Ford Motor Company (NYSE: F), the 121-year-old car maker, announced a $19.5 billion write off of its electric vehicle (EV) segment. That’s an enormous amount of cash to send to money heaven.

This was bad news for the U.S. EV market. Ford targeted electric trucks, to capitalize on its super popular F-150 model. However, the government killed the EV tax break. That curbed interest of U.S. car buyers on the higher end EV models like trucks.

But don’t think Ford’s problems show weakness in global EV sales. That’s not the case.

From 2024 to 2025, EV sales jumped 35%. Analysts from both International Energy Agency (IEA) and Bloomberg NEF estimate that EV sales will make up 40% to 50% of all vehicle sales by 2030. This industry is booming.

Ford’s bad news should not be an indictment of the global EV industry…and by extension demand for battery metals. The supply/demand outlook for those metals remains strong. But one metal stands out as the biggest winner for investors: copper.

Copper is the metal of electricity. Aluminum can substitute for it in some situations (like power lines). But if you want an electric motor, you have to use copper. And every EV needs electric motors.

In 2015, EV copper demand was 56,000 metric tons. It grew 1,650% to 1 million metric tons in 2025. That demand growth drove copper prices higher:

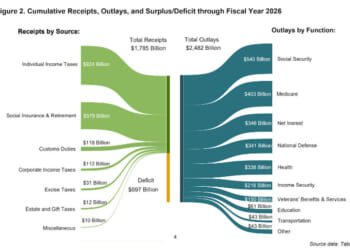

That trend will continue for the next five years, at least. The Copper Development Association forecasts copper demand to hit 2.5 million metric tons by 2030. Analysts at JP Morgan expect a deficit of 330,000 metric tons in 2026.

This trend will get a further boost by demand from AI datacenters. The sudden boom in electricity and batteries will further impact copper prices. There is no substitute for copper in many electrical uses.

There is an easy way to capitalize on that trend. The Global X Copper Miners ETF (NYSE: COPX):

The ETF holds a basket of major copper miners. Owning a basket of these miners reduces common risks from individual companies. For most portfolios, a position in COPX is the perfect exposure to the copper market.

That’s important because the copper market data points to much higher prices in the future.