Today, we’ll discuss what happened to gold, silver, metals and mining shares last Friday, and how you should play this game from here. (And as I do the last edits on this article on Tuesday morning, silver and gold prices are both up strongly.)

First, I’ll note that yesterday was Groundhog Day. And surely, you’ve seen the movie of that name starring Bill Murray, right? It’s classic Americana.

Punxsutawney, PA celebrates its most famous weather forecaster. Courtesy PCNTV.

G-Day flows from a tradition dating to the 1880s in the dark, hardwood forests of northwest Pennsylvania. A hibernating marmot named Punxsutawney Phil is awakened, rudely yanked from his box, and then queried as to whether or not he sees his shadow. If so, it means we can expect another six weeks of winter. Of course, it’s all mystical and secretive, and we only know what Phil’s handlers and interlocutors tell us.

Of course, you could also just do some math: add 42 days to February 2nd and wind up on March 16th, a few days before March 21st when winter officially ends anyhow.

Even then, it snows in Pennsylvania in April and sometimes May. And Punxsutawney Phil is a play on the weather odds, a safe bet that we’ll have more cold and snow. But Punxsutawney’s annual G-Day event is a long-running municipal self-promotion for a winter fest, with Phil as the centerpiece. And it’s all good, clean fun.

Now, what was NOT good, clean fun was last Friday when metals and mining shares melted down. No real metal was harmed last week, as we’ll see below. But many “paper” claims on wealth definitely went away.

Again, with gold as with Groundhog Day, mystical, secretive interlocutors try to explain it all. But as far as I’m concerned, we should just focus on the metallic basics. So, let’s dig in.

The Great Metal Meltdown

I won’t belabor last Friday, January 30th. Silver, gold, platinum, copper and more tumbled in price; as well as mining shares across the board. Down-down-down.

First things first, especially for the benefit of new subscribers or others who are not familiar with how things work in the arena of mines, metals and markets. That is, don’t panic. Do not freak out, sell out and book big losses. There’s a way out of this.

Yes, Friday was miserable but there’s actually some upside to what occurred, no matter how painful it may seem.

If you’re new to buying metals and mining shares, and you just started your journey in the last month or two, then you may have bought at high levels, and you took a hit on Friday, which hurts. I get it; we all get that at Paradigm Press.

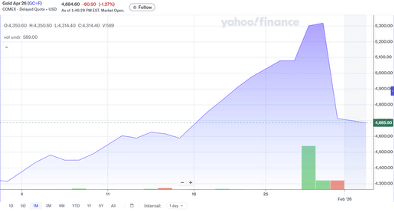

Then again, step back and consider your time horizon. Friday’s closing price for gold and silver still set a monthly record, both for metals and with many share prices. Here’s the chart for January gold, up from $4,300 early in the month to over $4,600 on the last trading day:

Gold price, January 2026. Courtesy Yahoo Finance.

That is, despite the price smackdown during Friday trading, gold still set a monthly record high. And if you go back to early November, gold traded at about $4,000. So, if you’re on just that three-month time frame, you’re up 15%. (And gold is over $4,900 this morning.)

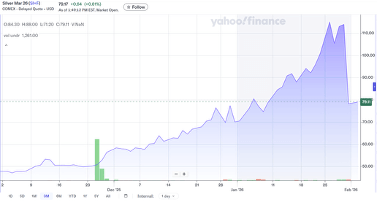

Now, here’s the silver chart going back three months. Silver is up from $48 per ounce in early November to $78 at the end of January, a gain of about 60%. And after Friday’s drop, the monthly close is still at an all-time high; not bad, right? (And silver is trading around $87 this morning.)

Silver price, Nov-Dec-Jan. Courtesy Yahoo Finance.

Okay, yes… obviously gold was over $5,300 about a week ago (and went to near $5,500 at one point); while silver was trading in the $115 range. And then those lofty price levels came down hard on Friday (hold that thought, it was the end of the month; see more below).

In other words, on Friday the market took back what it was giving away so abundantly in the previous three months. How fickle!

