I opened my portfolio this morning already wincing, knowing an ugly number would materialize.

Oof. It’s a red day for those of us with beefy allocations to gold and silver miners. Game of Thrones style.

Precious metal miners are correcting sharply. The SILJ junior silver miner ETF is down about 8.5% as of 12:40 PM. The GDX gold miner ETF is down about 7.8%. These are my preferred benchmarks for the mining space.

It’s important to keep things in perspective, however. SILJ is still up 21% over the past month, with GDX up 12% over the same period. Both ETFs are up well over 100% on the year. Even after today’s mini-crash.

Miners are falling along with the underlying precious metals. Gold is down about 2%, while silver is down 4.2%. Miners should act as a leveraged play on the metals they mine, so this move makes sense.

And believe it or not, this correction is a good thing for long-term holders. Parabolic spikes like the one we’ve been experiencing are thrilling, but not sustainable for long periods.

A 15% or even 20% pullback in miners wouldn’t be the worst thing in the world. It’s hard to say how long the correction will go on. If you’re only in precious metals for a quick trade, it might be time to exit stage left.

But if you’re looking to buy, now’s the time to prepare.

If you plan on averaging into the market, or already have a position you are looking to increase, now’s a fine time to buy. But I recommend spreading your buys out over at least a week or two, in case the correction goes on longer.

If you’re already in gold, silver, and miners, and have a mid-long time horizon… If you can withstand the volatility, my advice is simple: sit tight.

We saw an even sharper correction back in April, and that turned out to be a brief, but nice buying opportunity.

Durable Catalysts

By now, we all know that central banks are the primary drivers of this bull market thus far. But the chart below provides some interesting nuances.

Source: FT.com

This is a long-term chart of central bank gold holdings as a percent of reserves (excluding the US). Just recently, this number reached approximately 23%.

Back in 1980, central banks held more than 70% of their reserves in gold.

The world changed forever back in 2022, when Biden and his EU cronies seized Russia’s central bank assets. Ever since, central bankers have been shifting out of dollar assets, and into gold.

This trend should continue as trade wars, currency wars, and kinetic wars rage on. Not to mention all the money printing we’re going to see over the coming years.

As I am fond of saying, when the guys who run the money printing machines are backing the truck up to buy gold, it’s a signal we should not ignore.

The General Public Just Barely Arrived

Back in August, we noted that based on ETF fund flows into GDX, the largest gold miner ETF, the general public was still not buying the gold miner story.

I track ETF fund flows because it shows how interested the average investor is in a sector. So when we see the largest gold miner ETF still being sold by the general public, it’s a sign that the generalist investors still don’t get the miner story.

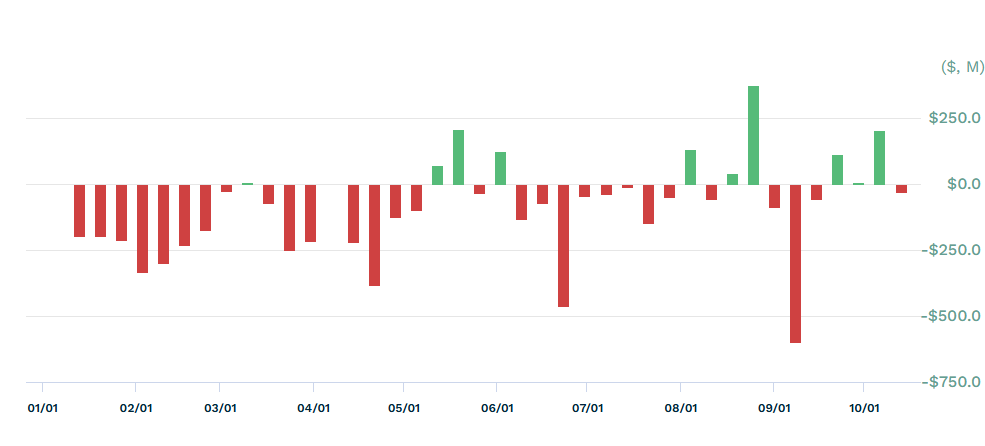

I’ve updated the ETF fund flows chart for GDX with the latest 2025 data below:

Source: ETF.com Fund Flows Tool

The red bars indicate net selling of GDX, while the green bars indicate net buying. The most recent green blip is from the week of 10/6, when $206 million flowed into GDX.

Yes, the ETF price can rise even though people are selling on net. It’s all based on the underlying price action in the miners that GDX holds. And those have been soaring.

As you can see, over the course of this year there’s still been far more selling than buying in GDX.

This tells me that Joe Q. Public is still not too interested in the precious metal miner story.

Yet gold and silver miner profitability has never been higher. Most big miners pull gold from the ground at a cost ranging from $1,500 to $2,000. Today they’re selling that bullion at over $4,000. Those are juicy profit margins.

I believe we’re headed to $5,000 gold, probably next year. And over the rest of this decade, $10,000 is certainly possible according to our pal Jim Rickards.

So no, I’m not selling my miners or metal yet.

The catalysts in place are durable. The Fed just switched into money-printing mode, as our friend Sean Ring noted earlier this week.

We’re also starting to see stress in the banking and credit space (look for a guest piece from banking expert Chris Whalen on Monday or Tuesday along these lines). This could provide additional investment demand for precious metals.

The setup for precious metals and miners continues to look peachy. But as we have noted many times, there will be mini-crashes along the way.

This is one of those days. In our view, we’re still early in this bull cycle.

Here’s some additional reading for those who missed these recent letters: