Here at the Daily Reckoning, we love contrarian investments.

Back in February, we highlighted an idea that fits the bill nicely: buying Brazilian stocks.

Specifically, we mentioned the iShares Brazil ETF (EWZ), which was yielding around 8% at the time, and Nubank (NU), a fast-growing digital bank.

Brazil had been in a slump since its stock market peaked in 2008. The country’s stock market is heavily tilted towards banks and commodities (especially oil and iron ore). Its currency has been volatile and generally fallen in value versus the dollar. So most investors have steered clear of the country.

But this is starting to turn around. The largest Brazilian ETF, EWZ, is up around 10% since February and looking good. It remains dirt cheap with fat yields. The plan is to hold this one for many years, and possibly decades, to come. Let the magic of compounding do its work.

But today we’re going to focus on Nubank, which at the time was a small position in my portfolio. Since that time, I’ve learned a lot more about Nubank (and bought more). And the outlook for this company is bright.

Let’s dig into this remarkable growth story.

Nubank: The Bull Case

Nubank is a fully-digital bank based in Brazil. It boasts a remarkable 122 million customers, nearly all of which use its popular mobile app. It offers checking and savings accounts, credit cards, personal loans, investment accounts, and more.

The company just reported Q2 2025 results, and they handily beat expectations.

- Revenue grew 40% year-over-year to $3.7 billion

- Net income rose 42% to $637 million

- Deposits soared 41% YoY to $36.6 billion

- 83% of customers are active on a monthly basis (solid engagement)

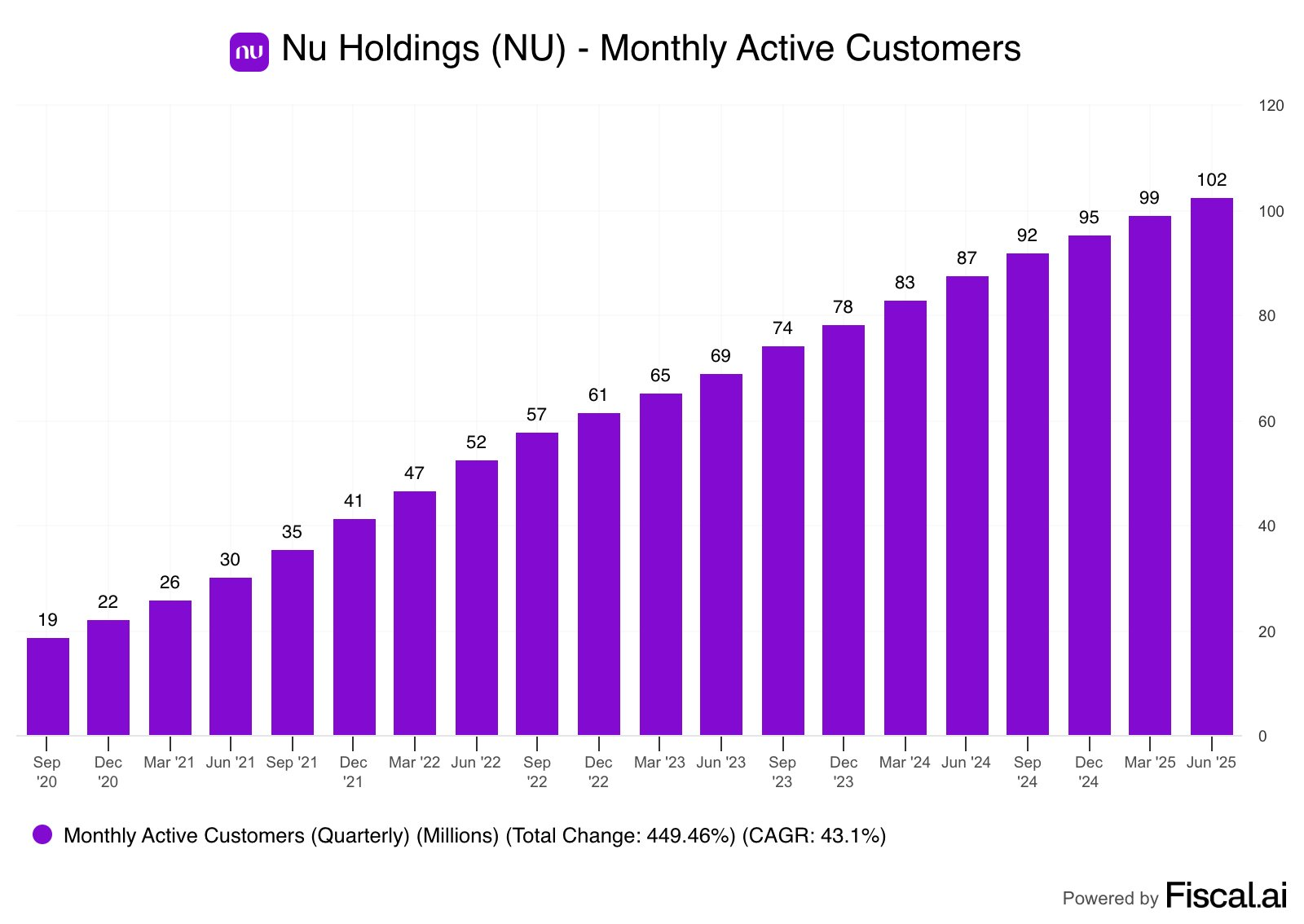

This company’s growth has been wildly consistent. Since 2020, they’ve grown from around 20 million active customers to more than 102 million:

Source: Fiscal.ai

When we first highlighted Nubank back on February 25, 2025, shares were trading around $11.20.

Today NU is up 23% to $14.20. But I don’t plan to sell anytime soon. This growth story looks to still be in its early stages.

A Powerful Growth Engine

Nubank is currently used by around 60% of Brazilian adults, a remarkable achievement. Management has been focused on further monetizing these customers with loans, investment services, crypto offerings, insurance, business lending, and more.

Nubank has many ways to further monetize its growing Brazilian user base.

But the company is also expanding into Mexico and Colombia, with significant progress so far. In Mexico, Nubank has 12 million customers representing 13% of the total population. In Colombia, the company has 3.4 million customers, or nearly 10% of that country’s total population.

It seems likely that Nubank will continue expanding across Latin America. Its digital banking model is low cost, with no physical locations or real estate expenses. The model is beautiful and Nubank has the potential to gobble up market share from existing banks across Latam (and possibly beyond).

The Brazil Discount

Brazil has been in an economic slump for a while now. Innovative growth stories like Nubank are few and far between. So the market generally pays less for Brazilian stocks than they do for American equivalents.

Today Nubank trades at a trailing P/E ratio of around 30. For a company growing revenue and earnings around 40%, that’s a very fair price.

If Nubank were an American firm, I can’t even imagine how high its valuation would be. Suffice to say 4x higher might be on the low side.

On the whole, I think Nubank is trading at an extremely fair price today and don’t plan to sell anytime soon.

Of course, NU is still an emerging market investment. If Brazil were to go through a currency or banking crisis, Nubank would almost certainly take a big hit in the short-term (along with everything else). Still, it’s a risk I’m willing to take in order to access the potential upside.

We’ll keep readers updated on Nubank and the larger Brazil investment theme.