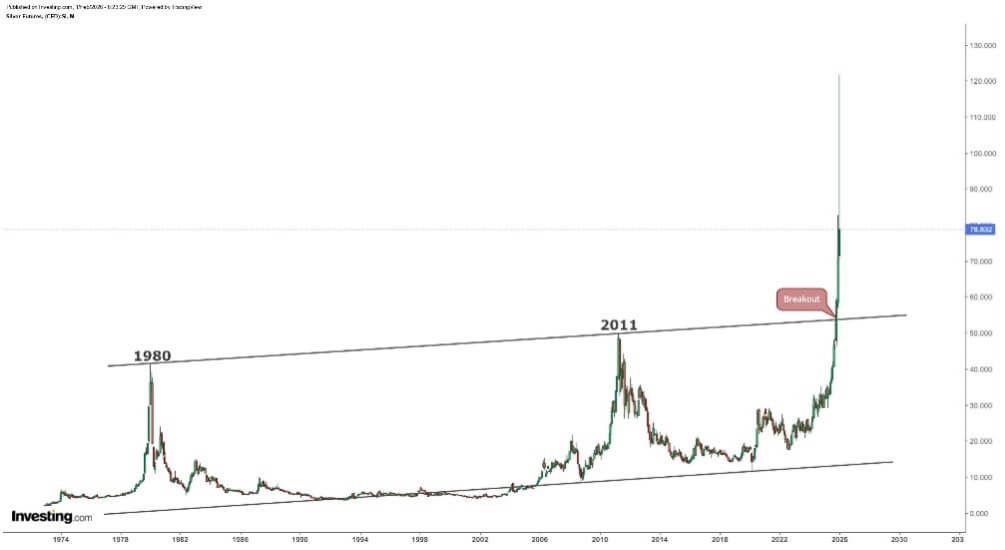

To many people, Friday’s meltdown came as a shock, but was it a surprise? Maybe not so much, because price charts were going nearly straight up – definitely with silver – and that kind of F-22-in-afterburner ascent is not how these things work. Indeed, look back at silver over more than half a century, to the early 1970s:

Silver price chart since 1972. Courtesy Investing.com.

What do you notice? In 1980, silver soared when the Hunt Brothers tried to corner the market; but they were foiled by the U.S. government. The Department of Justice prosecuted them, and then to bulk up silver supply the Treasury Department released a massive amount of metal from U.S. strategic stockpiles, like this 10-ounce ingot:

10-ounce silver ingot from U.S. strategic stockpile. BWK collection.

Then in 2011 we had a financial blowup, when silver ran up and then tumbled back down. Lots of reasons for that (not here), but basically the situation was unsustainable. Markets corrected.

Now, how about recently… namely the past couple of months, if not weeks? Well, the chart above speaks for itself: the silver price shot upwards in a historical breakout.

Underlying the silver runup were some solid justifications, namely the ongoing, global-scale increase in basic demand from industry (electronics, solar, EVs, data centers, weapons, etc.), which butted up against limited output from mines; that is, we have a structural, long-term deficit in mine and refinery production. And there are no quick supply fixes, other than finding more deposits, building more mines, and upgrading refineries.

Add on top of the supply-demand scenario a large cabal of speculators, past and recent. It’s everything from big banks like JP Morgan to day-traders who piled into paper, with many recent players acting on fear of missing out (FOMO). That is, they don’t care that it’s a silver rally, only that something is moving and they want to hitch a ride on the money train.

But always keep in mind the old lime, that “Nobody rings a bell at the top.” And those few weeks up to last Friday were about as near as you’ll ever get to feeling good about an inner urge to pull the sell trigger, book gains and stand aside.

Speaking of which; back on … check calendar… Jan. 22, my colleagues Jim Rickards and Dan Amoss recommended that readers of Strategic Intelligence sell Hecla Mining (HL) when it was trading at $31 per share. For many subscribers, this locked in a hard gain of about 480% since initiating coverage in … check calendar … early June 2025. Six months. Nice call.

Meanwhile, post-last-Friday, shares in HL currently trade at about $22, off by about 28% from its level at the time of the sell recommendation. Or stated another way, “Whew… Dodged that bullet.”

But there were many more bullets last Friday. Indeed, metal markets last week were a tableau of “intersecting fields of fire,” to use a term I learned long ago from a Marine Corps drill instructor.

Here’s What to Do Now…

Okay, remember at the beginning of this note when I talked about Punxsutawney Phil? It’s kind of a racket, although I mean that in a nice way. G-Day is a game to lure people to the woods of Pennsylvania for a winter party.

And what happened with silver and other metals last week was also a racket, but not in a nice way like with the iconic woodchuck. So, let’s review what happened (or didn’t happen) and figure out where to go from here.

First, do NOT fall for the mainstream media fairy tale that markets sold down on precious metals because President Trump nominated Kevin Warsh to run the Federal Reserve post-Powell, and that Warsh will be the next Paul Volcker. As my colleague Jim Rickards noted in a couple of emails to subscribers yesterday, Warsh may have been “a catalyst” during the sell-down, but Warsh alone was not the cause.

That is, Warsh won’t – and cannot – raise interest rates, strangle speculation, crush inflation, and restore total confidence in the dollar. That’s fantasy, like some talking groundhog who sees his shadow.

