Regular readers know we are preparing for a major market shift over the next few years.

A move out of expensive sectors like big tech and AI, and into hard assets. A rotation out of hype, and into reality.

This thesis is centered on the idea that the world has reached a tipping point with debt. Governments worldwide are up to their necks in it.

Central banks and political leaders have only a few options to deal with this debt. None are good.

They could attempt to pay off the debt. Raise taxes, cut spending, and let market forces do the dirty work. Many companies would fail in a short time period. Unemployment would skyrocket. It’d be a painful financial reset.

Alternatively, they can keep kicking the can down the road. And this is the only realistic option.

Further can-kicking will require massive money-printing operations. The Fed will be forced to gorge itself on U.S. debt.

Quantitative easing (QE) will be used to paper over gaping budgetary holes. And eventually, governments will be forced to go to extremes. They will have to keep interest rates artificially low even as inflation is uncomfortably high.

This is a recipe for a commodity super-cycle.

Gold and Silver First

During commodity bull markets, gold and silver typically lead the way. And that’s what we’ve seen so far.

We just experienced our first significant sell-off in precious metals of the cycle, and the bull looks like it’s ready to resume its upward climb. We could consoldiate for a while around these levels, and I’d be totally fine with that. But over the next few years, we’re headed much higher.

Historically, natural resource bull markets tend to last a decade or so. And they tend to coincide with the end of major bull markets, and the money printing that almost always happens during these times.

We saw this from 2000-2011, and 1970-1980. This coming one could last even longer, because the scale of today’s debt problems are so much larger than either of those previous periods.

