This post $714/oz Silver?! appeared first on Daily Reckoning.

Silver closed trading today in Shanghai, China at $131.31/oz.

That’s $16 over the U.S. price.

During this bull run, China has led the way. As we discussed yesterday, that’s where the bulk of silver demand comes from.

Silver is still primarily an industrial metal. As the best conductor of electricity, it’s highly useful in electric vehicles, solar panels, and even modern weapons systems.

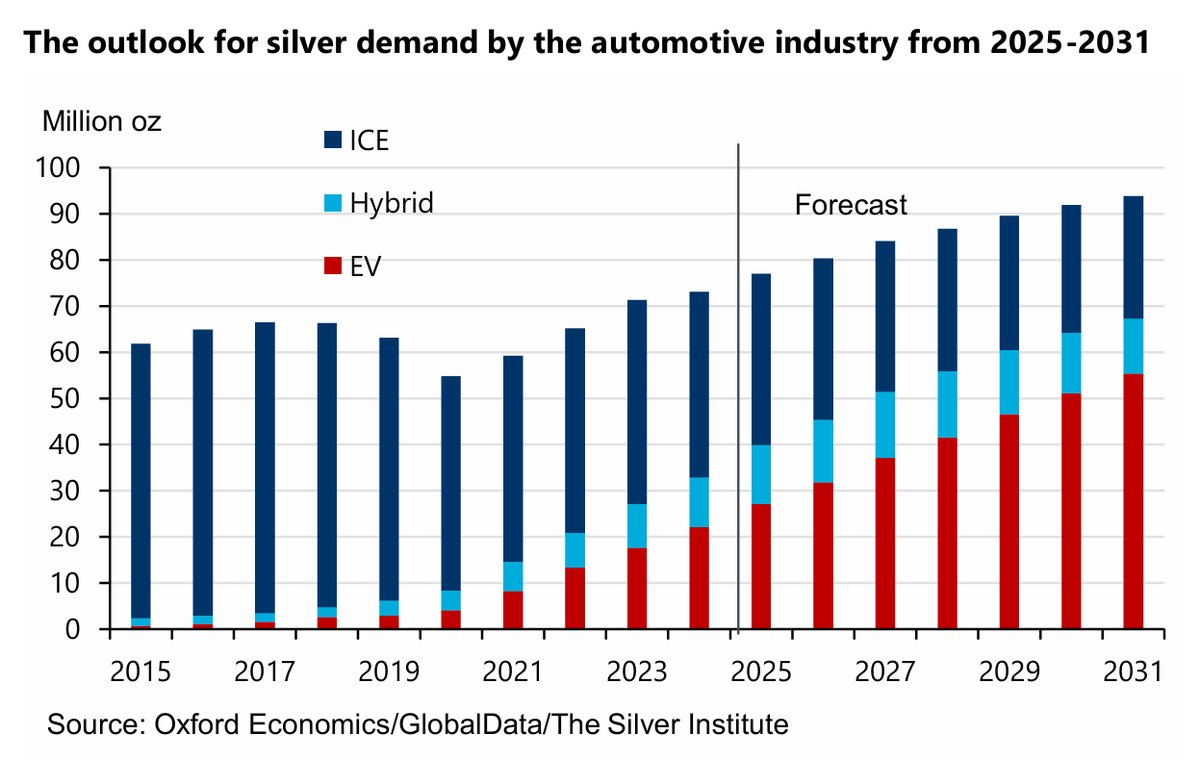

We’ve covered the solar story extensively, so let’s quickly look at how electric vehicles are also gobbling up an increasing share of global silver production.

Below is a chart showing annual silver demand from the auto industry, broken down by vehicle type (ICE = traditional gas engine, EV = electric vehicle, hybrid = combo).

As you can see, demand for silver from the auto industry is also booming. And with EVs and hybrids growing fast, demand for silver will continue to rise.

There’s also a big potential demand catalyst coming down the road. South Korea’s Samsung has developed a solid-state EV battery which requires 1 kilogram of pure silver per battery.

Apparently Samsung’s new battery can give a car 600 mile range, and the ability to recharge 80% in just 9 minutes. So even if the silver cost is significant, it’ll probably still be worth it even with a higher metal price.

That’s an enormous potential source of demand in the future.

