Is the Chinese economy collapsing? Or is something worse waiting in the wings? The short answer is that we could be looking at something much worse than a crashing economy. China could be part of a collapse of the global monetary system.

We’ll begin the analysis with the latest official economic releases from China. These releases showed some of the weakest performance by the Chinese economy since the 2020 pandemic collapse.

Things Aren’t Looking Good

Industrial production growth for October declined to 4.9% (year-over-year) from a prior level of 6.5%. This was the weakest reading since August 2024. Some sectors receiving state support such as autos, computers, shipbuilding and telecommunications did better than average, but the broader manufacturing sector slowed materially, and mining output also weakened.

Retail sales in October were also fragile. There was overall growth of 2.9%, but certain sectors crashed, including household appliances (- 14.9%), building materials (- 8.3%), and automobiles (- 6.6%).

Sectors showing strength included jewelry (+37.6%, although this can be partly a proxy for buying gold in the form of jewelry) and cosmetics (+9.6%). This was the smallest increase in retail sales in years and is especially weak considering that October traditionally marks the beginning of a seasonal buying surge.

The most disastrous data came from fixed-asset investment (FAI), which showed a 1.7% year-to-date decline. This is the steepest decline since the pandemic crash year of 2020.

Your editor on the Chinese high-speed train that runs from Shanghai to Beijing at over 300 kph. China has produced major technological advances, but it has done so in non-sustainable ways, including excessive debt and theft of intellectual property.

Property investment fell at -14.7% while infrastructure investment (long the pillar of Chinese growth) went negative at -0.1%. Manufacturing investment was positive at +2.7%, but that was only half the rate from earlier this year.

The bottom line is that all three pillars of investment – fixed assets, property and manufacturing – are slowing at the same time. Investment is one of the most powerful drivers of Chinese growth. While developed economies typically attribute about 25% of their GDP to investment, the Chinese component is closer to 45%. If investment is crashing in China, then overall growth is crashing along with it.

Real Estate Is Crashing Too

This recent data comes on top of the multi-year crash in property values. This crash has caused equity on many properties to be wiped out. To the extent that vanished equity represented the life’s savings of many everyday Chinese citizens, the impact on consumption and the reluctance to make new real estate investments is profound.

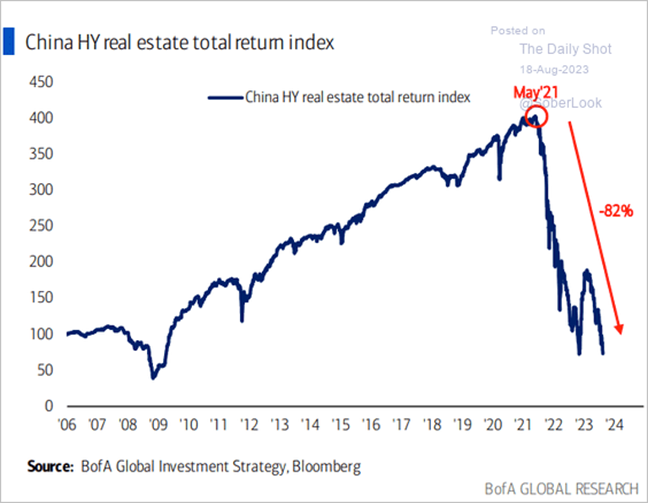

The real estate crash goes beyond individual owners and has led to the collapse of several of the largest builders and property investment companies in China including the Evergrande Group ($19 billion in losses), Country Garden ($11 billion in losses), Fantasia Holdings (recent $1 billion operating loss), Sunac (filed for bankruptcy in 2023), and several others.

The financial collapses of China Evergrande, Country Garden, and Sunac all come against the background of a broader crash in real estate debt and real estate-backed wealth management products. This chart shows that a major Chinese high-yield real estate index collapsed 82% in recent years and has never recovered.

The real estate collapse arrived at the same time as several failed “reopenings” of the Chinese economy after COVID and several “stimulus” plans after that. A major economic reopening was announced in 2022 after pandemic lockdowns were eased. This was a failure. Then China announced other major stimulus plans – so-called bazookas – including rate cuts, reductions in bank reserve requirements and subsidies to favored industries. These failed in 2024 and again in 2025. As in the United States, lower interest rates are not a sign of stimulus. They are associated with recession and depression.