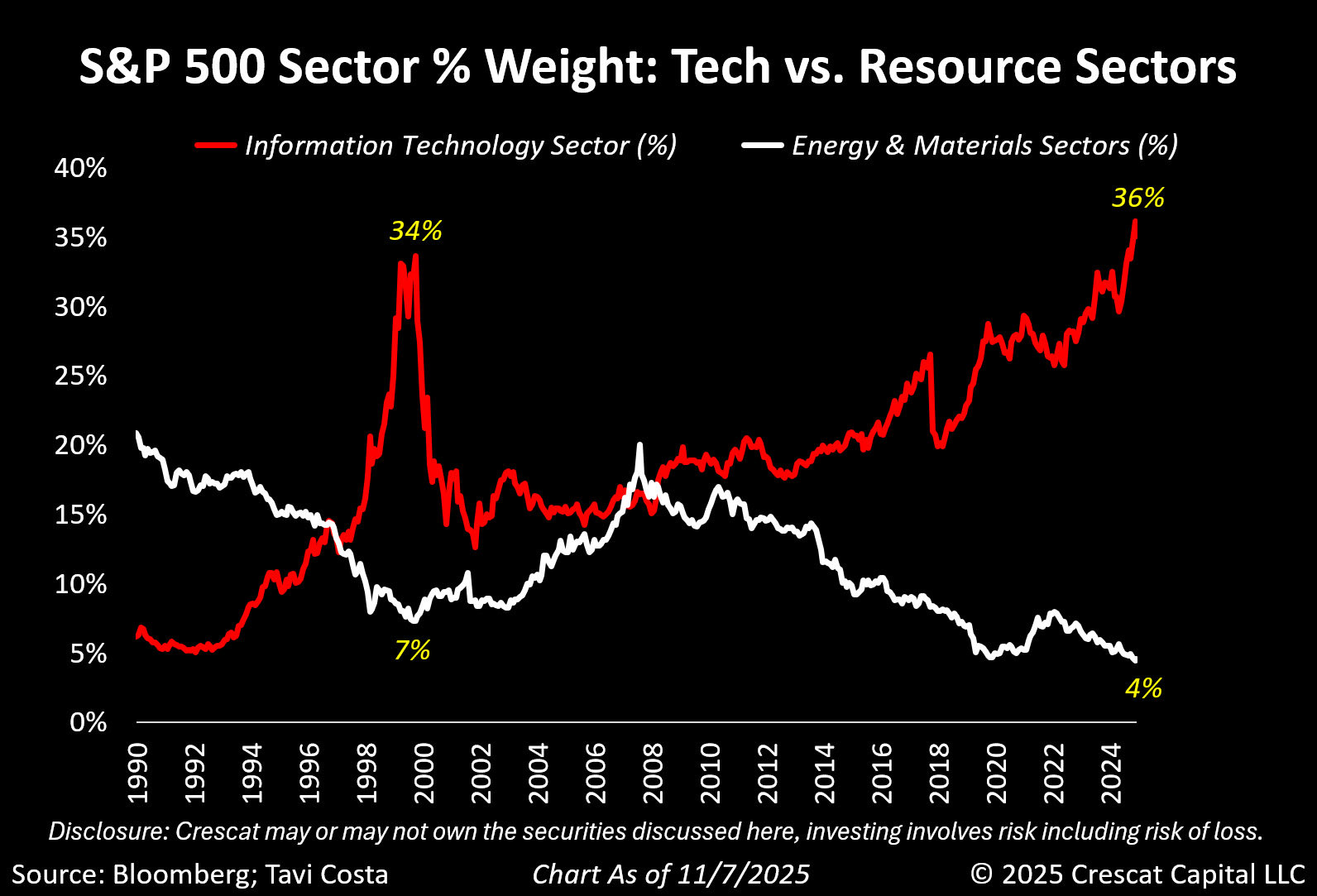

For investors, now is the time to start diversifying into natural resources. See the chart below, which shows the S&P 500 weightings of tech vs energy and materials:

Source: Tavi Costa

The takeaway from this chart is simple. Investors are extremely overweight tech, and underweight natural resources.

The Dollar Had a Good Run

All of this is happening at the same time as the world’s monetary regime is undergoing a sea change.

The U.S. dollar has had an incredible run over the past 75+ years. We came out of WW2 as the only developed country without widespread destruction, and world leadership was essentially ours for the taking.

But over time we’ve abused this position of power. We’ve exported the bulk of our manufacturing sector, ran up our debt to extreme levels, and complely over-financialized our economy.

Now the world is shifting back towards gold as a reserve asset. Trust in the dollar was forever lowered in 2022 when we seized Russian central bank assets in the wake of Putin’s invasion of Ukraine.

There’s no going back from that. Central banks all over the world are buying up gold and limiting their exposure to dollars and treasuries.

For Americans, this transition might be painful in the short-mid term. But in the long run, a much cheaper dollar will be a blessing. It will allow us to rebuild our manufacturing and resource sectors.

Building a Resource Rotation Portfolio

For the past year, I’ve been focused on building up a strong allocation to gold and silver miners. That’s worked out very well so far, and I hope to hold these positions for at least another 5 years. A few names we like are Newmont (NEM), Pan American Silver (PAAS), and Barrick (B).

But the resource sector is more than just precious metals.

Back in February we wrote about investing in Brazil, which is a resource powerhouse that’s been beaten down over recent years. The iShares Brazil ETF (EWZ) is the simplest way to play Brazil.

We also mentioned Petrobras (PBR.A), Brazil’s partially state-owned oil and gas giant. While our colleague Matt Badiali says oil producers are overpriced, we think Petrobras is a steal at its current P/E of 6. The share price is up around 10% since our first writeup, and it’s paying out nice dividends.

The company just smashed its recent earnings announcement, producing more than $6 billion in net income with oil hovering around just $60/barrel. Sure, if we see a major market pullback, Petrobras could fall. But we think it’s a great long-term compounder from these levels. Eventually oil will rebound, and if the company is already making a bundle at $60/barrel oil, at $100 it’ll be minting cash.

We also like Vale (VALE), Brazil’s iron mining giant. This one is now up about 20% from when we first mentioned it, and still cheap. The company does have some litigation to deal with relating to a environmental disaster from a few years ago, but this is already priced into the stock price (and more).

We’ve also tested the waters in the rare earth space with Lynas Rare Earths (LYSDY). When we first profiled that one, it was trading around $5.50. It went as high as $16 during the peak of rare earth mania, but has since fallen back to around $9, and may be worth a look again. Despite recent headlines, the trade war with China is far from over. Building independence in these critical elements will be key to strengthening our negotiating position.

We’ll continue to explore other ways to invest in the coming rotation. But this is a good start towards building a portfolio hedged against our inflationary future.

The average stock investor has perhaps 4% exposure to the natural resources sector. I’m looking to get my allocation up to around 30% over the next few years (including precious metal miners).

If this is the beginning of a commodity super-cycle and inflationary period, that type of exposure will go a long way towards protecting purchasing power, and with the right timing, even growing wealth during a chaotic period.