Today China has become the world’’s leading producer of EVs, batteries, and solar panels, with a majority market share in all three categories. The nation has been gobbling up silver stockpiles for more than a decade, and now supplies are running low.

So it makes sense that the price of silver is rising first in China, and then following here.

Investors Ignite the Fireworks

For the past year, we’ve been telling the industrial silver demand story. And all by itself, it was a powerful one.

We suggested that soon investors would catch on and begin to buy. Now they finally are.

And because the market was so tight due to booming industrial demand, it only took a little bit of additional silver demand to bust above $50/oz and go straight to $100+.

After such a vertical move, silver does seem due for a correction.

And as you may know, Jim Rickards is on record saying silver could hit $200 this year (when it was ~$65). And over the next few years, it’s possible we’ll go even further.

How high could silver fly? Let’s play with some numbers…

Gold-to-Silver Ratio

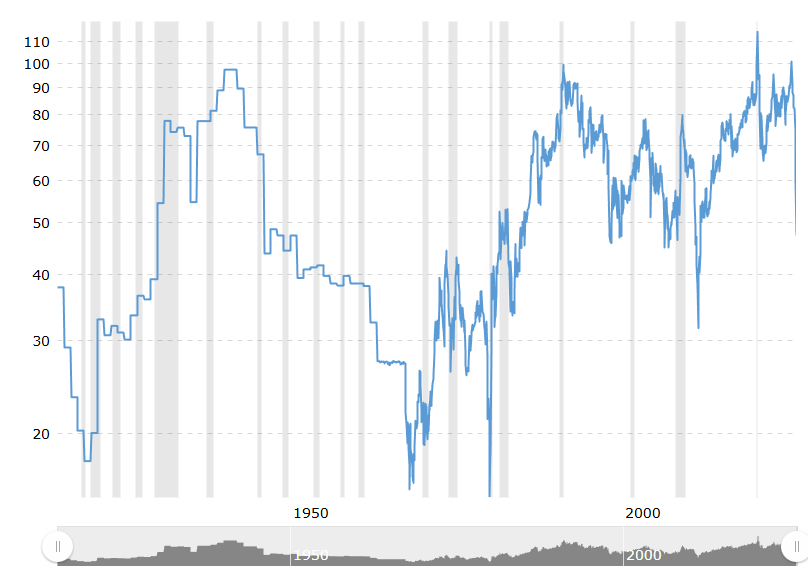

The chart below is a 100-year view of the gold-to-silver ratio. Right now it’s about 47 (meaning gold is 47 times more valuable than silver).

Source: Macrotrends

Back in April of 2025, the gold/silver ratio was over 100! What an opportunity that was. But I still expect silver to outperform over the coming years.

As you can see, back in 2011 the gold/silver ratio got to around 32. If we got back to 32 today, silver would be $165/oz (current gold price of $5,300 divided by 32).

However, as you can see on the chart, throughout the past 100 years silver has traded significantly lower than a 32 gold/silver ratio.

In 1919, the ratio reached ~17. The same ratio today would price silver at $311 per ounce.

In 1968 the ratio reached about 14. That’d equal $378 silver today.

All those numbers assume gold stays at $5,300. If it goes to $10,000, as Jim Rickards expects it to, a gold-to-silver ratio of 14 would mean $714/oz silver.

Ok, that seems a little crazy. Even to me. But who knows?

Industrial demand for silver is booming with no end in sight. Silver is essential for modern technology.

And at the same time, the world is waking up to the idea that it’s also an excellent way to preserve wealth. For tens of thousands of years, silver was money. It’s only been 60 years since the connection was severed.

Additionally, I believe countries will soon begin stockpiling silver (like they used to!). Silver isn’t just necessary for modern consumer electronics, it’s also a key ingredient in modern missiles, radars, and other key military hardware.

It’s downright irresponsible for a nation not to have a silver stockpile. And today, almost nobody does (Russia is the only one I’m aware of).

The term “perfect storm” is overused and cliche. But it applies here.

To be clear, I’m not saying silver is going straight to $200+. It will be a bumpy road filled with mini-crashes and lulls. But eventually, inflation (and/or stagflation) will make a roaring comeback and at that time, we’ll all want to have plenty of exposure to precious metals.

Gold, silver, and even other commodities will be like an oasis in a profit desert.

The post $714/oz Silver?! appeared first on Daily Reckoning.