The 1970s are known as a “lost decade” for U.S. investors.

The S&P 500 returned around -1.1% per year during the 70s. That includes dividends being reinvested, and accounts for inflation.

Naturally, certain sectors outperformed. Gold and silver miners, oil stocks, and other commodity producers stood out.

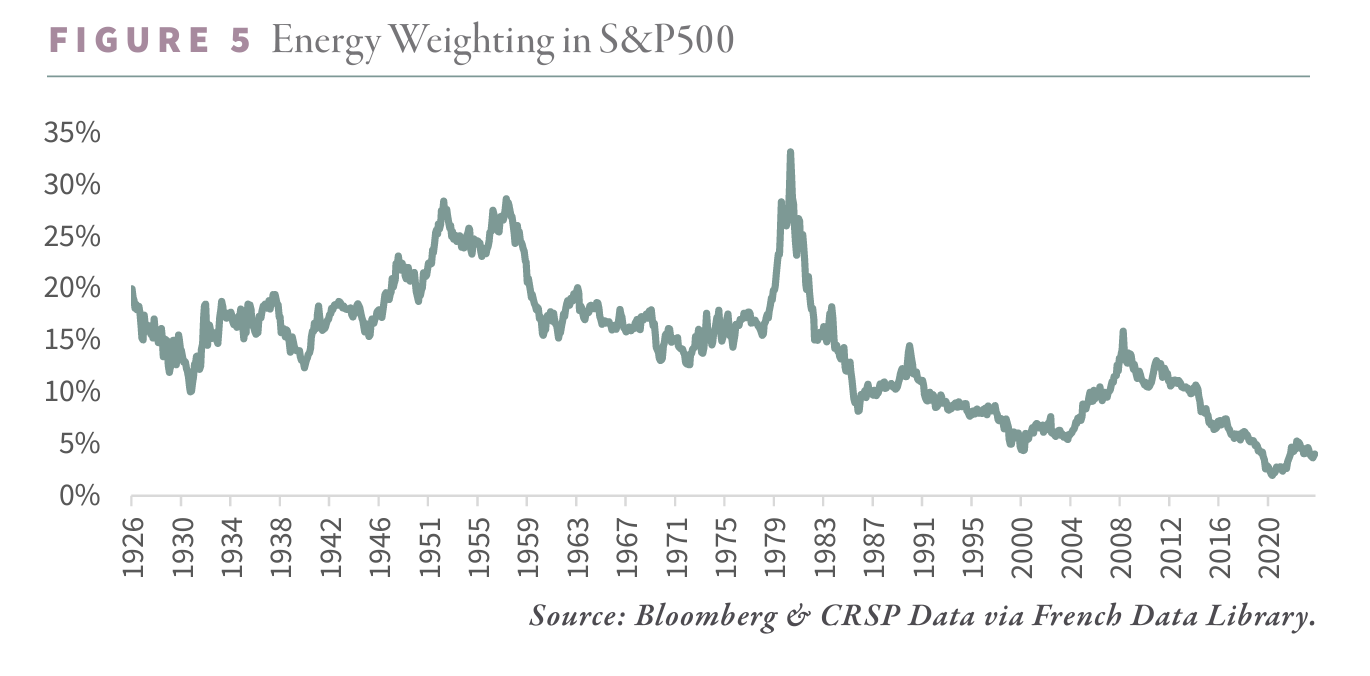

Hard assets did so well that by 1980, more than 30% of the S&P 500 consisted of oil and gas stocks! Petroleum companies were minting cash.

The chart below shows the energy sector’s weighting in the S&P 500.

Source: Gorozen

Notice how energy’s weighting in the S&P 500 went from around 11% in 1970 to over 30% by 1980. That means oil and gas stocks trounced the broad market.

Without that boost, the S&P would have performed even worse.

