As a nine-year old kid, I distinctly remember learning that a Mickey Mantle rookie card had sold for $60,000 at auction.

That was the beginning of an obsession with baseball cards.

To be honest, I wasn’t even a big fan of the game. My goal was to make a fortune by acquiring a rookie card of the next megastar: Ken Griffey Jr.

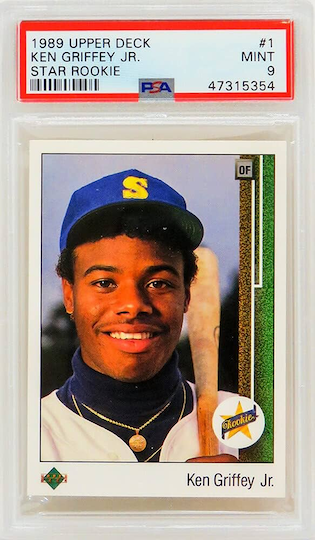

All the profits from my illicit candy-selling business at school were funnelled into buying Upper Deck baseball card packs. And when I finally found that 1989 Ken Griffey Jr. rookie card, the thrill was unbelievable.

I had found the modern-day equivalent of a 1952 Topps Mickey Mantle rookie card, or so it seemed. All that was left to do was keep it in mint condition, and riches would be in my future.

I placed the precious relic in a glass case on my wall.

One day, during a brawl with my older brother, the glass case was cracked. Fortunately the card was undamaged, so I left it up on the wall until I could find a replacement.

The next day, after returning from a sleepover, I came home to find my case, and card, gone.

My mother had thrown away the broken case, not realizing there was a priceless baseball card inside.

Devastation! Betrayal! Anguish! Ruination at my own mother’s hands! (lol).

A Lesson in Scarcity and Value

Apparently I wasn’t the only kid who planned to get rich off Ken Griffey Jr’s rookie card. Upper Deck sold 4-5 million of them to us impressionable young speculators.

35 years later, the card is worth maybe $50, depending on the condition (if you can find someone to buy it).

So even though Ken Griffey Jr. lived up to the hype and became one of the best of all-time, his rookie card was overproduced, widely collected, and essentially worthless.

The only people that got rich off those cards were the owners of Upper Deck, Topps, and Donruss.

The reason that 1952 Topps Mickey Mantle rookie card was so valuable is nobody knew it was going to be worth a ton of money. So only the truest of fans kept them in good condition. That’s why one Mantle rookie card recently sold for a remarkable $12.6 million.

By the time I started collecting in 1989, every kid had already heard about the Mickey Mantle card and wanted to duplicate that success.

There were a few important lessons here. First, always be sure what you’re buying has real value and is scarce.

This is why I don’t keep any more money than necessary in dollars. Fiat currency, like baseball cards, can be printed at will. There’s no true scarcity. I’d rather save in something rare, like gold or silver.

The same holds true with stocks. Some companies issue too many shares to their executives, diluting the value of existing owners’ stakes. Always keep an eye on the stocks you own and make sure the share count doesn’t get out of hand.

The final lesson is that setbacks are inevitable for investors. At times we’ll take losses which will be seared into our psyches.

At the time, these setbacks may seem impossible to overcome. Our brains tend to dwell on them incessantly.

For years after losing that stupid baseball card, I mourned the loss. For a while the value increased and every time the price went up, it stung.

Now I can see that the ~$300 I spent to acquire that baseball card was part of my investing tuition. It was the first of a few costly mistakes on my road towards becoming a successful investor. In hindsight, all of it was money well spent (well lost?).

There will always be more opportunities to make it back. But to take advantage of them, we must focus on the future rather than dwell on the past. While still remembering the lessons we have learned along the way.