banks, flat mining output, buying as an alternative to U.S. Treasuries since the U.S. is now stealing Treasury securities from lawful holders such as Russia, the fact that Russia has survived economic sanctions because over 25% of its reserves were held in the form of physical gold, and the use of gold by BRICS members as an alternative to the dollar. The retail frenzy stage has not yet started but that’s coming. Gold should move past $5,000 per ounce nicely on its way to $10,000 per ounce and higher.