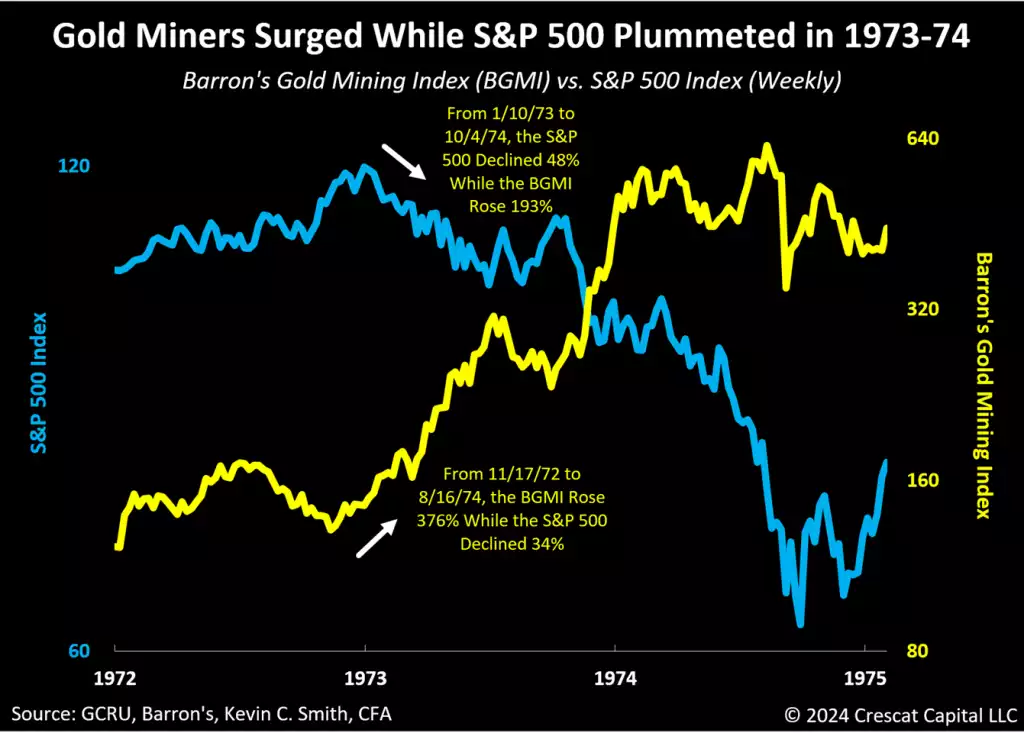

Gold and silver miners also shined during the 1970s, as we can see in the chart below, which covers a period from 1973-1974 when the broad stock market fell sharply.

Source: Crescat

As inflation raged and the S&P 500 was crashing, miners staged an incredible rally. This is the power that owning precious metal stocks can bring to your portfolio.

So the answer to “are stocks a good inflation hedge?” depends entirely on which sectors you’re invested in.

A broad index like the S&P 500 will offer better protection than bonds, but worse than hard asset stocks like gold miners and oil producers.

1970s, or 2001?

I keep coming back to the 1970s because it’s the last time the U.S. had a sustained inflationary period.

It seems we’re headed into something similar now. So there is much we can learn from the “lost decade”.

But today also bears remarkable resemblances to the dot-com bubble which popped around the turn of the century. Just like back then, our tech bubble today is based on real tech breakthroughs.

In both cases, however, the market eventually got overheated and valuations became stretched (more on that in Bubble Poponomics).

Artificial intelligence IS set to change the world (just like the internet did). But it’s going to take time to do so, and there is almost certain to be an AI/tech crash sometime in the next few years.

So no, I don’t think tech offers a good place to hide out during the chaos that is coming. Valuations are too rich, which means there’s big downside from any major pullback.

The scenario we face over coming years will likely be a strange period combining aspects of the 1970s and the dot-com bubble bursting.

Cheap Stocks > Hot Stocks

We have extensively discussed how hard assets like gold are an excellent way to hedge against inflation and volatility.

But cheap stocks are also a nice option. Overvalued stock sectors, like tech today, inevitably have a reckoning. There’s not really any dividend yield to cushion the blow, and drawdowns can approach 80% or even more in bubbly stocks.

Cheap stocks with fat dividends, on the other hand, offer built-in protection from inflation and crashes. Companies which stand to benefit from inflationary pressure AND offer high yields, are especially attractive (oil, gold stocks, and base metal miners, for example).

Unfortunately, cheap stocks are hard to find here in the U.S. Almost every sector trades at a significant premium to historical norms.

This is why I’ve been investing in emerging markets like Brazil. When the entire market is trading at under 10x earnings with ~6% yields, that’s attractive in a precarious market.

Don’t get me wrong. Gold, silver, and miners have performed extremely well and I expect that to continue for years to come. But it’s good to have some diversity in hedges.

For me, emerging markets have become an important aspect of hedging for what’s ahead. We’ll keep looking out for ways to hedge against inflation and other risks.