Negative Growth?

Chinese economic data must be considered in light of Goodhart’s Law. This economic rule says that when a metric becomes the object of policy, it loses value as a metric.

This applies to Chinese GDP. The Chinese GDP growth rate has declined from 10.0% per year in the early 2000s to 5.0% in 2024. The GDP growth rate (year-over-year) for the third quarter of 2025 was 4.8%. The Chinese clearly target the GDP growth rate and currently have a target of 5.0% growth. This means that growth is almost certainly lower, and the Chinese are using statistical sleight-of-hand or outright lying to make it appear they are at or near their target.

As noted above, about 45% of Chinese GDP comes from investment. However, much of that investment is wasted on ghost cities, white elephants and lavish projects that can never hope to provide any return on investment. If this wasteful investment were written off (as would be required under GAAP), Chinese growth would be cut from 4.8% to about 2.5%. Taking into account other manipulations and Goodhart’s Law, it’s entirely possible that China’s GDP growth is negative today. That outcome is not widely understood and would come as a shock to the panda-huggers on Wall Street.

Caught in the Middle-Income Trap

At an even higher level, China is stuck firmly in the middle-income trap. Absent pervasive corruption or war, countries can move readily from low income (annual per capita GDP of about $5,000) to middle-income (annual per capita GDP of about $15,000) through a combination of urbanization, infrastructure and cookie-cutter assembly-style manufacturing.

The breakout to high-income status (annual per capita GDP of $25,000 or more) comes only from proprietary technology and high-value-added manufacturing. Only a few countries (Singapore, Taiwan, South Korea, Hong Kong) have ever made this leap since World War II. China is good at stealing technology, but they are not good at creating it or applying it in their manufacturing sector. This is another major headwind to Chinese growth.

Other Headwinds to Growth

China has other significant growth hurdles independent of the issues noted above. China is now in the early stages of the greatest demographic collapse in the history of the world, even greater than the Black Death of the 14th century.

China’s current population of about 1.4 billion is expected to decline by half in the next fifty years. That’s a loss of 700 million people. This is due to a combination of the one-child policy (which began in 1980), sex-selective abortions and infanticide (which killed twenty million girls), and the decline in births per woman as the result of education, urbanization and job equality.

The simplest formula for estimating economic growth is (work force x productivity). There has been a global decline in productivity for reasons economists do not completely understand. If China combines this decline in productivity per worker with a decline of several hundred million workers, then its economy will likely decline by half or more. This is not a catastrophe that will suddenly strike in 2080. It’s happening now and will grow worse with time.

Chinese growth will also be hindered by an excessive debt-to-GDP ratio. That ratio is estimated at 300%, more than double the U.S. ratio of 123%. Any ratio > 90% retards growth. It’s impossible to borrow your way out of a debt trap. The only solutions are default, hyperinflation, or reducing the ratio with less government spending.

All three hurt growth or destroy capital in different ways. The only certainty is that growth will be weak for decades, unless there’s a total collapse in asset values and debt in which case the system may be reset after wiping out trillions of dollars in wealth.

Investors: Stay Away from China

On top of this economic catastrophe comes political turmoil. The best information available is that Chinese President Xi Jinping has been subject to a soft military coup in which he is now subordinate to the PLA leadership. Xi’s allies have been mostly purged. What comes next in terms of Chinese leadership is unclear. But uncertainty that will deter foreign capital from investing in China is almost certain.

And China is not alone. The weakness in the Chinese economy today comes in the context of negative growth in Japan and the UK along with barely positive growth in the EU. Unemployment is rising, world trade is shrinking, and commercial bank lenders are tightening lending standards among surprise credit losses.

Don’t believe the Wall Street narratives about how China is winning the AI race and is building a technological juggernaut. It’s not. China is stuck in the middle-income trap and has a unique combination of a crashing economy, trade wars, collapsing demographics, excessive debt, political turmoil, no rule of law and the flight of foreign capital all amid a world of no growth. Investors should keep as far away from China as possible.