Ancient skulls often have perfect teeth.

This may seem strange.

Because for 99.99999% of human history, we didn’t have toothbrushes or braces. No orthodontic surgeons to remove wisdom teeth.

So how were ancient people’s dental health so good?

Much of the answer lies in how they were used.

Gnawing on bones, chomping cartilage, and chewing on roots from a young age.

These actions create small stresses which tell the jaw and teeth to grow big and strong.

Meanwhile, today we puree young kids’ food into a slurry. The result is often underdeveloped jaws, and crowding of the teeth. This is also part of the reason why so many people have to get their wisdom teeth removed.

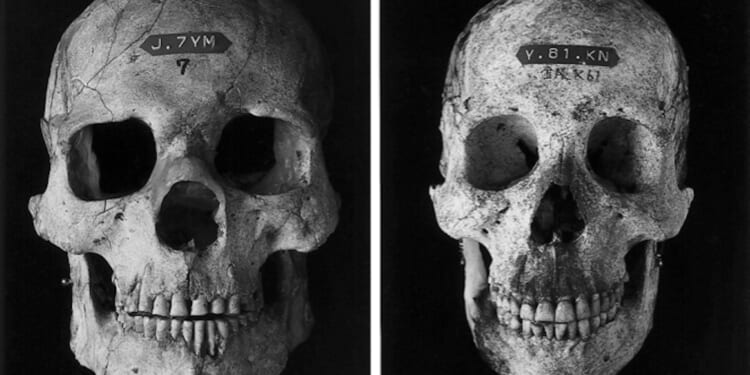

Take a look at the image at the top of the page. On the left is an ancient Japanese hunter-gatherer’s skull. On the right is a more recent Japanese farmer’s skull.

This is a dramatic example, but throughout the fossil record, this relationship tends to hold true. Due to their lifestyle, hunter-gatherers had far stronger jaws and teeth than modern humans do.

How is this related to investing, you ask? Stay with me for a moment…

Good Stresses

Ten years ago I read Nassim Taleb’s excellent book Antifragile.

It changed my perspective in a way few books have.

In Antifragile, Taleb explains how sometimes stress and volatility is good.

Something is antifragile if it benefits from disorder and chaos.

In many ways, our bodies are antifragile.

For example, astronauts in space don’t stress their bones enough due to the lack of gravity. So they grow weak, and have to constantly create impact stress to avoid becoming even weaker.

Even with specialized exercise tools, astronauts can only spend so long in space before their bones and muscles atrophy.

Taleb also cites how trees grown indoors don’t get enough wind stress, and if you try to bring them outside, they’ll quickly break.

Without certain environmental stresses, living beings cannot attain their maximum potential.

Many of these same principles can be applied to investing.

Building an Antifragile Portfolio

Regular readers will have already guessed where I’m going with this.

Precious metals (PMs) are an ideal antifragile asset.

The more things fall apart, the stronger they perform. They thrive on chaos.

The flip side is that PMs underperform during “boring” times of low volatility and stress.

But during times of war, inflation, debt, and market crashes, they act as portfolio insurance.

And right now, that insurance policy is paying out holders. And I believe the PM bull market will continue for at least 3-5 more years, and likely longer.

The market stresses we’ve been experiencing lately are unlikely to be resolved any time soon.

Inflation in “developed” countries has become problematic for the first time in decades. Trade wars are rewiring global commerce. And we’re witnessing the first truly modern war in Ukraine.

Moreover, nations around the world are hitting a tipping point with debt and deficit, most notably the U.S. and Japan.

So maintaining an antifragile portfolio will remain important for the foreseeable future.

Other Hard Assets

More broadly, it’s important for investors to have exposure to hard assets. If you own the S&P 500, it’s done incredibly well over the last 15 years.

But today the Magnificent 7 tech giants make up a whopping 37% of the S&P 500.

There’s barely any exposure to oil and other natural resource companies in the big indexes today. So you have to actively seek out industrial metal miners like Vale or BHP. The same goes for stalwart oil companies like Exxon, or more speculative names like Petrobras.

If we go through an extended period of stagflation, you’ll want to own more than just tech stocks.

Hard assets remain a key part of my portfolio.

What Else is Antifragile?

One of the most significant potential “black swans” is if something bad happens to the dollar. People who don’t have exposure to foreign stocks and/or precious metals risk losing a lot of their wealth in such a scenario.

This is part of the reason I own emerging market stocks. If the dollar ever crashes, owning foreign stocks will be a huge help. And it doesn’t hurt that they’re cheap with big dividend yields.

I believe American investors should own a healthy portion of their wealth in foreign stocks, especially emerging markets. Why EM? Because other developed nations like those in the EU suffer from many of the same problems we do in America. De-industrialization, a deteriorating political system, and far too much debt.

So for me, emerging markets are a key part of an antifragile portfolio.

I’m not saying you should sell all your U.S. stocks. What I am saying is that now is the time to think about diversifying into more antifragile assets.