Investors call copper “Dr. Copper” because this metal has a PhD in economics.

In the modern world, copper is foundational.

Electronics, wiring, motors, plumbing, cars, appliances. It’s in everything.

So most of the time, we can tell a lot about the economy by watching the price of copper.

And the price just broke out to a new all-time high above $11,200 per ton.

Source: Mining.com

But this isn’t purely a result of booming demand. On the chart above, that last note before the recent jump explains a recent mining tragedy which occurred in Indonesia at a major copper and gold mine operated by Freeport-McMoRan (FCX).

Seven workers were killed in a massive mudslide at the Grasberg mine. 800,000 tons of mud flowed into the underground portion of the mine, killing the seven workers and shutting down roughly 70% of production indefinitely.

The Grasberg mine produces roughly 4-5% of the world’s copper supply. It may be years until the site fully reopens. Or it may not reopen at all.

It’s fascinating how a ~4% drop in supply can boost the price by 24% in such a short period. That’s economics in action. Copper demand is inelastic, meaning when people need it, there’s basically no alternative (silver can work for some applications, but is 10x more expensive).

Copper Deficits Accelerate

The Grasberg disaster is just one of a number of factors contributing to rising copper prices.

First of all, the massive data center buildout and rise of electric vehicles are major factors. Demand for copper has never been higher.

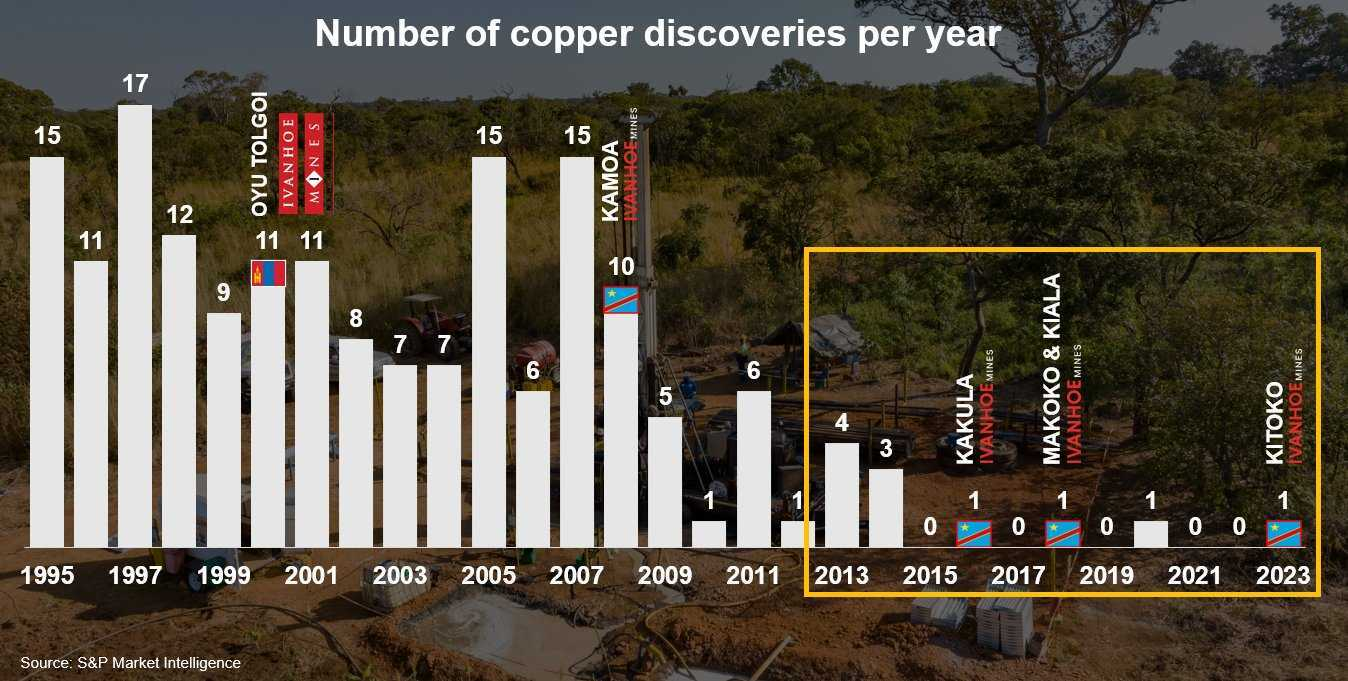

But there are also bigger issues on the supply side. The following chart shows the number of significant copper discoveries per year.

Most of the easy copper has already been mined. Companies are being forced to go deeper in the ground, and farther into the wilderness to find it.

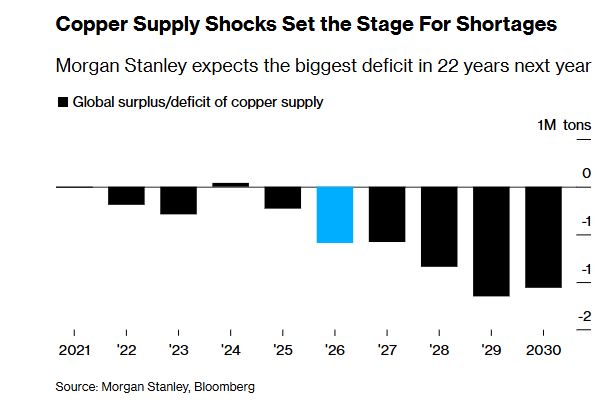

As a result, the world is currently in a copper deficit. Meaning we’re using more than we’re producing. Here’s a projection of the next few years, via Bloomberg:

