Last spring, I thought the tech/AI bubble was bursting.

That was wrong, or early. Same thing really.

I suggested increasing exposure to precious metals and emerging markets.

It’s worked out well so far. Hard assets and EMs have outperformed significantly.

But now a tech crash could once again be on the table. And it threatens to drag everything down with it. For a while at least.

Let’s dig into why software stocks are suddenly struggling, and whether it could lead to a broader correction.

AI Threatens Silicon Valley

In a twist of fate, recent developments in the AI market are devastating software stocks.

For years the AI boom/bubble dragged the tech industry up with it. Now the tables are turning.

Like Frankenstein’s monster, AI is turning on its creators.

Recently Anthropic, maker of the powerful Claude AI models, released new tools that caused an earthquake in tech. Especially in software-as-a-service (SaaS).

These new tools allow Claude AI agents (autonomous models) to take on legal, compliance, sales, marketing, and other tasks. Areas that have historically been profit centers for software companies.

As a result, Legalzoom (LZ) dropped 20% yesterday. Factset Research fell 10%.

Cloud software giant Salesforce (CRM) is now down 44% from its 52-week high.

Formerly hot SaaS names like The Trade Desk (TTD) are down 80% from all-time highs.

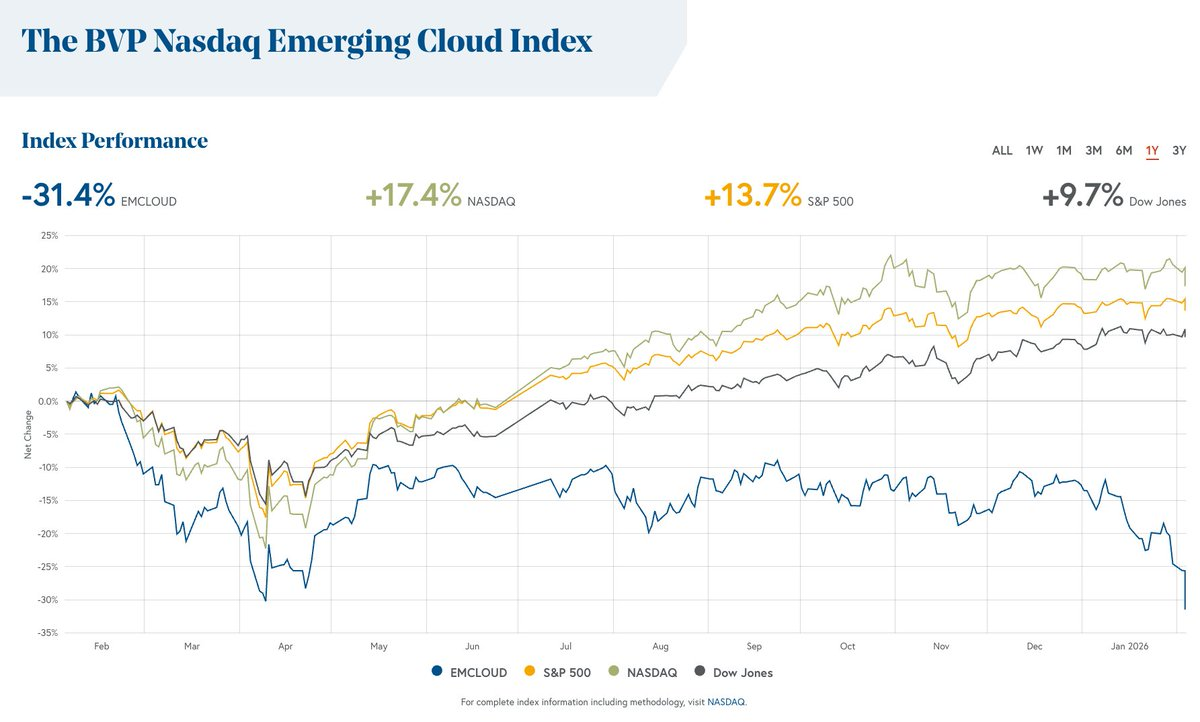

The chart below shows how the BVP Nasdaq Emerging Cloud Index (SaaS stocks) has underperformed the broad market.

The blue line at the bottom represents cloud software stocks. Oof.

Across the software sector, more than $285 billion worth of value was wiped out yesterday alone.

Software: Still Not Cheap?!

The scary part is that the software sector still looks expensive. Salesforce, for example, is still trading at 26x earnings. That’s one of the cheapest SaaS names I could find, and it’s still not cheap.

Most of the smaller and faster growing tech stocks are bleeding cash. Meanwhile, investors are losing their taste for up-and-comers with negative income.

The software sector’s high valuations made it vulnerable to a crash. But I’m not interested in buying the dip yet. Eventually there will come a time to shift out of hard assets, and into more growth-oriented stocks. But we’re not even close yet. My guess is we’re still at least 5 years out.

These moves tend to go much further than seems rational, on the way up and down.

Private Equity Has a Mini-Crash

Yesterday, amid the software crash, something interesting happened.

Private equity and credit firms fell sharply. Apollo fell about 7%. Blackrock shed 5%. Smaller players like Ares and Blue Owl fell more than 10%.

The reason? They’re heavily exposed to software companies. They lend them money and invest in their businesses.

Fears about AI disrupting tech companies are spreading.

Are these just the first dominoes to fall? Investors are finally beginning to realize the scale of disruption that AI can bring to all sorts of businesses. Software is the canary, but it’s going to affect everything eventually. White collar jobs, especially at the entry level, are also at risk.

A Cascading Sell-Off is Possible

Intense selling in the software space has begun to leak into other parts of tech. Even superstar stocks like Nvidia are well off their highs.

There is a risk that if the tech wreck continues, it will bleed into other areas. Even our hard asset investments (temporarily).

When a correction in an area like tech gets serious, it can cause people to sell unrelated investments in a panic. Maybe they need to cover a margin call, or just want to take profits.

So if we see a broad market pullback, it could temporarily derail the precious metals and EM bull moves. We were due for a correction anyway, so market fear could put a temporary damper on our favorite sectors.

But I continue to view major pullbacks in precious metals, miners, and Brazil as buying opportunities. Or if you’re already well allocated, like me, we can view them as holding opportunities.

This market is too unpredictable for me to be trading in and out constantly. So for now, my only plan is to stick to the plan. Sit on my hands and try not to obsess over every move.

If it does develop into a full-on market crash, the safest place to hide out will be in cash, gold and silver, natural resources, and cheap emerging markets.

Yes, they would fall initially with everything else. But they’ll recover first, and outperform for years to come. That’s how it played out after the dotcom bubble burst. And the setup looks similar today.

Eventually the time may come to short the market in size. Or at least hedge with a significant number of puts.

We’ll keep a close eye on this move and see if it develops into something more serious.