On Friday, ratings agency Moody’s finally downgraded America’s credit rating from AAA to AA+.

Yawn.

A ratings downgrade is a classic lagging indicator. By the time it happens, the market already knows.

And, no, the downgrade had nothing to do with Trump’s tariffs. The other big ratings agencies downgraded U.S. credit long ago; S&P in 2011, and Fitch in 2023.

Moody’s appears to have delayed the inevitable for as long as possible. When it comes to downgrading the world’s largest borrower, politics plays a role.

So far, U.S. stock markets have shrugged off the news. The Nasdaq and S&P are down slightly as of mid-day Monday. Everyone already knew our country’s finances were in a bad way.

Yields on U.S. debt did rise a bit, with the 30-year bond briefly surpassing 5%. We’ll keep an eye on that.

Gold rose nearly 1% to $3,228 per ounce. Silver nudged up slightly and is trading at around $32.63.

Don’t Get Complacent

U.S. stocks have come roaring back from the mini-crash we experienced in early April. Equities are now approaching highs reached in February of 2025.

The 90-day trade deal President Trump signed with China appears to have put investors at ease.

Retail investors are flooding back into American stocks.

But material risks remain.

While Moody’s downgrade of U.S. credit is a lagging indicator, it is still meaningful in a way. It shows that even the most biased credit analysts can no longer ignore America’s deteriorating financial status.

The good news is that for the first time in recent history, we have a U.S. President who wants to slash spending and eliminate entire federal departments. The bad news is that Trump isn’t getting much support from Congress.

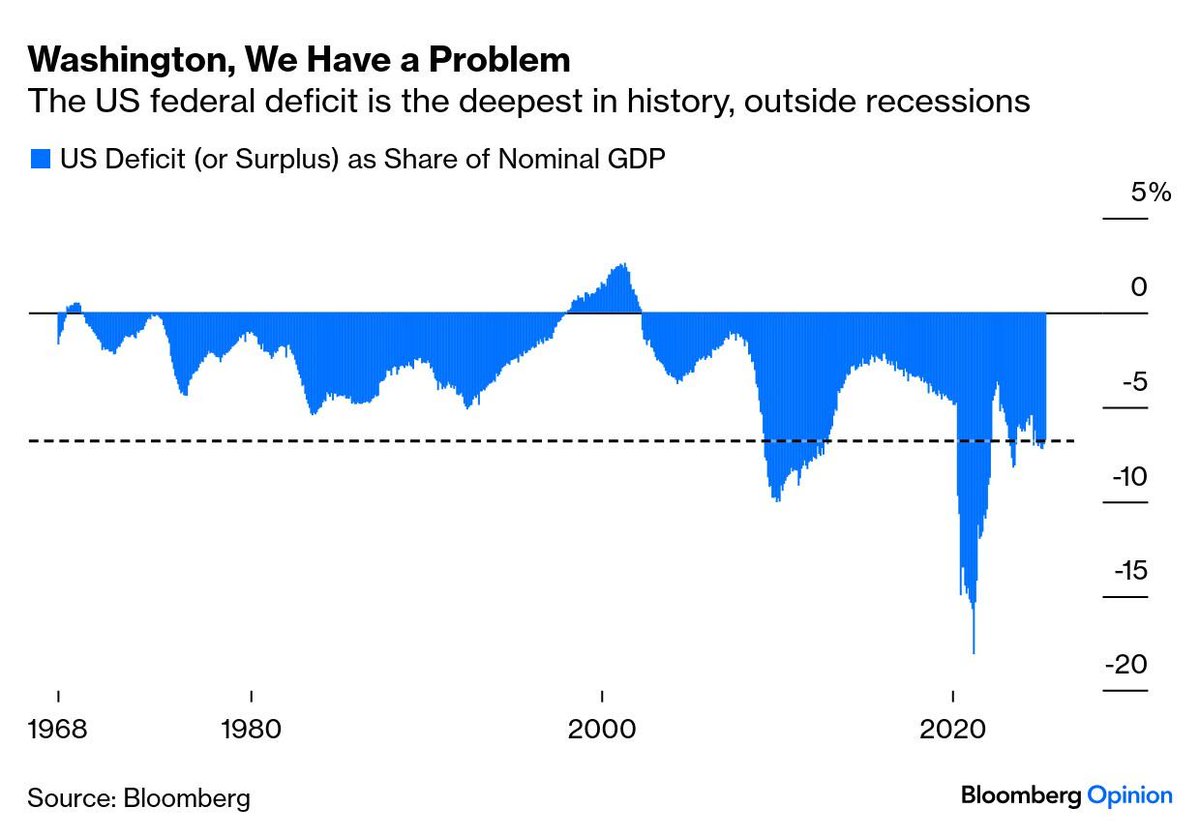

Biden left the country quite a mess. Take a look at the 2024 U.S. budget deficit, which is the worst in history (excluding recessionary periods).

Source: Bloomberg

I am still hopeful President Trump will be able to make significant cuts to federal spending. There is plenty of waste and fraud to be eliminated.

However, even if he’s able to cut $1 trillion from next year’s budget (which is unlikely), that would still leave a roughly $1 trillion deficit.

And even though the majority of that deficit is being wasted, it would still be painful to remove it.

Despite the fact that the money is being spent haphazardly, it’s still boosting the economy. In the long run, of course, eliminating such wasteful spending is necessary and correct. But in the short-term, it’s going to sting.

So if Trump succeeds in cutting spending, there will be pain. If he fails… a different type of pain.

Down the first path lies short-term pain and long-term gain. Down the second path lies less near-term pain, but more in the long run.

The China Deal Could Fall Through

Markets breathed a sigh of relief when Trump’s team was able to strike a temporary trade truce with China. Both sides made significant concessions in order to come to a 90-day agreement. That’s a good sign.

But how far apart are China and the U.S. from striking a long-term deal? Further than most expect. Will the two countries be able to reach a long-term deal in 90 days? We’ll see…

And for that matter, why haven’t we seen more trade deals signed? So far we have full or partial deals with the U.K., Qatar, UAE, India, and Saudi Arabia. There is still an incredible amount of work to be done.

The market currently appears to expect a quick and clean resolution to the trade wars. Call me skeptical, but hammering out deals which will shape the future of global commerce for the next few decades is no simple matter.

President Trump and Scott Bessent aim to reshape global trade. If they are successful, major disruption can be expected while we adjust. If they fail… the U.S. will continue to decline as a global power, and our economy will continue to degrade.

Either way, disruption is inevitable. None of this is priced into current U.S. investor expectations.

Prepare While Others Celebrate

The point here is that it’s too early to be celebrating.

American stocks appear to be pricing in almost zero downside risk, despite the fact that there’s an abundance of it. And black swan risk? The market is pricing-in absolutely no risk of a major systemic shock.

At any moment the trade war could go hot again. China could begin selling off its large stash of U.S. Treasury bonds. The U.S. could de-list Chinese equities. China could decide the time to invade Taiwan has finally arrived. India could nuke Pakistan, or vice versa. War could break out between Iran and Israel.

There are endless potential black swan scenarios, and the market is currently pricing in none of them.

Meanwhile, over the past few weeks we’ve had a substantial pullback in gold and silver miners, and this remains one of the more attractive sectors in the market today.

They could certainly fall a bit more, but now is a fine time to start buying. I recently added to Pan-American Silver (PAAS), and the Sprott Physical Silver Trust (PSLV).

While most investors are rushing to buy up tech stocks at high valuations, I’d much rather continue to build positions which stand to benefit from the inevitable chaos ahead. Precious metal investments remain a fine way to do just that.