Copper Miners are Booming

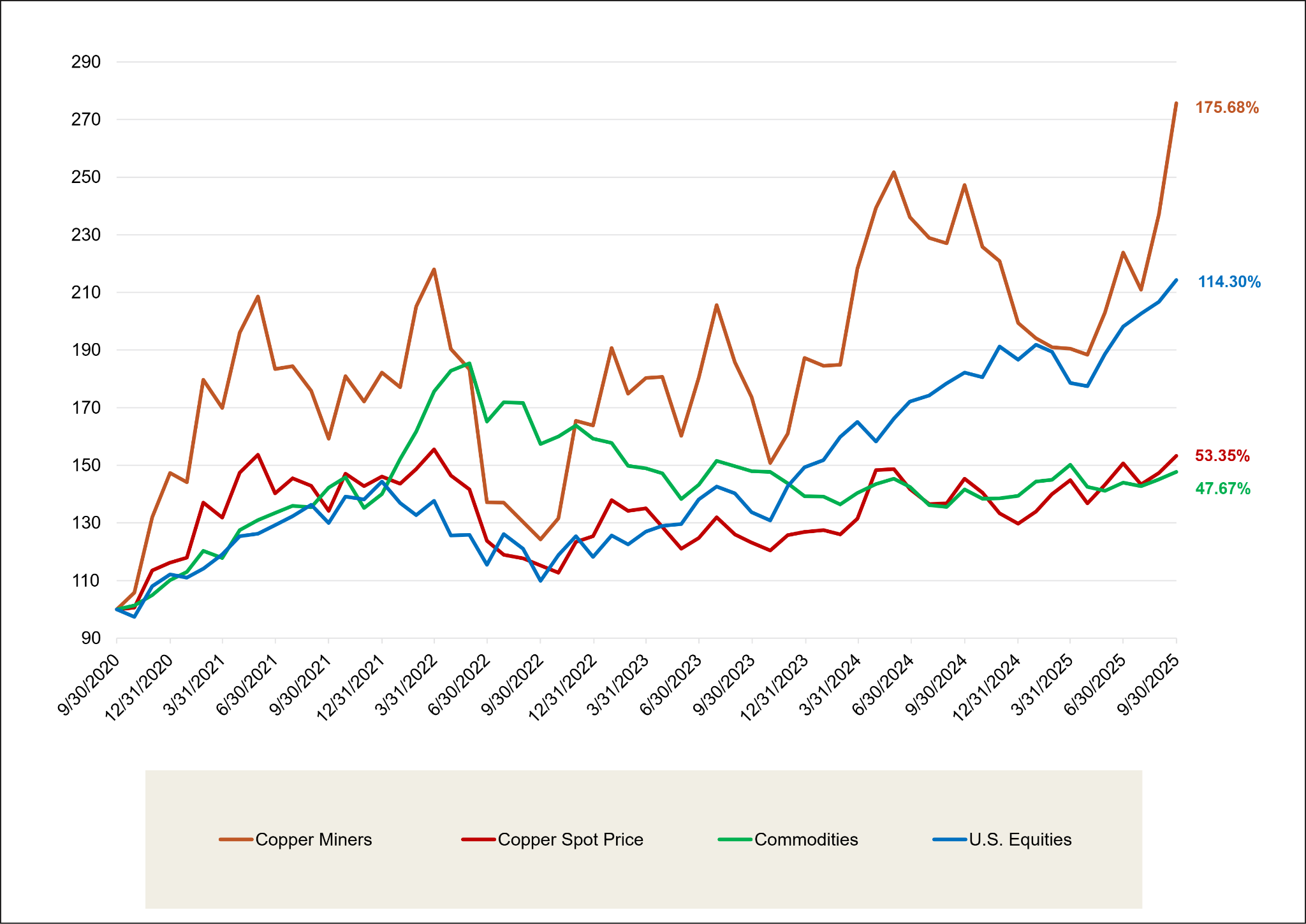

Copper miners are quietly hitting the ball out of the park. Below is a chart from Sprott which shows how copper miners (copper-colored) perform vs the S&P 500 (blue), broad commodities (green), and the metal itself (red).

Source: Sprott

Copper miners are up an impressive 175% over the past 5 years. That handily beats the S&P 500’s 114%. It also trounces the price increase of copper itself, which was 53% over the same period.

As you can see from the chart, these stocks are highly volatile. But when copper moves, they act as a pure leveraged play. With the right timing, it can be a beautiful thing.

Today, the copper sector looks overbought in the near-term. But I’ll be watching for a correction, which could be an excellent buying opportunity.

Here are a few easy ways to play copper stocks:

- The Global X Copper Miners ETF (COPX)

- Teck Resources (TECK)

- Freeport-McMoRan (FCX) – [note: this is a higher-risk option. FCX operates the troubled Grasberg mine, but has a global portfolio]

As a bonus, many copper miners also produce gold, silver, and other valuable metals.

Barrick Mining (B) is a great example here. Traditionally Barrick was focused on gold, but in recent years they’ve been diversifying heavily into copper. That’s one I’d feel comfortable buying today. It remains cheap, and gives investors significant exposure to both gold and copper.

Over the long term, I like copper miners quite a bit. I plan to hold onto the few I own, and will look to buy more if we see a crash.

However, I’m currently holding off on buying any more pure copper miners. I may be wrong here, and this bull run could have a lot further to go.

But the sector has seen incredible returns over the past few years. If and when we get a major correction in the overall stock market, copper and the companies which mine it will take a hit.

If we do get that crash, it’ll be time to back up the truck and buy stocks which mine the good doctor. We’ll keep an eye out and let you know.