Warren Buffett famously says that if he were managing a mere $1 million, he could achieve 50% annual returns.

It may sound crazy at first, but trust me, Uncle Warren is onto something here.

This is the full quote, which was from a Q&A at the 1999 Berkshire Hathaway annual shareholder meeting.

“The highest rates of return I’ve ever achieved were in the 1950s. I killed the Dow. You ought to see the numbers. But I was investing peanuts then. It’s a huge structural advantage not to have a lot of money. I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that.“

Warren followed up during another Q&A explaining that investors seeking large gains should “try and know everything about everything small.”

In other words, the advantage small investors have is that they can buy stocks which are too tiny for professionals and billionaires to bother with.

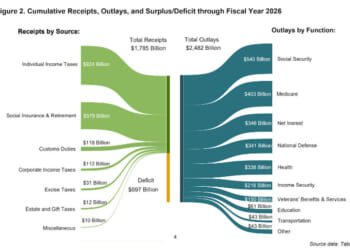

For example, Buffett’s firm Berkshire Hathaway currently has $344 billion in cash. Most of it is sitting in short-term U.S. treasuries while they wait for more attractive market conditions (cheaper stocks).

When they do deploy that cash, it will need to be into mega-cap stocks. Buffett can’t invest in a $100 million stock. It’s too small. If he tried to buy $50M of a $100M stock, the price would soar, perhaps 3-4x depending on the volume and how many shares are available.

Besides, a $50M investment isn’t going to move the needle for a firm like Berkshire.

The other angle is that Wall Street analysts don’t cover microcap stocks, and they barely cover small caps.

When big investors and Wall Street are (by necessity) ignoring an entire sector of the market, there is bound to be opportunity.

Exhibit A

In April of this year, Paradigm hosted a free online event titled The Final Secret of Jekyll Island.

It was a panel discussion featuring Jim Rickards, Byron King, Sean Ring, Dan Amoss, Zach Scheidt, and hosted by Aaron Gentzler.

We were on site in Jekyll Island, Georgia. At the same resort where the Federal Reserve was schemed out back in 1910.

During the panel, the topic of rare earth investments came up. Our friend and Daily Reckoning contributor Byron King highlighted a unique investment idea. A tiny rare earth stock named Ucore (UURAF).

Here’s what Byron had to say, direct from the event’s transcript:

“You may have heard, in the rare earth space, of a big company called MP Materials… I’ll give you a smaller company, it’s pre-revenue, but it’s all-American and it knows exactly what it’s doing in the rare earth space, and that’s called Ucore, U-C-O-R-E.

It trades on the OTC, U-U-R-A-F, Ucore. I have seen their technology, I’ve been following this company for, golly, 15 years now. I know the management very well. I’ve seen the demonstration plant in Kingston, Ontario, which is just a little bit west of Watertown, New York, on the north side of Lake Ontario.”

At the time, Ucore was trading around $1.21 per share. Today it trades at $3.80, a more than 3x gain. Not bad for a 5 month period.

This is the type of opportunity that’s very difficult for institutions and mega-investors to access. They simply couldn’t buy enough shares to make it worth their time.

But for smaller investors, this is the beautiful type of opportunity that could potentially help reach the 50% per year mark.

Kudos to Byron for providing the free pick to our readers. He’s not just a geologist, but also a walking encyclopedia of mining companies.

Beware Suspicious Stocks

Yes, it’s possible to find alpha (outperformance) in small and microcap stocks. But you need to know what you’re doing.

There are a lot of tiny stocks out there, but most are tiny for good reason. When I first started trading back in the early 2000s, I learned this lesson the hard way. Chasing a bunch of penny stocks, and almost all of them went nowhere (but down).

Here’s Buffett’s disclaimer on the matter:

“With a million dollars, you could earn 50% a year, but you have to be in love with the subject. You can’t just be in love with the money.”

If you go out looking for small stocks with big potential, it helps to have knowledgeable guides. Fortunately, here at Paradigm we have a few editors who fit the description. Byron King, James Altucher, and Chris Cimorelli stand out in my mind.

We’ll revisit the small and microcap space from time to time. Stay tuned.