Inflation is a demon. A thief that steals the fruits of our labor.

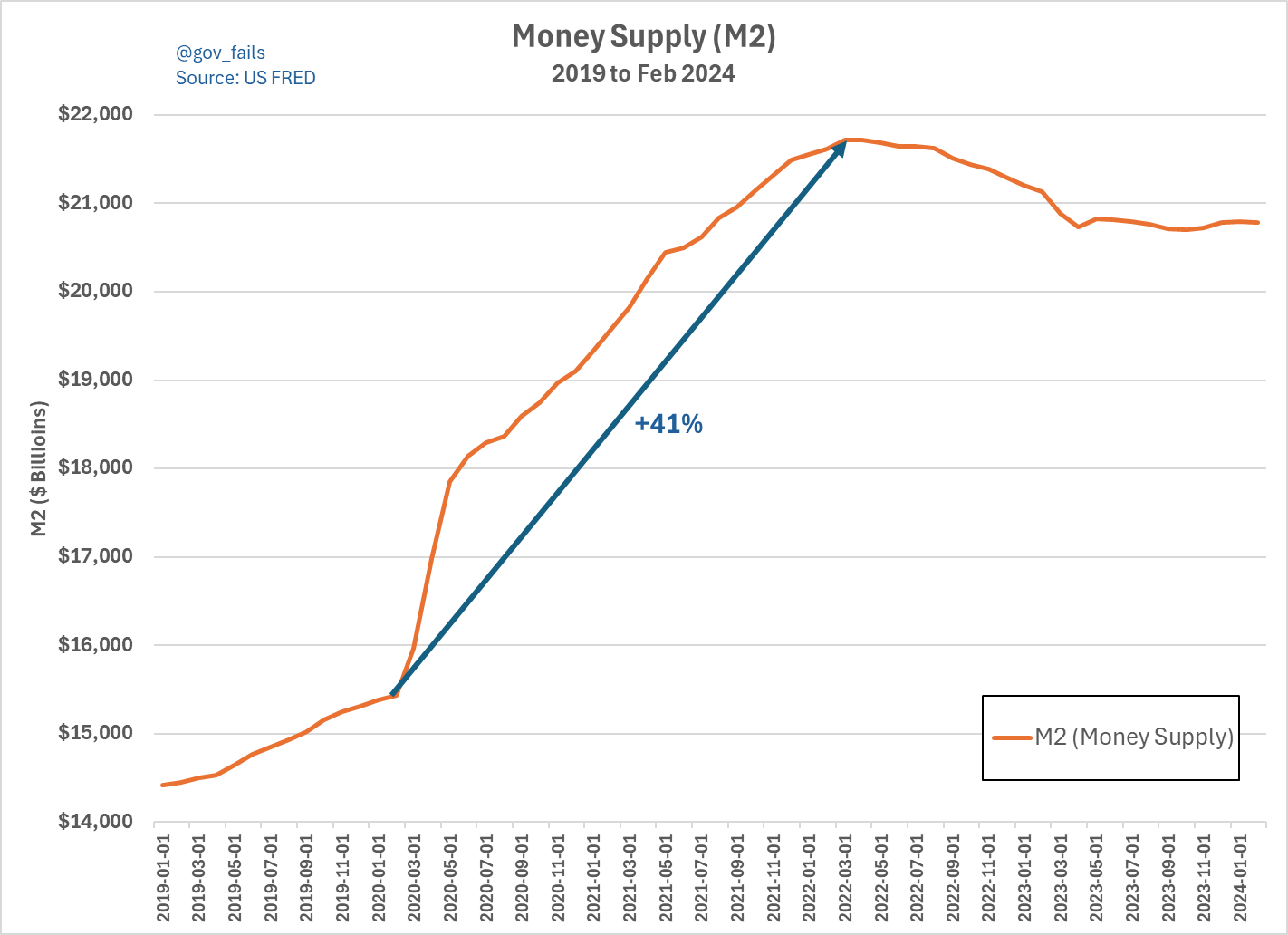

The primary cause of inflation is growth in money supply. More money sloshing around = higher prices, all else being equal.

See the chart below, which shows how America’s money supply grew a shocking 41% from March 2000 to March 2022.

Source: Gov_Fails on X

During the pandemic the government unleashed unprecedented stimulus. The CARES Act of March 2020 was a whopping $2.2 trillion package which included the $900 billion PPP (paycheck protection program), direct stimulus to many households, and assistance to state and local governments.

Various other stimulus programs brought the total COVID spending bill to at least $5 trillion.

As you can see on the chart, M2 money supply (cash, checking and savings accounts, money market funds, etc) soared.

The Federal Reserve enabled this spending by increasing its balance sheet by $5 trillion, from $4 trillion to $9 trillion.

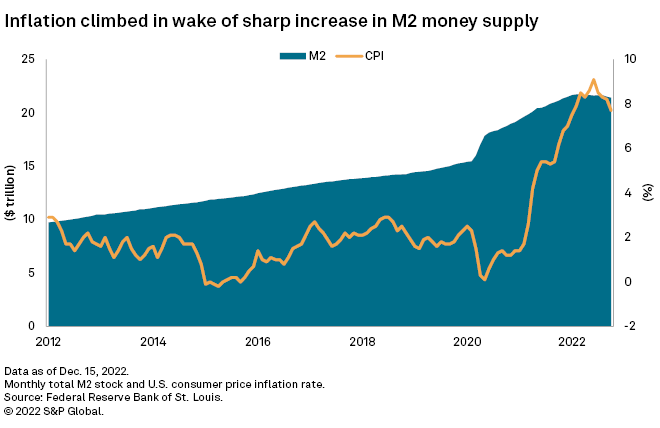

Inflation vs. Money Supply

According to government inflation stats, during that 2 year period where money supply rose 41%, inflation only rose 11%. The chart below tells the story.