To expand on this, in 1980 the U.S. debt-to-GDP ratio was around 30% and America could absorb 20% interest rates, although it was a huge hit to the economy (and yes, I was there; it sucked). Those stiff rates also caused immense harm. They triggered the demise of much of the legacy U.S. industrial and manufacturing base. So yes, Volker killed inflation, but he also expedited the ruination of what became America’s Rust Belt. Mixed blessing, right?

Today, the U.S. debt-to-GDP ratio is 125% and increasing. Every three months, Uncle Sam adds about $1 trillion of new national debt to the books. And interest is already over $1 trillion per year, soon to be the single largest expenditure item in the federal budget.

So no, Warsh cannot raise rates because he’ll literally drive the Treasury insolvent. In fact, he’ll have to lower rates which favors precious metals and hard assets like base metals and energy.

Meanwhile, last Friday silver and gold didn’t crash, so much as they were body-slammed, to use a World Wrestling metaphor. That is, we experienced a one-day, 35% price collapse in Western metal markets with no change in mine or refinery supply, nor lower demand from industry and other major buyers like central banks or other well-heeled entities.

Does this make sense? Not at all.

And while paper silver in London and New York traded down to $78, actual metallic silver in Shanghai still moved at over $120. In other words, real metal commanded a high price, while silver paper contracts were burning up in the waste baskets.

Stated another way, last Friday – at the end of the month, when many metrics get measured! – people who know how to move markets moved the markets.

That is, people with piles of paper silver flushed newer speculators (i.e., FOMO buyers of recent weeks) and crashed the price. Incidentally, this massive sell-down salvaged more than a few well-connected players who were caught in a naked short situation in a fast-rising market. They cleared their books, as best they could. Sauve qui peut, right?

Again, physical metal not only doesn’t lie, it tells the whole truth and nothing but the truth.

And as of this morning (Tuesday), Shanghai silver trades above $100, while Western paper silver moves at $87. That is, think in terms of real price versus fake price. Because China is where most of the world’s silver gets used in things like electronics, solar panels, chemicals and much else. So Chinese industry requires real metal, not paper. Our Chinese counterparts don’t want silver “settlements,” they want real silver!

Presently, as everything unfolds Western silver vaults are being emptied by calls on real metal as people with paper do what’s called “stand for delivery.” And now, any entity that has sold paper silver against real silver must now fire up the forklifts and deliver.

But whoops, there’s not enough silver to go around. Indeed, by some calculations the silver market has as many as 350 paper contracts for every real ounce. It’s musical chairs with but one chair in a big high school gymnasium. And paper is toast, so to speak.

If you hold real, physical silver – coins, ingots, bars – hang on and ride it out. It doesn’t matter that you bought $110 silver last week and it was $80 yesterday (and $87 today). At least you have the metal, so just sit on it and await developments.

As for mining shares, every company is different. On my end, I spent the weekend going through every name in my portfolio, asking myself why I owned it and if I want to hang on. Why did I buy? What’s the mineral asset? How is management? Where is the company going? And if it’s a producer, is it earning money?

Again, much of investing is about earnings-earnings-earnings. So, does the mining play make money? Well, the fact is that many mining plays are already making beaucoups money in the current environment. They were making money at $2,500 gold, and more at $3,500 gold, and they’ll do just fine at $4,500 gold. And they made money at $25 silver, and more at $35 silver, and they’ll do very well at $65 or $75 silver, let alone $87.

One idea that I’ve long followed is the Sprott Physical Silver Trust (PSLV), which has been buying silver and storing it, and they actually own the metal. And metal is truth.

Absolutely, be cautious. But also, the current share price sell-down is a buyers’ opportunity for great names at beaten down prices. Let the dust settle. Look for the best companies, assets, management teams, etc. Watch the charts, wait for dodgy days in the market, use limit orders and never chase momentum.

Wrap-Up

You think you’ve got it tough? Last week the U.S. Mint announced that its precious metal products will be delayed in production, with prices “to be determined.” So yes, the Mint is behind the 8-ball, just like everyone else.

While up in Canada, I’ve heard rumblings that the Royal Canadian Mint may declare force majeure and default on numerous delivery contracts. Which is another way of saying that “good silver” (i.e., .999 or .9999 fineness) is leaving North America and headed to Asia due to those high premium spreads.

And to answer one recurrent question from readers, scrap silver is hard to sell just now because refineries are focused on servicing large industrial clients, versus melting down your grandmother’s old candlesticks. I expect that it will be many months before the scrap silver market adjusts to these new realities.

Again, don’t panic. Wait for things to settle. Real silver and gold are scarce and valuable, although the price mechanism has been torqued out of shape by paper markets. But one way or the other, “real” metal beats paper, and that’s where the world is headed.

That’s all for now. Thank you for subscribing and reading.