Source: S&P

So if money supply jumped 41%, how did inflation only rise 11%?

Part of the explanation for this discrepancy is that official inflation (CPI) is badly flawed. We covered this in detail in Is Gold Cooked? The real inflation rate over that period was likely at least 20%.

But it’s more complex than just that. The velocity of money, how quickly it moves through the economy, slowed dramatically. People used much of the stimulus money to pay off debt, stayed home, and saved money.

Additionally, the dollar is a global asset. So the vast amounts of money printed didn’t all stay in the U.S. Much of it found its way abroad.

And that brings us to the next point, which is other factors preventing inflation from rising. Chief among them is the rise of China and other manufacturing powerhouses abroad.

King Dollar Means Cheap Goods

Despite its flaws, the U.S. dollar remains the world’s fiat reserve currency of choice. The bulk of global trade is still conducted using dollars, and central banks still keep a good portion of their reserves in U.S. treasuries.

So international demand for dollar assets remains high, at least compared to other fiat currencies. That means we can import foreign products cheaply, and run large deficits (for now).

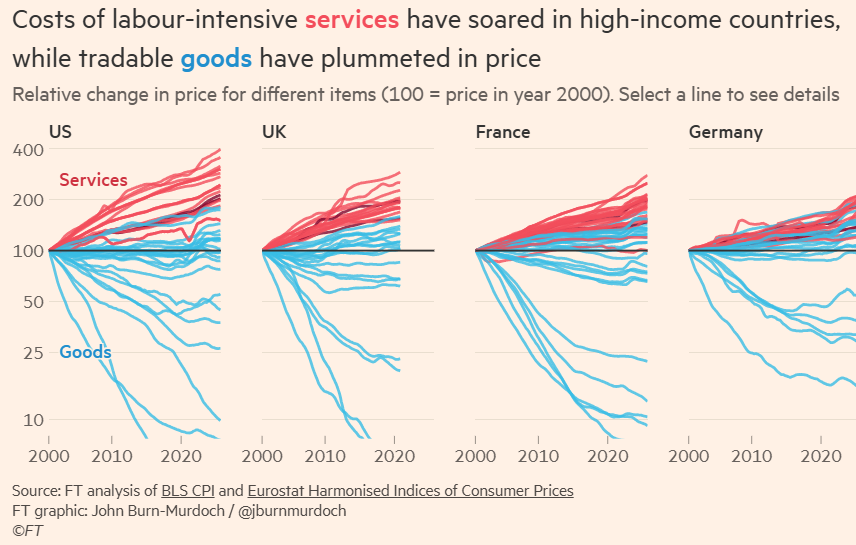

This is demonstrated in the chart below, which shows how the cost of services (in red) has soared compared to the cost of goods (in blue).

Source: Financial Times

This sharp difference between goods and services is caused by the flood of cheap imports from China and other manufacturing powerhouses.

Without these discounted goods from overseas, inflation in America would be much higher. Probably close to the price increases we’ve seen in services.

In some ways, this has been good for American consumers. Our dollars go a long way buying foreign goods.

But it’s also been devastating to our manufacturing industry. The majority of factories have long since been shipped overseas, and the bulk of new facilities are constructed in countries with cheaper currencies.

Now that America is looking to rebuild our industrial sector and produce more goods at home, we can expect to pay more for those goods in the future. Over the coming years I expect this will drive inflation higher.

However, if we do it correctly, it will also create lots of high-paying jobs and raise wages.

If we can manage to bring back a significant chunk of manufacturing, there will likely be a transition period where inflation is elevated. But if that’s the price we have to pay to build back a real economy, it’ll be worth it.

Inflationary Outlook

Currently the Federal Reserve expects inflation to average around 2.2% annually over the next 5 years. Consumers are more pessimistic, expecting around 3.2%.

I believe both of these expectations will prove to be optimistic. It wouldn’t surprise me if inflation averaged 5%+ over the next 10 years (and that’s official CPI, meaning the real rate would be higher). And it could be much worse than that.

Eventually the government will be forced to stimulate the economy again, and the Fed will be forced to gobble up all that excess debt. When the next recession hits, the QE and government stimulus will be unprecedented.

And as America re-shores our manufacturing capacity, we can expect to pay more for locally-made goods. But again, this is going to be a good thing over the long run. The re-birth of the Rust Belt would be worth a few years of uncomfortable inflation. I am hopeful that overall wages may be able to keep up with inflation, or stay close. But it’s not a sure thing.

Additionally, it seems clear that President Trump wants a weaker dollar. And it looks like he’s going to gain control over the Fed early next year.

So my forecast for inflation remains elevated. This is why we believe in owning gold, silver, miners, and other natural resources.

When the next wave of inflation hits, they will offer far better protection than overpriced stocks. We saw this clearly in the 1970s, when hard assets shielded savvy investors from the scourge of monetary debasement.